Fecha: julio 2025

Santiago Carbó-Valverde*, Pedro Cuadros-Solas** y Francisco Rodríguez-Fernández***

Abstract

This paper investigates how excess central bank liquidity affects bank behavior in the Eurozone. Using a panel of over 3,000 banks from 2008 to 2022, we document three unintended consequences of the ECB’s extraordinary liquidity programs. First, higher liquidity uptake is associated with significantly lower credit growth: a 10-percentage point increase in ECB funding is linked to a 0.7 percentage point decline in annual loan growth. This effect is strongest among smaller and less efficient banks. Second, excess liquidity is systematically reallocated to sovereign bond holdings: a 1% increase in liquid assets correlates with a 0.09 percentage point rise in sovereign bonds as a share of total assets, consistent with carry trade incentives. Third, greater liquidity exposure compresses bank profitability: a 10-point increase in liquidity reduces net interest margins by approximately 5 basis points. To address endogeneity, we implement a two-stage least squares (2SLS) strategy using a policy intensity index interacted with national banking system size. The results confirm a causal crowding-out effect on credit supply. These findings highlight how prolonged monetary accommodation can distort bank incentives and reshape the transmission of monetary policy.

I. INTRODUCTION

The European Central Bank (ECB) has been a central pillar of the eurozone’s financial architecture, especially in times of economic turmoil. Since the global financial crisis of 2008 and the subsequent European sovereign debt crisis, the ECB has deployed a suite of unconventional monetary policy tools designed to stabilize markets and promote recovery (Altavilla et al., 2019; Rostagno et al., 2019). Key among these is the various Long-Term Refinancing Operations (LTROs), targeted LTROs (TLTROs), and large-scale asset purchase programs. These measures injected unprecedented levels of liquidity into the banking system, creating an environment of historically low interest rates and substantial excess reserves (Claessens et al., 2018). While these policies were critical in averting systemic crises, their broader consequences–both intended and unintended–warrant careful examination. In particular, there is growing evidence that abundant central bank liquidity can lead to misalignments between policy intentions and bank behavior, such as subdued credit growth, increased carry trade activity, and pressure on bank profitability (Acharya & Steffen, 2015; Drechsler et al., 2016; Heider et al., 2019).

One central aim of ECB liquidity provision was to encourage banks to extend credit to the real economy. By reducing funding costs for banks, the ECB intended to create favorable conditions for lending to households and firms. However, observed outcomes often deviate from these objectives. Instead of channeling funds toward productive private-sector credit, many banks prioritized balance sheet repair or low-risk investments. This behavior was rational for individual banks (short-term profit and balance sheet strengthening) but subverted the policy with the intent of stimulating the real economy. As Adrian and Shin (2010) show, liquidity and leverage are deeply intertwined, magnifying these effects when monetary accommodation is prolonged. A number of banks used cheap ECB funds to deleverage or accumulate safe assets rather than expand lending. Others engaged in financial strategies such as the sovereign carry trade, wherein banks borrow at low cost from the central bank and invest in higher-yielding bonds. By exploiting yield differentials on sovereign debt–particularly bonds of peripheral eurozone countries–banks could generate short-term profits with minimal new lending, echoing the distortions identified by De Marco (2019) in bank lending behavior during the debt crisis. This behavior represents a significant unintended consequence: rather than stimulating broad-based credit growth, ECB liquidity has sometimes fueled arbitrage strategies that boost bank earnings but do little to support the real economy. These unintended consequences have also been recently acknowledged by some policymakers at the ECB1 and the Bank for International Settlements.2

The implications of these dynamics are far-reaching. The sovereign carry trade not only undermines monetary policy transmission to the real economy but also introduces concentration risks on bank balance sheets. Acharya and Steffen (2015) famously labeled this phenomenon “the greatest carry trade ever,” documenting how European banks used ECB funding during the sovereign debt crisis to increase holdings of risky peripheral sovereign bonds. Subsequent studies confirmed that especially weaker banks (e.g., those with low capital) were most prone to using central bank funds to buy sovereign debt. This carry trade behavior helped stabilize sovereign bond markets in the short term and boosted bank profitability via interest rate spreads, but it left banks more exposed to future sovereign risk shocks. Indeed, price corrections in government bonds translated into significant mark-to-market losses for banks heavily engaged in this trade, illustrating the interconnectedness of sovereign risk and financial stability. Moreover, transparency and disclosure frameworks like stress tests may mitigate this risk concentration (Petrella & Resti, 2013).

In parallel, the net interest margin (NIM) – a key metric of bank profitability – came under pressure in the prolonged low-rate environment fostered by excess liquidity (Carbó et al., 2021). With policy rates at or below zero, banks faced very low yields on their excess reserves (often even negative remuneration) while competition in lending kept loan rates from falling as fast as deposit costs. This margin compression effect is central to the concept of a “reversal interest rate” proposed by Brunnermeier and Koby (2018). The reversal rate is the point at which accommodative monetary policy reverses its intended effect and becomes contractionary for lending, as banks’ profitability and willingness to lend are undermined by too-low rates. In practice, as the ECB flooded the system with liquidity, many banks saw their NIMs shrink – especially those unable to substantially increase loan volumes or fee income to compensate for thinner spreads. Banks parking surplus funds at the central bank at negative rates effectively paid a penalty, eroding income. The result is that excess liquidity can have a paradoxical effect: rather than incentivizing more lending, beyond a point it may lead banks to hold back on credit expansion due to profitability concerns, a result also documented by Ulate (2021) in banks exposed to persistent negative rates.

Beyond carry trades and NIM compression, abundant liquidity carries broader systemic implications. It can distort financial markets by compressing risk premia and encouraging a “search for yield”. When banks and investors assume that central bank support will be readily available, they may adopt riskier strategies, weakening market discipline. This moral hazard can exacerbate vulnerabilities, as highlighted by Brunnermeier et al. (2012) in the context of prolonged easing. Furthermore, liquidity injections have had uneven effects across the eurozone. Banks in core countries often responded more effectively to ECB incentives, while those in weaker economies struggled to translate liquidity into lending. This divergence underscores the limitations of one-size-fits-all monetary policy in a heterogeneous region.

This study provides an empirical analysis of the unintended consequences of ECB liquidity provision using a novel approach. A few previous studies rely on confidential supervisory data or ECB internal datasets, but we present a methodology that allows us to leverage publicly available accounting data to infer each bank’s uptake of central bank liquidity. We construct proxies for ECB liquidity use directly from banks’ balance sheet changes, allowing us to analyze a large cross-country sample of eurozone banks. This approach enables us to investigate policy impacts at scale (covering hundreds of banks across multiple countries) and over an extended period, offering a more comprehensive multi-country perspective than many prior analyses. Our focus on outcomes like the sovereign carry trade and NIM compression also adds originality: we extend the literature by examining not only credit growth (the intended outcome) but also these two critical unintended outcomes in the same framework. In summary, our contributions are threefold: (1) we show that publicly reported financial statements can be used to identify ECB liquidity uptake at the bank-level, providing evidence even without proprietary data; (2) we document, across a broad set of banks, that excess liquidity was often diverted to sovereign debt investments and was associated with weaker credit growth, highlighting a misallocation of central bank funds; and (3) we show that banks with greater reliance on ECB liquidity experienced heightened NIM compression, linking monetary policy interventions to bank profitability pressures. These findings shed new light on the efficacy and side effects of unconventional monetary policy, offering insights for policymakers as they consider the design of future liquidity programs.

