‘Bringing it all back home’: a short-term necessity or the start of a long-run change in economic relations?

Fecha: junio 2020

Iain Begg, European Institute, London School of Economics and Political Science, and Funcas Europe

Faced with the conjunction of the most acute health crisis for a century and the severity of the resulting economic downturn, governments across the world have had rapidly to re-think their approach to crisis management. For many, previously unthinkable public interventions became the norm almost overnight. Suddenly, ceilings on social policy spending – and not only on health care – were relaxed, and vast amounts of public money have been allocated to sustaining companies unable to trade and households deprived of income.

This is no ordinary economic downturn, derived from private excesses, ‘animal spirits’, policy mistakes – or a combination of all three – leading to one of the periodic convulsions of capitalism, such as the financial and euro crises of a decade ago. Instead, there is a cruel paradox at the heart of the covid-19 economic crisis. It has been deliberately caused to contain the spread of the virus. But conventional economic stimulus packages – by design – have a contrary effect of aiming to restore economic activity, as expeditiously as possible.

This poses a stark dilemma for policymakers of how to reconcile protection of public health and economic well-being. So long as lockdown is necessary for health reasons, restrictions on economic activities requiring people to come in close contact with one another have to be maintained. However, companies cannot remain in hibernation for long without becoming increasingly vulnerable, and the longer people are away from employment the greater the risk of ‘hysteresis´, the debilitating effect of lack of a job on employability.

Policymakers need to find ways of enabling businesses to weather the storm, households to obtain enough income to compensate for inactivity and more resources to be allocated to health, all at the same time as anticipating how to engineer an economic recovery. Governments have therefore had to concentrate in a first phase of the policy response on mitigating the adverse consequences of the lockdown, but in a second phase will have to switch rapidly, when the health criteria permit, to stimulating demand. In confronting these economic challenges, governments have generally given priority to the domestic economy and paid relatively little attention to cross-border ramifications and inter-dependencies.

This policy note explores how an apparent backlash against internationalism is influencing the policy responses to Covid-19, the costs and benefits of different strategies and what all this presages for the post-Covid global economy. The note continues with a discussion of how the lockdown dovetails with national stances on protecting domestic activities, then the next section looks at, and suggests rationales for, and a typology of, the types of measures being adopted. Discussion of the implications for future policy and conclusions complete the note.

From lockdown to strategic autonomy

Economic actors are used to occasional shutdowns, such as when a factory is refitted, when faced with lengthy strikes, or during periods of extended holidays. But these are usually either well-planned or affect only a small segment of the economy. What is different about the current context is the breadth of the shutdown and the many unforeseeable consequences of it being extended. Moreover, the incidence is highly skewed and the ensuing losses stem from civic duty in following government dictates rather than ‘normal’ business risks.

The direct effects of lockdown mean firms are exhausting working capital, workers and the self-employed are losing jobs and income, investment in the economy has been put on hold and the public finances are deteriorating at an alarming rate. The speed of the economic deterioration has been breath-taking and forthcoming estimates for the 2nd quarter of 2020 are now expected to reveal double digit falls in GDP in most OECD countries. For 2020 overall, the fall in GDP in Europe could approach ten percentage points and optimism about a rapid bounce-back is receding.

Unsurprisingly, the clamour for governments to act has been loud and insistent. But it has also re-opened debates about dependence on partner countries and exposure to the winds of globalisation. Where should boundaries be drawn and how should vital national requirements be met? At the start of the lockdown, Emmanuel Macron made this statement in a televised address to the nation. ‘Delegating our feeding, our protection, our ability to heal to others is madness. We need to take back control’ [author’s translation from the original French]. He struck a chord with his citizens, just as the phrase ‘take back control’ was so effective in the Brexit referendum campaign. Subsequent polling found that the great majority would like to see significant amounts of economic activity repatriated to French soil.

