Banking

Highlighted

En los últimos tiempos se registra en la UE un incremento de los importes de deuda pública emitidos por los Estados miembros; el sector bancario es tradicionalmente el mayor inversor en estos activos, que dotan a su cartera de estabilidad y seguridad. Pero existe un estrecho vínculo entre el riesgo soberano y el riesgo bancario, que se manifiesta a través de cualquier shock que afecte a la calidad de la deuda pública, como sucedió a finales de 2025 en Francia. Ante episodios como este, el avance en la unión bancaria, con una estructura institucional, un supervisor común y mecanismos de resolución de crisis, ha supuesto una mejora para el control de riesgos de las entidades, que se refleja en una mayor diversificación de sus inversiones en deuda soberana de otros países europeos.

Artículo

Spanish banks across the 2020–2025 rate cycle: Divergent margin drivers between SIs and LSIs

Fecha:

February 2026

Six years of rate fluctuation reveal distinct asset-liability management strategies across

Spanish banks. Funding costs drove margin gains during tightening, while asset yields

regained primacy as rates normalised, with significant divergence between SIs and LSIs.

Artículo

Shadow banking and financial stability in an era of private credit

Fecha:

February 2026

The rapid expansion of non-bank financial institutions is reshaping the geography of

financial risk in Europe and globally. High leverage, liquidity mismatches, and growing

interconnections with traditional banks raise the probability that future episodes of stress

originate outside the regulated banking perimeter.

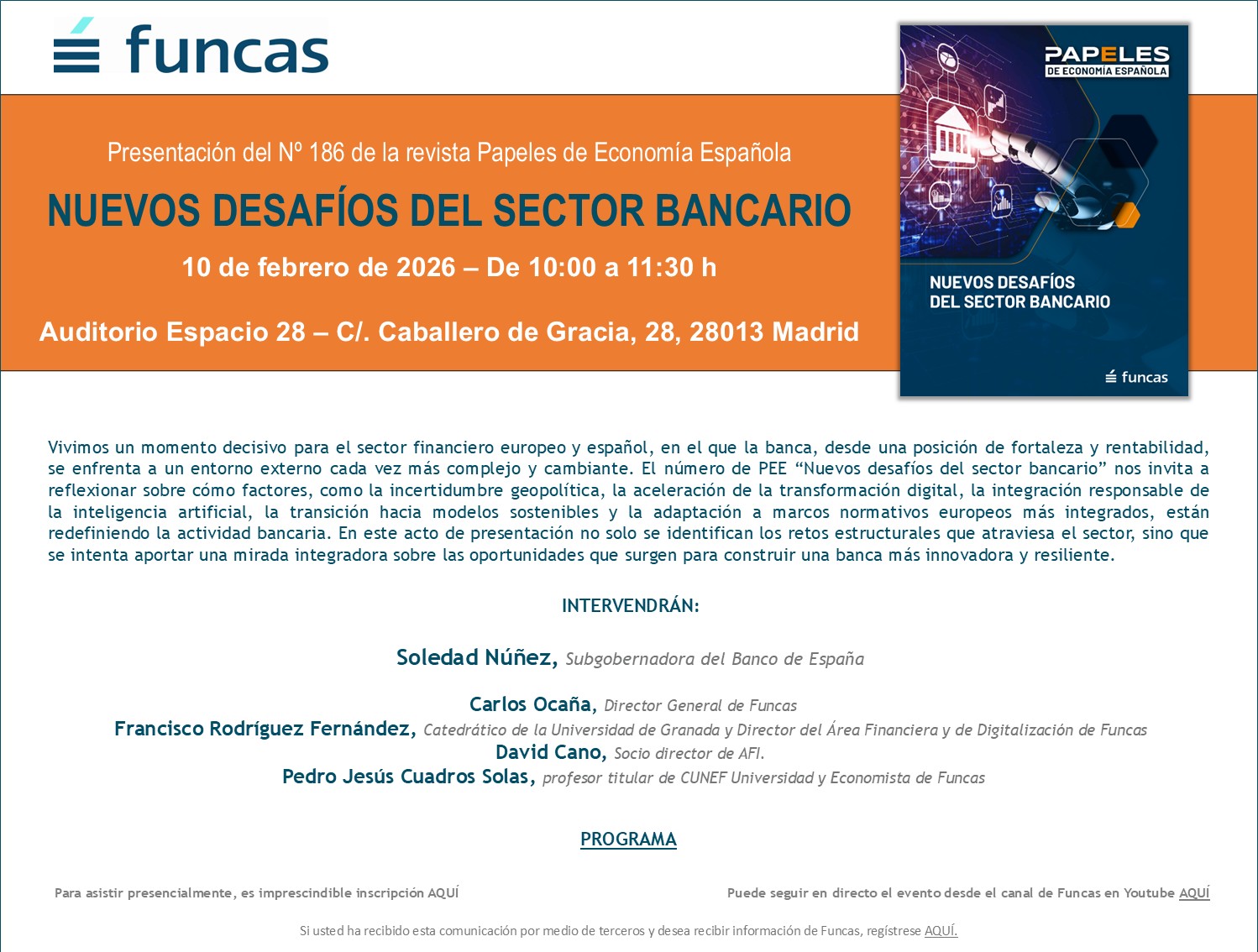

Evento

Presentación del núm. 186 de la revista Papeles de Economía Española “Nuevos desafíos del sector bancario”

Fecha:

February 2026