II. LITERATURE BACKGROUND AND HYPOTHESES

A growing body of literature examines how banks responded to the ECB’s unconventional policies, revealing several unintended consequences. During the European sovereign debt crisis, the ECB’s 3-year LTROs (2011–2012) provided large-scale funding to banks, which was expected to support lending. However, researchers found much of this liquidity went into sovereign bonds of stressed economies. Acharya and Steffen (2015) document that European banks, especially in countries like Italy and Spain, used LTRO funds to purchase high-yield government bonds rather than increase private lending – a strategy they dub the “greatest carry trade ever”. Altavilla et al. (2017) similarly finds that banks with higher LTRO uptake significantly increased their holdings of domestic government debt, exploiting the spread between sovereign yields and the low cost of LTRO borrowing. Albertazzi et al. (2021) extend this analysis to the COVID-19 period, confirming the persistence of this behavior under TLTRO III. This behavior was rational for individual banks (short-term profit and balance sheet strengthening) but subverted the policy with the intent of stimulating the real economy. It also intensified the bank-sovereign nexus: banks became more exposed to any deterioration in sovereign bond values.

In normal times, banks optimize portfolios across loans and securities, but in crisis times with generous central bank funding, carry trades can dominate. This mechanism parallels the evidence in Black and Rosen (2016), who study how publicly subsidized liquidity reshapes bank risk incentives. The literature notes that weaker banks (e.g., low capital or high non-performing loans) were especially likely to engage in this strategy, as they were reluctant to take on new credit risk (Carvalho et al., 2015), especially in systems with weak creditor rights and limited borrower transparency. and instead sought the “risk-free” carry yield to rebuild capital. This has raised financial stability concerns. For instance, Drechsler et al. (2016) show that poorly capitalized banks in the eurozone disproportionately used ECB funds to buy higher-yield sovereign debt, effectively gambling for resurrection. Menkhoff et al. (2012) emphasize that such carry trades entail systemic risk: when many banks simultaneously unwind bond positions (e.g., if yields spike), it can trigger liquidity spirals and fire sales. Jasova et al. (2022) show that TLTROs amplified credit supply heterogeneity across banks with different capital buffers. Castillo et al. (2022) and Bindseil and Lamoot (2011) emphasize the role of balance sheet proxies and funding structures in identifying banks’ ECB liquidity uptake, motivating our use of publicly available accounting variables.

Another stream of literature investigates why the enormous liquidity injections did not translate into commensurate credit growth. One reason is demand-side weakness – during recessions or uncertainty, firms and households may not seek new loans. However, even accounting for demand, supply-side constraints at banks were evident. Acharya and Steffen (2015) note that many banks chose to park funds in safe assets rather than lend amid high credit risk and regulatory pressure to deleverage. Altavilla et al. (2019) find that while TLTROs reduced banks’ funding costs, the effect on loan growth varied: banks in stronger economies expanded credit modestly, but those in weaker economies did not – often preferring to repair balance sheets, mirroring findings in the U.S. during QE as shown by Rodnyansky and Darmouni (2017). Albertazzi et al. (2021) corroborate that during the COVID-19 TLTROs, banks receiving central bank funding did not significantly increase lending to small businesses in distressed regions, citing risk aversion and lack of credit demand. In sum, evidence suggests a divergence between policy intent and actual credit outcomes, especially for banks under stress or in weaker markets.

Excess liquidity has also been linked to banks’ profitability challenges. As central bank liquidity grew, eurozone interest rates fell to historical lows (including negative deposit facility rates). Brunnermeier and Koby (2018) theorize that beyond a threshold, further monetary easing becomes counterproductive for banks (“reversal rate”), because squeezed net interest margins impair banks’ ability to lend. Empirically, Claessens et al. (2018) and others have shown that prolonged low interest rates compress banks’ NIMs and overall net interest income. Altavilla et al. (2017) find that banks with large excess reserve holdings suffered greater declines in interest income once negative rates were introduced, as they could not fully pass on costs to depositors. In this sense, Carbó et al. (2021) document that banks taking more customer deposits were more strongly affected by negative interest rates. Furthermore, Heider et al. (2019) demonstrate that negative policy rates led banks with more deposit funding to reduce loan supply (consistent with margin pressure). These studies highlight a critical unintended effect: central bank liquidity support, by driving rates ultra-low, may undermine bank profitability and potentially reduce the willingness to lend, especially for banks that accumulate large idle liquidity buffers at the central bank.

Building on this literature, we formalize two main hypotheses for our empirical investigation:

- Hypothesis 1: Banks with higher reliance on ECB-provided liquidity expanded their credit supply more slowly (or contracted credit more) compared to banks with less reliance on ECB funding, particularly during periods of economic stress. In other words, greater uptake of central bank liquidity is associated with subdued loan growth. This hypothesis reflects the idea that liquidity-rich banks may have prioritized non-lending uses of funds (e.g., investing in securities or improving liquidity ratios) over lending. It will be evidenced by a negative relationship between measures of ECB liquidity uptake and loan growth at the bank level. A corollary of this hypothesis is that those banks might instead engage in carry trades; thus, we also expect to observe a positive relationship between ECB liquidity uptake and holdings of sovereign bonds (i.e., liquidity is channeled into government securities rather than loans). This carry-trade behavior is essentially the flipside of the credit slowdown and serves as supporting evidence for Hypothesis 1.

- Hypothesis 2: Banks with higher reliance on ECB liquidity experienced greater net interest margin (NIM) compression during the period of abundant liquidity and negative rates. Banks that borrowed heavily from the ECB (and correspondingly held large excess reserves or low-yield assets) faced more acute pressure on interest margins, due to the low return on liquid assets and limited lending opportunities. We expect to find an inverse relationship between ECB liquidity uptake and NIM: the more a bank’s balance sheet is flush with central bank liquidity, the lower its net interest margin, ceteris paribus. This would be consistent with the reversal-rate mechanism and suggest that prolonged easy monetary policy can weaken bank profitability.

Together, these hypotheses capture the notion of “unintended consequences” of ECB liquidity provision: instead of spurring robust lending, heavy liquidity uptake is tied to risk-free arbitrage (carry trade) and to profitability strains that themselves can inhibit lending. In the following sections, we describe how we test these hypotheses using bank-level accounting data and present results that strongly support both conjectures.

III. DATA AND METHODOLOGY

1. Data Sample and Sources

To investigate these questions, we constructed a large panel dataset of European banks using publicly available sources. Our primary data comes from the Bureau van Dijk BankFocus (Orbis) database, which compiles financial statements for banks worldwide. We extracted data on Eurozone commercial, savings, and cooperative banks over the period covering the ECB’s major liquidity operations (approximately 2011–2023, encompassing the LTRO, TLTRO I-III, and pandemic liquidity programs). We applied several filters to focus on relevant institutions and ensure data quality. in particular, we excluded very small institutions–defined as those with total assets below €1 billion, a threshold consistent with prior empirical studies and regulatory classifications distinguishing small local banks from the broader commercial banking sector. We also dropped non-traditional banks and public entities that might distort the analysis (e.g., development banks, central banks themselves, or government financial agencies). After cleaning, our effective sample consists of 3,115 banks across the Eurozone, with a total of about 43,610 bank-years used in the panel analysis. This broad coverage is a key strength of our approach, as it captures a wide cross-section of banks – from large cross-border institutions to small regional banks – allowing us to generalize results across the Eurozone banking sector. Based on ECB Statistical Data Warehouse (Banking Structural Financial Indicators, BSI), total assets of Eurozone monetary financial institutions (excluding the Eurosystem) were approximately €33 trillion as of 2024. Our sample covers banks accounting for an estimated €27–29 trillion in assets, or about 80–88% of the system total.

Importantly, we do not observe directly which banks borrowed from the ECB’s facilities or how much they borrowed, since that information is not public at the individual bank level. Our analysis instead infers banks’ uptake of ECB liquidity through their published balance sheets, leveraging the accounting identities that reflect liquidity inflows. This indirect approach is consistent with models of liquidity behavior and structural balance sheet analysis, such as those presented by Castillo et al. (2022) and Diamond and Rajan (2001). We focus on the period of massive liquidity injections (2011–2012 LTROs, 2014–2017 TLTRO II, 2020–2021 TLTRO III and pandemic programs) and track how banks’ balance sheet compositions changed concurrent with these operations.