Similar demands have arisen elsewhere in Europe, not least in Germany where a key part of the package of economic measures in response to Covid-19, was a loan scheme aimed at companies vulnerable to hostile takeover as share prices fell because of economic lockdown. A specific instance was a proposal for a €9 billion bailout of Lufthansa, including the acquisition by the German state of 20 percent of its equity. Initially, the company’s board rejected conditions insisted upon by the European Commission, but it now looks as though it will proceed, despite objections from competitors, not least Ryanair. It represents an especially tricky dilemma for the European Commission in its role as the guardian of the EU’s competition policy.

In some respects, these sentiments and policies reflect long-standing preferences. France is often considered to have protectionist instincts, although some might argue it is more often gestures than actions. Former French PM, Dominique de Villepin, claimed that blocking a takeover by an Italian predator of a French utility company was ‘economic patriotism’. In Germany, the expression ‘heuschrecke’ (locusts) – referring to the predatory behaviour of (mainly ‘Anglo-Saxon’) hedge funds and private equity investors – was used to great political effect by the SPD leader Franz Müntefering.

De Villepin was rebuffed by his compatriot Dominique Moisi who agreed that Europe needs globally competitive companies and that some of these have to become bigger. However, he said ‘the introduction of patriotic criteria confuses the debate. Could French giants be good for Europe, but European giants bad for France?’.

What these examples illustrate is the fuzzy line between what may be good for one country, at least in the short-term and what may be good for Europe and other parts of the world, let alone how it affects consumers or workers. Indeed, for Moisi, the likely casualty of the economic patriotism logic is Europe: ‘Europe is falling between national political calculus on the one hand and the economic logic of a world market for energy on the other’. Much the same reasoning is evident in the repeated insistence by Europe’s leaders on the necessity of safeguarding the single market.

Countries traditionally thought-of as pro-globalisation or free-traders are also becoming increasingly protectionist. Even before the present administration, with its slogan of ‘make America great again’, the US had become more wary of multilateral deals; and Brexit has obvious protectionist undertones. These tendencies have in part been fuelled by the seemingly inexorable rise of China, a country that also practices various form of protection for strategic reasons, and other increasingly competitive emerging market economies. In richer economies, the losers from globalisation – whether actual or just perceived by themselves as such – have become a more powerful constituency, the more so as the wealthiest owners of capital are seen to be the principal beneficiaries of openness.

Changing expectations and the quest for strategic autonomy

Clearly though, the health and economic challenges of covid-19 have taken these concerns to a new level. Shortages of vital protective equipment for health workers, allegations of attempts to prise cargoes away from their legitimate customers and claims of who will have first call on a possible vaccine have abounded.

The European Council adopted the expression ‘strategic autonomy’ to articulate its concerns about undue dependency on external suppliers. In a speech to the European Council on 13th May, reporting on the previous month’s EUCO, President Charles Michel revealed he had ‘sensed an increasingly shared conviction at this European Council of the need to draw lessons from the past and to restore Europe’s production capacities. I’m tempted to paraphrase the message from the European Council by saying that we should bring back the “made in Europe” label’.

There are four conceptually distinct justifications for the various forms of protection implicit in many of the measures being introduced or under consideration, some of them more salient in the context of a crisis combining health and economic damage. The first can broadly be understood as security. It is most immediate in relation to medical supplies, especially in light of the anecdotal evidence of efforts to divert shipments. A second, related justification is ensuring the survival of strategically important sectors of an economy.

Then, there is enhancing the resilience of an economy against shocks, both on the supply and demand sides. China’s initial lockdown led to shortages of components for industry in other countries, but as they too became subject to lockdowns, China felt the same effect in reverse, exacerbated by falling demand and policy actions taken by trading partners. Without alternative sources of inputs, companies with business models relying on the ‘just-in-time’ principle realised their vulnerability to disruption. This was seized on in mid-April by Donald Trump who, according to Breitbart (one of his few favoured media agencies) said ‘we’ve learned a lot about supply chains … we’ve learned that it’s nice to make things in the U.S., I’ve been saying that for a long time’.