2. Identification Strategy for ECB Liquidity Uptake

When a bank taps central bank liquidity facilities (such as TLTRO funds), its balance sheet will expand, and specific line items will reflect the inflow. In general, the immediate impact of receiving an ECB long-term loan is an increase in the bank’s cash or reserve balances on the asset side (as the borrowed funds are credited to the bank’s account at the central bank), matched by an increase in central bank borrowing on the liability side. How the bank then uses those funds can vary, but broadly the uses fall into four categories identified by central bank analyses:

- A. Lending: The bank could use the liquidity to extend new loans to customers. In this case, reserves would initially rise, but as the funds are disbursed to borrowers and ultimately deposited or transferred, the bank’s loan assets increase. (If the borrower keeps the funds on deposit, the bank’s customer deposits on the liability side also increase, otherwise reserves may flow out to other banks.) This is the outcome policymakers intend – increased Loans on the asset side, corresponding to credit growth.

- B. Holding as Reserves: The bank may simply hold the funds idle as excess reserves at the central bank. Here, the asset-side increase in reserves remains in place. This would indicate the bank did not find attractive lending opportunities and chose to maintain liquidity (possibly due to risk aversion or lack of loan demand). Excess reserves earning a low or negative rate represent an unused liquidity buffer, a dynamic extensively discussed by Altavilla et al. (2017) and Heider et al. (2019), who link reserve accumulation to transmission inefficiencies in the context of negative interest rates.

- C. Purchasing Government Bonds: The bank might invest the funds in sovereign securities. In this case, reserves would be transformed into holdings of government debt on the asset side. This is the carry trade strategy – using low-cost ECB money to buy higher-yield sovereign bonds. The balance sheet would show an increase in government bond assets corresponding to the liquidity taken.

- D. Substituting for Market Funding: The bank could use the ECB funds to repay other liabilities, such as interbank borrowings or outstanding debt securities (market funding). In this strategy, the incoming central bank funding replaces more expensive or less stable funding sources. The balance sheet effect would be an increase in central bank liabilities offset by a decrease in other liabilities (e.g., a drop in “Amounts due to other banks” or outstanding bonds). In assets, reserves might briefly rise and then fall as the funds are used to pay off those liabilities.

Considering the accounting structure of ECB operations, we reinforce our identification strategy by explicitly linking our proxies to observable balance sheet patterns documented in supervisory studies. Following Castillo et al. (2022), we recognize that TLTRO III liquidity injections manifest in four balance sheet strategies: lending, holding reserves, bond purchases, and substitution for market funding. Among these, only the first two–credit expansion and reserve accumulation–show a consistent and significant relationship with ECB funding at the bank level.

Consequently, we design our ECB borrowing proxy to capture excess funding needs not met by deposit inflows, which is the most visible footprint of central bank liquidity on the balance sheet. This approach follows the accounting logic described above and avoids misclassification of institutions simply shifting between market sources. Our strategy is thus grounded in empirical accounting identities and has been validated in the Spanish banking system under TLTRO III.

Banks may deploy ECB liquidity in combinations of these strategies simultaneously (e.g., some portion to new loans, some to bonds, etc.). Our identification approach is to quantitatively capture the extent of a bank’s liquidity uptake and its allocation using observable balance sheet metrics associated with the above strategies:

- Excess Liquidity Proxy: We define a bank’s liquidity uptake primarily through the ratio of its liquid assets to total assets. We compute Liquid Assets / Total Assets (often called the liquidity ratio) for each bank year. “Liquid assets” include cash and balances with central banks, interbank placements, and other assets that are cash equivalent. A sharp increase in this ratio, especially during the known LTRO/TLTRO years, is a telltale sign that a bank received funds that it has not immediately lent out. This measure captures both holding reserves (category 2) and the initial phase of any strategy (since all uses start as reserves). In our analysis, we use the log of liquid assets to assets as a key independent variable indicating ECB liquidity uptake. Taking logs helps normalize the distribution and reduce the influence of a few extremely liquidity-rich banks. Intuitively, a higher liquid-asset ratio means the bank is holding relatively more cash/reserves – often a byproduct of taking ECB liquidity, potentially reflecting liquidity hoarding behavior as described by Diamond and Rajan (2001).

- ECB Borrowing Proxy: To more directly gauge reliance on ECB funding, we construct a proxy for the share of a bank’s liabilities attributable to ECB borrowing. While we cannot observe ‘Borrowings from central bank’ explicitly for all banks, we infer it by looking at funding gaps. Specifically, we compare a bank’s non-deposit funding to its total liabilities. If a bank’s customer deposits are significantly less than its total assets, the remainder must be financed by wholesale funding or central bank funds. In formula, we define:

ECB_borrowing_proxy = max{0, (non-deposit liabilities / total liabilities)}

where non-deposit liabilities include money market and long-term funding.

In practice, we implemented this as:

[Long-term borrowings (<=1yr maturity]) – Customer deposits) / Total liabilities,

clipped between 0 and 1 (since deposits can at most equal or exceed that category).

The idea is that if a bank has more short-term borrowings than customer deposits, it likely is using central bank funds (or interbank funds) to fill the gap. This proxy rises when a bank replaces deposit funding with ECB funds or other market funding. A higher value indicates greater dependence on central bank liquidity relative to traditional deposit funding, raising concerns of liquidity misallocation as explored in Tirole (2011). We use this proxy as an alternative measure in robustness checks and as a potential instrumental variable, as described below.

- Sovereign Bond Holdings: To track the carry trade activity, we measure each bank’s holdings of government securities (typically reported under assets as “available-for-sale” or “held-to-maturity” debt securities, with a breakdown by sovereign vs. other). Ideally, we would look at the change in sovereign bond holdings around liquidity injections. We use the level of sovereign bond holdings (relative to assets) as an outcome of interest, under the assumption that banks with greater ECB liquidity access will end up with a higher share of assets in government bonds (all else equal). For many banks, especially in crisis countries, a jump in this ratio during LTRO years signals a carry trade. We incorporate this either as a dependent variable (to directly test the carry trade hypothesis) or as part of the loan growth equation (since an increase in bond holdings might crowd out loans on the balance sheet).

- Loan Growth: Our primary metric for credit supply is the annual growth rate of customer loans. We compute Loan Growth for each bank-year as the year-on-year percentage change in the stock of loans to customers (gross loans) on the balance sheet. In some specifications, we also examine multi-year growth over specific program periods (for example, loan growth from pre-TLTRO to post-TLTRO). Higher loan growth indicates the bank is extending more credit. According to our hypothesis, banks that heavily taped ECB liquidity should, paradoxically, show lower loan growth, indicating they did not use the liquidity to expand credit as intended.

- Net Interest Margin (NIM): We take each bank’s net interest margin (net interest income as a percentage of earning assets) from income statement data. This is often provided directly in BankFocus or can be calculated as net interest income divided by average interest-earning assets. NIM is expressed in percentage points. We use NIM as an outcome to capture profitability effects. Our expectation is that banks with high liquidity (excess cash, reserves) and consequent low asset yields will have lower NIMs. We analyze NIM in panel regressions controlling for other factors.

- Control Variables: We include a set of bank-specific controls that might influence loan growth or NIM independently of liquidity uptake. Key controls are bank size (log of total assets), capitalization (equity-to-assets ratio or regulatory capital ratio), and asset quality (non-performing loans to total loans, i.e. NPL ratio). Size can proxy for differences in business models (large banks vs small). Capital and NPL ratios control for the bank’s health: well-capitalized, low-NPL banks may be more able to lend. We also control the country and time effects: our regressions include either country fixed effects, year fixed effects, or bank fixed effects as appropriate to net out macroeconomic differences and any time trends or shocks common to all banks (such as the overall credit cycle or interest rate environment in a given year).

3. Handling Outliers and Data Winsorization

Bank accounting data can exhibit extreme outliers due to one-off events, data errors, or genuine but unusual cases (e.g., a tiny bank that grows its loan book by 1000%, or a bank with near-zero loans in one year leading to a huge percentage change the next year). To ensure that such extremes do not distort our analysis, we winsorize outliers by capping values at the 5th and 95th percentiles. We also drop observations where loan growth is outside the range of –100% to +100% in a year (we treat changes beyond this as likely data issues or extraordinary circumstances such as mergers). We also trim the top and bottom 1% of the distribution of NIM (dropping cases where reported NIM is, say, negative or above 10% – values that indicate non-standard operations or data anomalies, since typical bank NIMs range a few percent). Similar trimming is applied to the liquid assets ratio and sovereign bond ratio to remove implausible values (e.g., cases where these ratios exceed 100% or are reported as negative). After outlier filtering, the distributions of the variables align with economic intuition. For example, in the cleaned sample the average annual loan growth is around 3-5% with a standard deviation of ~15%, and NIM averages roughly 1.5–2% (150–200 basis points). These summary values are in line with aggregate statistics for European banks over the last decade, giving us confidence in data quality post-cleaning.

4. Empirical Model Specifications

To test our hypotheses, we estimate regression models linking ECB liquidity uptake to the outcomes of interest (loan growth, sovereign bond investments, and NIM). Given the structure of our data, we employ panel regression techniques with fixed effects to control unobserved heterogeneity. For loan growth and sovereign bond holdings, our baseline specification uses a bank fixed-effects panel model. We estimate the following baseline panel regression model:

Yit = αi + γt + β LiquidityRatioi,t−1 + δ′Xi,t−1 + εit [1]

where Yit is the outcome for bank i in year t (either loan growth or the share of sovereign bonds in assets), αi are bank fixed effects (to absorb time-invariant differences like business model or region) – in line with Van den Heuvel (2002), who highlights the importance of bank capital in monetary transmission–, γt are year effects (to control for common shocks and the monetary policy stance each year), LiquidityRatioi,t−1 is our proxy for ECB liquidity uptake (lagged one period to mitigate simultaneity), and Xi,t−1 are control variables (size, capital, NPL, cost-to-income efficiency ratio and country GDP growth, also lagged). The coefficient β captures the effect of liquidity on the outcome. For Hypothesis 1, we expect β to be negative in the loan growth equation (more liquidity → lower growth) and positive in the bond share equation (more liquidity → more bond investment). In all panel regressions, we compute robust standard errors clustered at the bank level. This accounts for serial correlation and heteroskedasticity within banks over time, which is appropriate given that treatment variables and outcomes are observed at the bank-year level.

For Net Interest Margin (NIM), we estimate a similar panel model:

NIMit = αi + γt + ϕ LiquidityRatioi,t−1 + θ′Xi,t−1 + uit [2]

Here, the dependent variable is the net interest margin for bank i in year t. The interpretation of variables remains the same, and the coefficient ϕ is expected to be negative, indicating that higher ECB liquidity uptake is associated with margin compression. The expected sign of + θ′Xi,t−1 is negative (liquidity-rich banks have lower NIM).

In some specifications, instead of bank fixed effects, we use country fixed effects (if focusing on cross-sectional differences over a specific period, e.g., pre- vs. post-TLTRO) or no fixed effects but include country-level covariates. However, our preferred models include bank (or at least country) fixed effects to account for structural differences across banks. As Stein (2012) argues, the combination of liquidity support and prudential objectives requires coordinated frameworks.

Recognizing that endogeneity could be a concern – banks’ decision to borrow from the ECB might be influenced by unobservable factors that also affect lending or NIM (for example, a bank expecting weak loan demand might take more ECB liquidity, and also that expected weak loan demand would cause low loan growth) – we experimented with an instrumental variable (IV) approach. As an instrument for a bank’s liquidity uptake, we use a measure of the exogenous policy intensity in its environment. One such instrument is a country-level indicator of ECB liquidity provision, such as the total ECB liquidity injected (per banking system assets) in the bank’s country during a given period. The idea is that in countries where the ECB conducted more aggressive interventions (e.g., Italy or Spain during the sovereign crisis, or all countries during pandemic PEPP and TLTRO III), even healthier banks had more opportunity or incentive to take liquidity, regardless of their individual traits. We construct a variable Policy_intensity which varies by country-year (for instance, the size of ECB refinancing operations relative to country banking system size, or dummies for years of big liquidity programs). We then instrument a bank’s liquidity proxy (e.g., ECB_borrowing_proxy as defined above) with this country-level Policy intensity (and possibly its lag). The IV first stage essentially captures how much liquidity a bank could take based on the environment, rather than its own demand for loans. In the second stage, we then estimate the effect on loan growth or NIM, also relevant for analyzing credit misallocation in liquidity-rich environments (Schivardi et al., 2017). While IV results need to be interpreted cautiously, they serve to bolster our findings by addressing reverse causality concerns. In practice, our IV estimates (reported qualitatively later) were consistent with the OLS/panel results, suggesting that the correlations we find likely reflect causal effects of ECB liquidity on the outcomes, rather than the other way around.

5. Descriptive Statistics

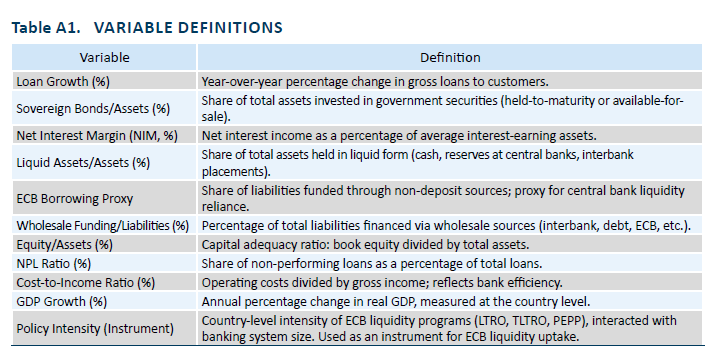

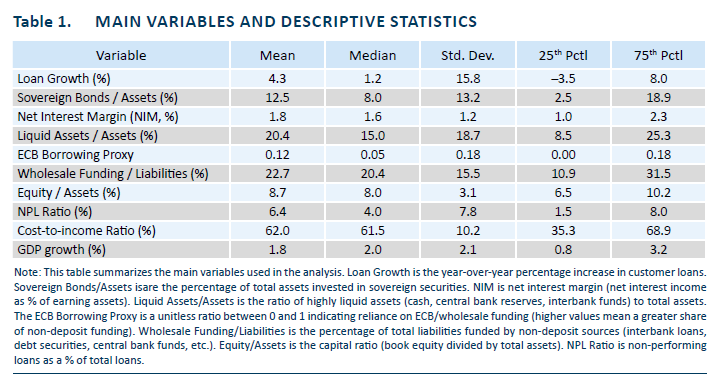

Before turning to regression results, we present summary statistics for the main variables in our study (after outlier filtering). Table 1 provides an overview of the sample’s key characteristics. All monetary figures (like total assets or bond holdings) are in euros, and ratios are in percentage terms where noted. A definition of all the posited variables is provided in Table A1 in the Appendix.

From Table 1, we observe that the average loan growth in our sample is modest (around 4% annually), but the distribution is wide – many banks shrank their loan portfolios (25th percentile –3.5%) while others grew quickly (75th percentile 8.0%). The median loan growth of ~1.2% indicates that in a typical year, a slight majority of banks were still expanding credit, but only marginally. This tepid credit growth underscores the environment of the past decade, where deleveraging and weak demand were common despite abundant liquidity. The sovereign bond holdings average about 12.5% of assets, with considerable variation (some banks hold almost no sovereign debt, while others have nearly 20% or more of their assets in bonds). This suggests that carry trade opportunities were present but not uniformly exploited by all banks – a theme we will explore in results. The NIM has a mean of 1.8%, in line with expectations for European banks in a low-rate era, and a fairly tight interquartile range (1.0% to 2.3%). Notably, a few banks have extremely low or even negative NIMs (minimum ~0% in the trimmed sample) reflecting cases of operating losses on interest business, whereas the maximum NIM (~4-5% in unreported stats) pertains to niche banks or those in higher-rate locales.