The fourth rationale is old-fashioned mercantilism, states rigging the market to favour their own producers. It arises where governments believe they can exercise their power to confer an enduring competitive advantage on their producers, despite the well-established findings of international trade theory and the empirical evidence on the benefits of free trade.

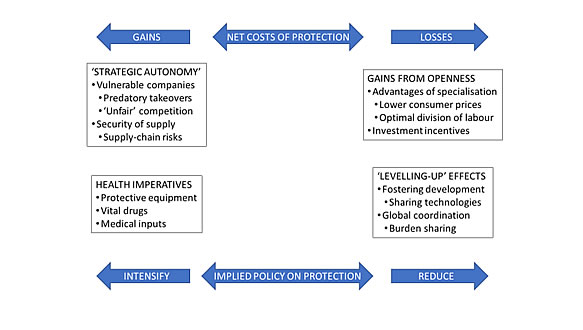

Elements of all of these can be seen in how different sort of measures have been portrayed in public debate (see figure 1). In today’s exceptional circumstances, governments have made clear they see persuasive reasons for protecting vulnerable companies, as described above, from the ‘locusts’ of global capitalism. They also see merit in diminishing risks from overly complex global supply chains, even if at the expense of forgoing some of the gains from trade.

Medical supplies give rise to a more clearcut narrative, exemplified in the Macron quote, above. The global shortage of personal protective equipment (PPE) sparked controversy in public opinion along the lines of ‘why do we have to rely on China?’ and ‘why can our own companies not provide this and why are they not in these markets?’. Yet an alternative explanation could simply be poor strategic planning, illustrated by the report that France had recently incinerated its stock of face masks.

On the other side of the equation, the underlying promise of globalisation is that more can be supplied more cheaply if barriers to trade are cut. This benefits consumers (i.e citizens), improves the incentives for division of labour and can induce investment. Though contested by some who view it as unduly ‘Panglossian’, more open markets are conducive to more rapid economic development and encourage diffusion of technology, rather than restriction of access to it. A more strategic issue is the scope for coordination of policy responses, as well as scope for equitable sharing of burdens.

Figure 1. Gains and losses from more protective policy stances

Manifestly at a time of as much economic stress as the present, pandemic-induced crisis, accepted norms can quickly be discarded. Eurozone countries were rapidly dispensed from applying fiscal rules and provisions for controlling state aids were suspended in March. An update extended the period over which the suspension of rules would apply, and the list of authorisations expands daily, with the decisions referring to how ‘exceptional interventions by the Member States to compensate for the damages linked to the outbreak are justified’.

Typical examples are national measures to provide liquidity support for companies in Belgium, Poland and Spain in which much the same form of words is used in each case in authorising the measure. Thus, for a €50 billion loan guarantee scheme in Belgium, targeted at companies of all sizes, the judgement is as follows:

The Commission therefore concluded that the measure will contribute to managing the economic impact of the coronavirus in Belgium. It is necessary, appropriate and proportionate to remedy a serious disturbance in the economy of a Member State.

The sorts of measures being adopted during the crisis exhibit features of the rationales described above and the reasoning behind them. Some are outright grants to support business operation while others are about enabling companies to tide-over the erosion of working capital from the lockdown. Table 1 suggests a simple typology and highlights some of their properties. Underlying these measures are broader governance choices about the role of an activist industrial policy in both the recovery from the current economic crisis and as a long-term instrument of governance.

However, as reported in the Financial Times on May 1st, an emerging worry is that the greater fiscal capacity of richer member states will enable them to spend more, potentially distorting the single market in their favour. Germany, at the time, accounted for over half the emergency state aid announced. This may make sense for now, but when recovery takes hold, could mean further divergence among member states. The notion of the level playing-field is what is at risk.