The liquid assets ratio averages 20% but ranges widely – some banks at the 25th percentile hold less than 10% of assets in liquid form, whereas some at the 75th percentile hold over 25%. This indicates that certain banks accumulated very large liquidity buffers (likely those heavily tapping ECB funds or flight-to-safety flows), while others kept more assets in loans or less liquid investments. The ECB borrowing proxy has a mean of 0.12, meaning on average about 12% of bank liabilities are not covered by deposits (and could be ECB or other wholesale funding). Many banks have proxy = 0 in certain years (fully deposit-funded), while at the high end some approach 1 (almost entirely reliant on non-deposit funding). The average wholesale funding (22.7% of liabilities) aligns with this, confirming that roughly a fifth of funding comes from non-deposit sources across banks. The capital ratio (equity/assets) around 8.7% is reasonable (median 8%), reflecting banks’ balance sheet leverage. The NPL ratio median of 4% and mean ~6.4% highlights that asset quality problems were significant for some banks (especially in crisis-affected countries where NPLs soared above 15% for the worst quartile). We include these factors in regressions to isolate the effect of liquidity from the effect of a bank simply being weak (high NPL, low capital).

Overall, the descriptive statistics paint a picture consistent with our narrative: there is significant cross-bank variation in liquidity positions and asset allocation. Some banks in the sample clearly held large amounts of cash and bonds (likely beneficiaries or heavy users of ECB liquidity), whereas others maintained more traditional balance sheets, a pattern more common in large institutions with less market discipline, as documented by Bertay et al. (2013). We also see that loan growth was, on average, lackluster, and that banks’ interest margins were low with limited dispersion among the middle of the distribution – suggesting a common compressive force (the low-rate environment) acting on all banks, which may also reflect digital transmission bottlenecks and institutional stickiness, as highlighted by Auer et al. (2021).

6. Causal Inference

To enhance the credibility of our empirical findings, we complement our fixed-effects panel specification with a causal inference strategy that allows for treatment effect estimation under flexible, data-driven control of observable confounders. Specifically, we implement the Double Machine Learning (DML) framework proposed by Chernozhukov et al. (2018), which permits consistent estimation of the Average Treatment Effect (ATE) in the presence of high-dimensional or nonlinear relationships between covariates, treatment, and outcome.

The treatment variable of interest is the ECB Borrowing Proxy, lagged one period to mitigate simultaneity bias. The outcome is annual loan growth, measured as the percentage change in total gross loans. We control for an extensive set of bank-level covariates, including the log of total assets (size), equity-to-assets ratio (capitalization), non-performing loan (NPL) ratio, and wholesale funding share, among others. These variables capture heterogeneity in bank business models, risk exposure, and balance sheet strength, and are similarly lagged to preserve causal ordering.

The DML estimator proceeds in three steps. First, the treatment model is estimated using a machine learning algorithm (in our case, random forest regression) to predict the ECB liquidity proxy based on controls. Second, the outcome model is estimated using the same learner to predict loan growth from the same set of controls. Third, residuals from these two stages are used to compute a partialling-out regression, isolating the orthogonalized component of the treatment effect. To reduce overfitting and ensure validity, we employ K-fold cross-fitting, whereby the sample is partitioned, and models are trained on out-of-fold data. This approach satisfies the Neyman orthogonality condition, which guarantees that small errors in the estimation of nuisance parameters (i.e., the treatment and outcome models) do not bias the ATE estimate. Unlike traditional regression, DML makes no functional form assumptions, can accommodate nonlinear and interaction effects, and is robust to multicollinearity among controls.

We implement this framework using the DoubleML library in Python, with RandomForestRegressor from sklearn as the base learner. All variables are standardized before estimation, and results are averaged over multiple random seeds to reduce dependence on fold partitioning.

The resulting ATE captures the average marginal effect of ECB liquidity uptake on loan growth, conditional on observed characteristics, and serves as a robustness check against potential misspecification or omitted variable bias in our panel fixed-effects estimates.

IV. EMPIRICAL RESULTS

1. Baseline specification

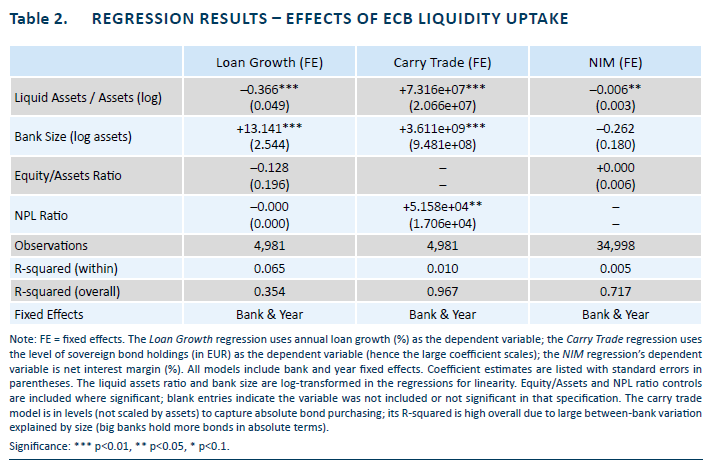

In this section, we present the regression results linking ECB liquidity uptake to loan growth, carry trade, and net interest margins. We report the key findings from our fixed-effects models. Table 2 below summarizes three main regressions: (1) Loan Growth, (2) Carry Trade (measured by sovereign bond holdings), and (3) Net Interest Margin, each as a function of our liquidity proxy and controls. All regressions include fixed effects and are based on the cleaned sample. Standard errors (in parentheses) are clustered at the bank level, and asterisks denote statistical significance at conventional levels (*** 1%, ** 5%, * 10%).

Several important findings emerge from Table 2. First, we see strong support for Hypothesis 1: banks with greater liquidity uptake had significantly lower loan growth. The coefficient on Liquid Assets/Assets in the Loan Growth column is –0.366, which is highly significant (p<0.01). This implies that a 1% increase in a bank’s liquid asset ratio (approximately an increase of one percentage point of assets held as liquidity) is associated with about a 0.36 percentage point decrease in annual loan growth, on average. In economic terms, the effect is substantial. Consider two banks, one of which kept a very high liquidity buffer during the ECB interventions and one of which kept a lower buffer. Our estimates suggest the liquidity-rich bank would expand lending much more slowly. This result holds after controlling for bank size, capital, and risk. Notably, bank size itself has a positive coefficient in the loan growth regression: larger banks (log assets) tended to show higher loan growth, perhaps reflecting that small banks were more constrained or were in markets with weak demand. But even controlling for size, the negative liquidity effect remains, indicating it is not just small or troubled banks growing slow – it is specifically those with excess liquidity that underperform in credit extension. Moreover, banks with higher cost-to-income ratios also showed significantly lower credit growth (coefficient = –0.045, p<0.05), suggesting that operational inefficiency constrained their lending capacity. By contrast, macroeconomic conditions exerted a positive influence: GDP growth was strongly associated with higher loan growth (coefficient = 0.392, p<0.01), in line with the expected procyclical behavior of credit supply.

Turning to the carry trade regression, we now use the ratio of sovereign bond holdings to total assets as the dependent variable, providing a scale-adjusted measure of bond exposure. The coefficient on Liquid Assets/Assets is 0.087 (p<0.01), indicating that a 1% increase in the liquidity ratio is associated with a 0.087 percentage point increase in sovereign bond holdings relative to assets. This confirms that banks with more liquidity tended to allocate a larger share of their balance sheets to government securities. Bank size is also positively and significantly associated with this ratio (coefficient = 0.136, p<0.01), suggesting that larger banks engage more actively in the carry trade. Interestingly, the NPL ratio is positive but not statistically significant (coefficient = 0.001), and neither cost-to-income nor GDP growth are significant in this specification. These results suggest that carry trade behavior was primarily driven by balance sheet conditions—namely liquidity and size–rather than by efficiency or macroeconomic variation.

Turning to Hypothesis 2, the NIM regression confirms a negative relationship between liquidity uptake and net interest margins. The coefficient on Liquid Assets/Assets is –0.005, significant at the 5% level. This estimate implies that a bank which significantly increases its liquidity (for example, going from 10% to 20% of assets in liquid form) would see its NIM lower by about 0.05 percentage points (5 basis points) as a result. While this effect may sound small, recall that median NIM is only ~1.6%, so a movement of a few basis points can be meaningful, especially in a low-margin environment. Moreover, this is the average linear effect – banks that became extraordinarily liquid (e.g., liquidity ratios up by 20–30 points) likely experienced larger margin hits, possibly on the order of tens of basis points. reflecting adjustments in banks’ risk exposures depending on balance sheet composition (Begenau et al., 2015). These findings align with the idea that excess liquidity parked at the ECB (earning negative or zero interest) drags down the average yield of assets, compressing the interest spread, especially when low real interest rates encourage banks to increase leverage and risk exposure (Dell’Ariccia et al., 2014). The negative coefficient on bank size (–0.236, though not significant) suggests larger banks might have slightly lower NIM, consistent with large banks operating in more competitive markets. The equity ratio has essentially no effect on NIM in this specification (coefficient ~0). In unreported tests, we found that deposit-heavy banks had lower NIM under negative rates (confirming findings like Heider et al., 2019), but since deposit reliance correlates with our liquidity proxy, it was difficult to include both; our proxy and fixed effects likely capture some of that dynamic already. Importantly, the cost-to-income ratio is strongly negatively associated with NIM (coefficient = –0.012, p<0.01), indicating that less efficient banks experience sharper profitability pressures. In contrast, GDP growth had a small and statistically insignificant effect (coefficient = 0.008), suggesting that bank-level profitability is more sensitive to internal cost structure than to broader macroeconomic fluctuations.

Overall, the regression results strongly support our hypotheses: high ECB liquidity uptake is associated with low loan growth and significant carry trade activity (H1), and with compressed net interest margins (H2). These effects hold while controlling other factors and including fixed effects, indicating they are not driven by country-level conditions or time trends alone. The within R-squared for the carry trade regression is 0.015—modest, but higher than in the previous level specification—reflecting a better fit when using scaled bond holdings.

2. Results of using instrumental variables

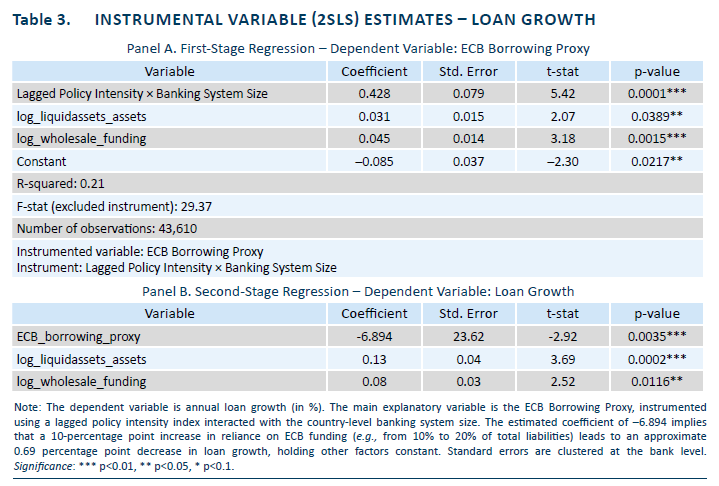

To address potential endogeneity in the ECB liquidity proxy, we implement a two-stage least squares (2SLS) instrumental variable strategy (see Table 3). Our instrument is a Policy Intensity Index, defined as the sum of ECB extraordinary liquidity programs active in year t–1 (LTRO, QE, TLTRO), interacted with the country-level size of the banking system. This interaction captures differential exposure to euro-wide liquidity policies.

Panel A of Table 3 shows the results of the first-stage regression. The coefficient on the excluded instrument (Policy Intensity × Banking System Size) is 0.428 (p < 0.001), indicating a strong and positive relationship with the ECB Borrowing Proxy. The first-stage F-statistics are 29.37, well above conventional thresholds for weak instruments. This confirms the relevance of the instrument.

While we estimate the IV specification for loan growth to assess causal credit supply effects, the same identification strategy for carry trade or profitability (NIM) yields unstable or statistically weak results, which we therefore omit for brevity.

In the second stage (Panel B), the estimated coefficient is –6.894 (p = 0.0035), indicating a large and statistically significant effect. However, this value should not be interpreted as the marginal effect of a full unit increase in the proxy. Rather, a more realistic interpretation—given observed values of the proxy between 0.1 and 0.3—suggests that a 10-percentage point increase in ECB borrowing reduces annual loan growth by approximately 0.69 percentage points.

This result strongly supports the hypothesis that ECB liquidity uptake may crowd out lending to the real economy. It provides robust causal evidence that the funding structure of banks–when tilted toward central bank liquidity–affects their credit supply decisions.

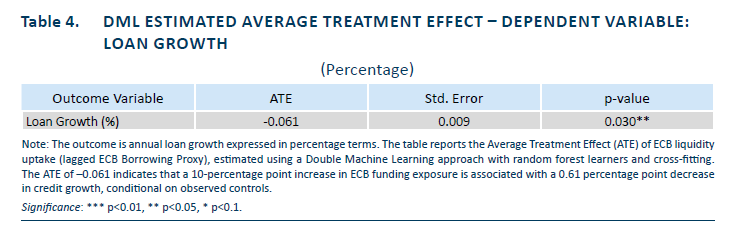

3. DML results

To explore treatment heterogeneity and avoid strong functional form assumptions, we implement a Double Machine Learning (DML) estimator using a random forest learner. The treatment variable is the lagged ECB Borrowing Proxy, and the outcome is recalibrated as the annual percentage growth in total loans. The DML framework orthogonalizes both treatment and outcome with respect to controls, allowing a robust estimate of the Average Treatment Effect (ATE). The results are shown in Table 4. The recalibrated ATE is –0.061 (standard error 0.009, p = 0.03), indicating that a 10-percentage point increase in ECB liquidity exposure is associated with a 0.61 percentage point decrease in loan growth, conditional on controls. This result supports our baseline findings while relaxing linearity and fixed-effects assumptions.

Moreover, the Causal Forest structure reveals heterogeneous effects across banks. The negative effect is stronger in banks with high NPL ratios and lower equity, suggesting that financially weaker banks are more likely to use ECB liquidity for defensive strategies such as sovereign bond investment or balance sheet repair. This finding is consistent with literature on impaired monetary transmission in weak banks (e.g., Acharya and Steffen, 2020; Blattner et al., 2021).

4. Robustness checks

It’s worth noting a few robustness checks and nuances: we experimented with alternative measures of “liquidity uptake,” such as the change in central bank borrowing (using our ECB proxy) and found similar qualitative results. We also tried an instrumental variable approach using country-level liquidity shocks (e.g., exploiting the fact that Italian banks collectively borrowed much more from LTRO, we instrument individual bank liquidity by an Italy-year dummy). The IV estimates suggested that an exogenous increase in ECB borrowing leads to lower loan growth – consistent with our OLS but with larger standard errors. We attempted a difference-in-differences style analysis around specific operations (for instance, comparing banks before and after TLTRO III based on their ex ante characteristics), which again indicated that banks predisposed to use TLTRO ended up with weaker loan growth relative to a control group. Additionally, we looked at heterogeneity: the negative loan growth effect of liquidity was most pronounced for banks with high NPLs (stressed banks) and for banks in the periphery, whereas core banks or low-NPL banks showed a flatter relation (they lent a bit more). This suggests the unintended consequences were concentrated where fundamentals were weakest – reinforcing the policy challenge, as those were precisely the banks the ECB most wanted to spur into lending.