Table 1. Typology of protective measures

| Objective | Examples | Advantages | Drawbacks | Impact on public finances |

| Liquidity support for companies to enable them to maintain and service borrowing | Widely used across the EU, with loans from both the state and the central bank | Keeps strategic sectors or individual firms alive, cushions the decline in working capital; cheap finance | Loans are meant to be repaid, therefore create future problems for recipients | Depends on extent of re-payment; risks of non-performing-loans affecting public debt adversely |

| Furlough or reduced working hours | UK furlough; self-employed in Spain; kurzarbeit in Germany; and many similar | Lessens loss of productive capacity; safeguards human capital by making ‘hysteresis’ less likely | Difficult to judge exit strategy for state; may only postpone rising unemployment | Heavy immediate costs; cannot last indefinitely; legacy of higher public debt |

| Equity injection intended to prevent a company closing or facing ‘serious difficulties’ | Government stakes in Lufthansa and Finnair; blurred boundary with ‘routine’ state holdings of equity | Deters predatory takeovers; extreme measure to sustain a business; safeguarding strategic companies | Distorts competition more than loans; difficult to balance with market entry; unfair advantages for richer countries; complexity of rules | Limited, but could escalate; risks of loss of state investment; rules require plan for state to withdraw |

| National preference in procurement | Substantial reduction in EU, e.g. rules Polish procurement law for Covid-related supplies and French Covid law; applied to national vaccine research | Speed of obtaining needed goods and services; secures essential supply chains; creates space for national champions | Poor state record of picking winners; raises costs of public goods; deters cross-border cooperation, though some scope for joint procurement | Limited; but can lead to reduced efficiency of state spending |

| Reconfiguring supply chains | US national emergency order; many EU countries promoting national chemical/pharma; Japan subsidies to ‘reshore’ from China | Lower dependency; ensures medical supplies; helps resilience of economies; reduces economic contagion | Exploited to restrict fair competition; disruption for companies and customers; higher costs | Limited short-term; duplication costs for public investment; potential short-term gains of tax revenue |

Policy challenges and implications

The sheer extent of the protective measures now in place across Europe, as well as in the US and other richer countries, would have been inconceivable as recently as six months ago. Amid much talk of a fundamental change of economic model, an open question is whether the outcome will be a retreat from the multilateral, broadly free-market form of globalisation of recent decades. With increasing acrimony between the US and China, sometimes inflicting collateral damage on other trading partners, the EU will face a choice between following a similar path and working to revive multilateralism. Specifically, the former would entail adopting a much more interventionist – and inward-looking – industrial policy, following in the footsteps of the US. The ‘green deal’ proposed by the Commission offers a positive vision for such a policy, but the possibility of a contest of intensifying restrictions damaging to all sides should not be ignored.

Crises as profound as the present one will have scarring effects not easily cured. A second big policy challenge is what the future of many of measures adopted will be; put another way, is there an exit strategy? Just as with resort to life support in a medical emergency, the expectation is that the patient will recover, ending the need for support. Before long, loans granted to keep companies afloat will need to be repaid and states will have to decide whether the business remains viable or could become a ‘zombie’ unlikely ever to restore its fortunes.

A particularly delicate short-term policy choice will be when and how to withdraw support. A progressive tapering of furlough schemes, for example, is unavoidable because the cost to the state is so great. In some cases, such as state injections of equity, the suspension of EU rules is both temporary and conditional (Lufthansa, for example, has been obliged to offer other airlines some of its slots at its hub airports), and the Commission decision to approve the measure stipulates an end-point. It would not be surprising if this led to tensions between the member states and the Commission, but also to claims of foul-play by other member states.