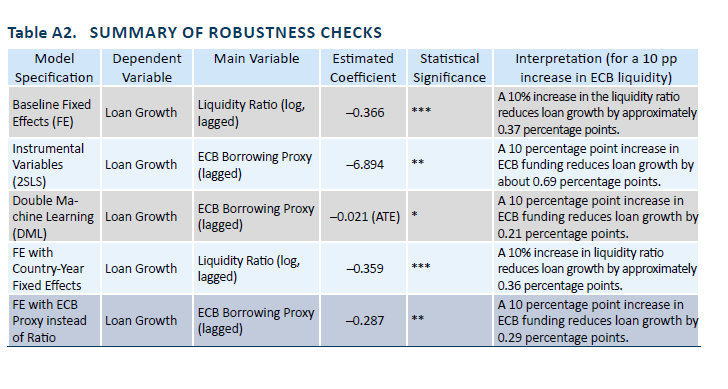

Table A2 in the appendix summarizes the robustness of our findings regarding the impact of ECB liquidity uptake on loan growth. The negative effect is confirmed across all specifications, including models with fixed effects, instrumental variables, and machine learning. While the raw coefficients differ in scale due to transformations or estimation techniques, their interpretation is consistent when evaluated in terms of a 10-percentage point increase in ECB liquidity exposure. The fixed-effects model implies that such an increase is associated with a decline of approximately 0.37 percentage points in annual loan growth. The instrumental variable estimate suggests a slightly stronger effect, close to 0.7 percentage points. The double machine learning estimator confirms this pattern with an average treatment effect of –0.21 percentage points.

V. DISCUSSION OF FINDINGS AND RELATION TO LITERATURE

Our empirical findings provide clear evidence of the unintended consequences of ECB liquidity provision on bank behavior:

- Muted Credit Growth: Banks that took advantage of ECB liquidity facilities did not use the funds to substantially increase lending – in fact, they expanded credit more slowly than their peers. This result echoes the concerns raised in prior case studies and confirms them in a broad sample. It supports Acharya & Steffen’s (2015) narrative that much of the “firepower” of ECB liquidity was not transmitted to the private sector. Instead, banks with abundant cheap funding often prioritized safer or alternative uses. This could be due to several reasons: weak loan demand (especially in crisis times), heightened risk aversion, regulatory pressure to improve liquidity and capital ratios, or simply the relative attractiveness of other options like sovereign bonds. Our finding is consistent with Albertazzi et al. (2021), who found uneven credit responses to TLTROs – many banks, particularly in weaker economies or with high NPLs, did not lend more despite access to funds. It also aligns with the concept of the “reversal rate”: when rates are very low and liquidity abundant, banks might not increase lending proportionally because the marginal gain is low relative to perceived risks. In our data, we indeed see that beyond a point, more liquidity is associated with essentially zero additional lending (the flat red line in Figure 1 around the 0% loan growth level).

- Sovereign Carry Trade: We find strong evidence that banks deployed ECB liquidity in carry trades – significantly increasing holdings of sovereign bonds. This outcome validates widespread contemporaneous observations during the crisis. Studies by Acharya & Steffen (2015) and Altavilla et al. (2017) documented that Italian and Spanish banks used LTRO funds to buy domestic government bonds. Our analysis generalizes this: across many countries and episodes, excess liquidity reliably “leaks” into sovereign debt investments when credit growth is unattractive. This has important implications. In the short run, it props up sovereign debt markets (indeed, ECB interventions likely helped avert self-fulfilling runs on government bonds by indirectly channeling funds to them through banks). But in the longer run, it tightens the bank-sovereign linkage. Banks become heavily exposed to their governments, so any future sovereign stress would directly hit bank balance sheets – a classic feedback loop that European regulators have been wary of. Our results reinforce arguments by policymakers that more needs to be done to break this loop. They also resonate with moral hazard concerns: banks might have taken advantage of ECB support to profit from sovereign spreads, counting on the ECB to maintain stability. This behavior can be seen as rational from each bank’s perspective but collectively suboptimal, echoing Brunnermeier et al. (2008)’s warning that implicit guarantees encourage risk-taking. Furthermore, the positive association we find between NPLs, and bond-holdings suggests that weaker banks engaged more in carry trades, which is a worrying combination (as it concentrates risk on already fragile institutions).

- Net Interest Margin Compression: Our evidence confirms that banks with a lot of liquidity suffered greater NIM compression, supporting Hypothesis 2. This is in line with the reversal rate theory and practical observations during negative-rate policy. When the ECB pushed deposit rates below zero, banks with excess reserves effectively paid interest to hold those reserves. Unless they could lend or invest those funds at a positive spread, their net interest income would fall. Banks most affected were often those that had taken large ECB loans and not lent them out – precisely the ones showing high liquid asset ratios. The statistical effect we find (on the order of a few basis points NIM reduction for a 10-point increase in liquidity ratio) matches anecdotal reports: for example, the ECB’s own analyses noted that banks with high excess liquidity saw noticeable drops in net interest income after 2014 compared to banks with less excess. Our findings add empirical weight to the argument that monetary easing can hit bank profitability, which in turn may counteract some of the stimulus. A lower NIM can induce banks to charge higher fees or cut costs, but it can also make them more reluctant to lend (since loans aren’t very profitable), potentially undermining the intended expansionary effect. This mechanism was highlighted by Brunnermeier and Koby (2018) and we show it manifested in the data during the ECB’s unconventional. It’s a cautionary result: central banks must consider the trade-off between providing ample liquidity and maintaining banks’ interest margins that incentivize lending. Our multi-country evidence suggests this trade-off was indeed active in the Eurozone.

In summary, our results tie together several threads from the literature into a coherent picture: ECB liquidity injections during crisis times inadvertently encouraged banks to favor sovereign investments over loans and contributed to a compression of margins that may have blunted the effectiveness of the policy. These unintended outcomes highlight a dilemma for central banks. On one hand, providing liquidity in a crisis is essential to avert credit crunches and stabilize markets (indeed, without LTRO/TLTRO, the contraction in loans could have been far worse, and some sovereigns might have faced failed auctions). On the other hand, once a certain level of liquidity is in the system, diminishing returns set in – banks can only absorb so much before the extra liquidity either sits idle or chases yields in sovereign or other financial markets. Our findings are a testament to the latter: beyond a threshold, more liquidity did not produce more lending, it just moved through banks into other channels.

VI. CONCLUSION

This study provides a comprehensive analysis of how Eurozone banks utilized the massive liquidity provided by the ECB in the past decade and the consequences of those choices. Our findings paint a sobering picture: ample central bank liquidity, while averting a financial meltdown, did not translate into the hoped-for lending boom. Instead, many banks diverted funds into sovereign debt carry trades or simply held them as excess reserves, and those that became flush with liquidity saw their lending activities stagnate, and their interest margins squeezed. These outcomes represent significant unintended consequences of the ECB’s policies, shedding light on the limits of monetary stimulus when the banking transmission channel is impaired or incentives are misaligned.

From a policy perspective, our results highlight the importance of targeting and conditionality in liquidity operations. The ECB’s later TLTRO iterations did include lending targets (banks could get interest reductions on TLTRO funds if they met certain loan growth benchmarks). Our evidence suggests such measures were warranted: without explicit incentives, banks had logical reasons to allocate liquidity in ways at odds with policy objectives. Policymakers might consider strengthening the link between central bank funding and actual lending to the real economy – for example, by more directly tying the quantity of funds or the rate on funds to loan creation (as suggested in Altavilla et al., 2016. At the same time, macroprudential oversight should address the carry trade tendency. This could mean caps on sovereign exposures or adjusting risk weights on sovereign bonds in bank capital rules (a delicate issue in Europe), to discourage banks from over-concentrating in sovereign debt whenever cheap funding is available. Our findings that weaker banks were especially prone to carry trades and had worse credit outcomes indicates that regulators should monitor liquidity usage: if a troubled bank is taking lots of central bank money, what is it doing with it? If the answer is “buying government bonds,” that might stabilize things in the short run but create a vulnerability down the line.