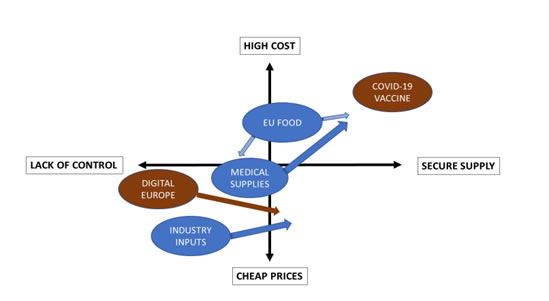

The basis for decisions will not be purely economic, not least in relation to measures aimed at reconfiguring supply-chains. Political motives may be selfish, exemplified by overt mercantilism, but may be justifiable responses to public concerns. An especially tricky trade-off is between security and cost, as depicted in figure 2.

Figure 2. The cost-security trade-off: some illustrations

Medical supplies exemplify the security dimension. Faced with global shortages of protective equipment or ventilators, governments proved ready not just to throw money at the problem, but also pushed very hard for a re-purposing of industrial capability. In the short- to medium-term, the covid-19 crisis has seen security dominate cost. Similarly, governments seem ready to invest at national level in finding vaccines, rather than cooperate fully.

Concern about access to industrial inputs also seems to be motivating a drift towards more national control, while from a different perspective, Europeans are looking at exerting greater control of digital technologies, not least in securing tax revenue from the digital giants. Food security, on the other hand seem to be subject to competing pulls: wanting security of supply, while also favouring lower costs. Many other examples could be added to the chart.

There are also various medium- and longer-term concerns. As every document generated by Brussels unfailingly attests, the single market is at the heart of EU prosperity. For this reason, restrictions on state aids are central to EU competition policy and can be simply explained: such aids confer an advantage on companies receiving them. When the public finances of some states are more robust than others, it is hard to ensure a level playing-field. Ursula von der Leyen emphasised this point in her presentation of the ambitious ‘Next Generation EU’ proposals. The direct challenge to policymakers is not just when to revert to Treaty-based restrictions on state aids, but also how to repair the bumps in the level playing-field which place some countries at a systematic disadvantage.

Careful shepherding of the public finances is another area of concern in two respects. First, in economies where the recovery takes longer or is weaker, and with monetary policy running short of ammunition, the need for fiscal stimulus will remain. Governments which have used much of their fiscal room for manoeuvre in mitigating measures could struggle to boost their economies when the lockdown eases. The much more extensive efforts by the EU level to engineer a fiscal stimulus could be doubly helpful in the regard, by lowering collective borrowing costs and favouring the worst hit.

The second budgetary concern is the longer-term one of how to unwind the large deficits and debts racked-up during the crisis, bearing in mind the likely need for health and care spending to continue at levels well above those prior to the crisis. Tax rises will, at some stage, be part of this equation and competition among countries to extract revenue from certain tax bases must be expected to intensify. There have already been skirmishes around taxation of digital companies and more should be anticipated.

A last, broader question about the range of virus-related repatriation and protection measures is what they will mean for an international system already facing stresses as a result of trade tensions and criticism of international agencies. Globalisation and multilateralism have their critics and undoubted shortcomings, and the transmission of covid-19 supply shocks along supply chains is undeniable. The policy implication is that governments should strengthen industrial policies aimed at building up capacity in areas deemed strategic or vital.

Although some measures to increase choice in sourcing may, in due course, be warranted, these will take time to establish and be disruptive while being re-engineered. Governments are also notoriously bad at picking winners while, as Dieter Helm cynically remarks, ‘losers are good at picking governments…to the general detriment of household and industrial customers’.

Consequently, global coordination rather than confrontation may, perhaps counter-intuitively, offer a more effective way forward. As Baldwin and Freeman emphasise. self-interest suggests ‘the US may need China and India to keep their “active pharmaceutical ingredient” plants open, while China and India may need the US to keep its semiconductor plants open.

A clear danger today is that the lessons from the last global depression on a comparable scale – the 1930s – will be too easily forgotten. Throwing-out the baby with the bathwater has never been a great idea.

I am grateful to Raymond Torres for constructive suggestions on an earlier draft