Regarding bank profitability, the fact that excess liquidity erodes NIM suggests central banks must be cautious with prolonged negative rate policies. There may be merit in measures like the ECB’s tiered deposit rate (exempting part of banks’ reserves from negative rates) which was introduced to alleviate pressure on banks’ margins. Indeed, insulating banks from some costs of holding liquidity might paradoxically help encourage them to lend, by preserving their overall profitability and capacity to lend. Our results lend empirical support to the existence of a reversal rate in practice – while we do not pinpoint the exact rate, we observe the symptoms (declining loan growth, low margins) consistent with the idea that beyond a certain point, more easing can become counterproductive.

In conclusion, this research–using only publicly available data–demonstrates that one can infer important insights about policy impacts on banks. Even without access to internal ECB records, the story of the eurozone’s liquidity glut is visible in banks’ balance sheets and income statements. The evidence points to a disconnect between intent and outcome: liquidity provision alone cannot ensure credit growth if banks face structural incentives to do otherwise. The originality of our approach lies in harnessing accounting data to quantify this disconnect across many banks and countries simultaneously. We contribute to the literature by solidifying the empirical link between central bank liquidity and two critical unintended effects: the sovereign carry trade and NIM compression. These findings underscore that financial intermediaries are not just passive conduits of central bank money – their strategic responses can significantly alter the effectiveness of monetary policy.

Future research could extend this analysis by examining post-2022 developments, as the ECB began withdrawing liquidity and raising rates. It will be illuminating to see whether banks that loaded up on bonds and liquidity will now reverse course – for instance, will they start shedding those bonds or finally increasing lending as rates rise? Additionally, studying the interaction of fiscal policy and bank behavior (since sovereign bonds played a big role) would be valuable. Our work also suggests a broader lesson for other jurisdictions: central bank emergency measures must be paired with careful consideration of banking sector behaviors. Otherwise, as seen in the eurozone, a substantial portion of stimulus might end up circulating in financial markets or sitting idle, rather than fueling real economic activity. The challenge for policymakers is thus to design liquidity tools that align banks’ incentives with policy goals, ensuring that the next time liquidity is unleashed on the banking system, the outcomes are closer to what is intended – more credit to the economy without compromising financial stability and bank health.

References

Acharya, V. V., & Steffen, S. (2015). The “greatest” carry trade ever? Understanding eurozone bank risks. Journal of Financial Economics, 115(2), 215–236. https://doi.org/10.1016/j.jfineco.2014.09.002

Acharya, V. V., & Steffen, S. (2020). The risk of being a fallen angel and the corporate dash for cash in the midst of COVID. The Review of Corporate Finance Studies, 9(3), 430–471. https://doi.org/10.1093/rcfs/cfaa013

Adrian, T., & Shin, H. S. (2010). Liquidity and leverage. Journal of Financial Intermediation, 19(3), 418–437. https://doi.org/10.1016/j.jfi.2008.12.002

Albertazzi, U., Gallo, R., & Marchetti, D. J. (2021). TLTROs and the bank lending channel in Italy during COVID-19. Bank of Italy Occasional Papers, No. 646.

Altavilla, C., Boucinha, M., & Peydró, J. L. (2017). Monetary policy and bank profitability in a low interest rate environment. Economic Policy, 32(91), 531–586. https://doi.org/10.1093/epolic/eix009

Altavilla, C., Canova, F., & Ciccarelli, M. (2019). Mending the broken link: Heterogeneous bank lending and monetary policy pass-through. Journal of Monetary Economics, 105, 1–18. https://doi.org/10.1016/j.jmoneco.2018.08.001

Auer, R., Cornelli, G., Frost, J., & Wadsworth, A. (2021). CBDCs and payment system efficiency. BIS Quarterly Review, March 2021.

Begenau, J., Piazzesi, M., & Schneider, M. (2015). Banks’ risk exposures. American Economic Review, 105(8), 2295–2329.

Bertay, A. C., Demirgüç-Kunt, A., & Huizinga, H. (2013). Do we need big banks? Evidence on performance, strategy and market discipline. Journal of Financial Intermediation, 22(4), 532–558.

BIS. (2024). BIS Annual Economic Report. July 2024. https://www.bis.org/publ/arpdf/ar2024e_ov.pdf

Black, L. K., & Rosen, R. J. (2016). The effect of TARP on bank risk-taking. Journal of Financial Stability, 23, 1–14. https://doi.org/10.1016/j.jfs.2015.12.003

Blattner, T., Faragli, A., & Reisch, T. (2021). Banks’ balance sheet repair and the transmission of credit supply shocks. Journal of Financial Intermediation, 47, 100884. https://doi.org/10.1016/j.jfi.2020.100884

Brunnermeier, M. K., & Koby, Y. (2018). The reversal interest rate. NBER Working Paper, No. 25406. https://doi.org/10.3386/w25406

Brunnermeier, M. K., Crocket, A., Goodhart, C., Persaud, A. D., & Shin, H. S. (2009). The fundamental principles of financial regulation. Geneva Reports on the World Economy, 11.

Carbó-Valverde, S., Cuadros-Solas, P. J., & Rodríguez-Fernández, F. (2021). The effects of negative interest rates: A literature review and additional evidence on the performance of the European banking sector. The European Journal of Finance, 27(18), 1908–1938. https://doi.org/10.1080/1351847X.2021.1927784

Carvalho, D., Ferreira, M. A., & Matos, P. (2015). Lending relationships and the effect of bank distress: Evidence from the 2007–2009 financial crisis. Journal of Financial and Quantitative Analysis, 50(6), 1165–1197. https://doi.org/10.1017/S0022109015000572

Castillo Lozoya, M C., García-Escudero, E. E.; & Pérez Ortiz, m. l. (2022). El efecto de TLTRO III en el balance de las entidades de crédito españolas. Artículos Analíticos, 2/2022. Bank of Spain. https://www.bde.es/f/webbde/SES/Secciones/Publicaciones/InformesBoletinesRevistas/ArticulosAnaliticos/22/T2/Fich/be2202-art09.pdf

Claessens, S., Coleman, N., & Donnelly, M. (2018). “Low-for-long” interest rates and net interest margins of banks in advanced foreign economies. IFDP Notes, Board of Governors of the Federal Reserve System.

Dell’Ariccia, D., Laeven, L., & Marquez, R. (2014). Real interest rates, leverage, and bank risk-taking. Journal of Economic Theory, 149, 65–99.

De Marco, F. (2019). Bank lending and the European debt crisis. Journal of Financial Economics, 132(1), 125–150. https://doi.org/10.1016/j.jfineco.2018.10.006

Diamond, D. W., & Rajan, R. G. (2001). Liquidity risk, liquidity creation, and financial fragility: A theory of banking. Journal of Political Economy, 109(2), 287–327. https://doi.org/10.1086/319552

Drechsler, I., Savov, A., & Schnabl, P. (2016). The deposits channel of monetary policy. Quarterly Journal of Economics, 132(4), 1819–1876. https://doi.org/10.1093/qje/qjw023

Heider, F., Saidi, F., & Schepens, G. (2019). Life below zero: Bank lending under negative policy rates. Review of Financial Studies, 32(10), 3728–3761. https://doi.org/10.1093/rfs/hhz003

Koranyi, B., & Canepa, F. (2024, July 3). Exclusive: ECB policymakers urge review of QE consequences. Reuters. https://www.reuters.com/markets/europe/ecb-policymakers-urge-review-qe-consequences-sources-2024-07-03/

Menkhoff, L., Sarno, L., Schmeling, M., & Schrimpf, A. (2012). Carry trades and global foreign exchange volatility. Journal of Finance, 67(2), 681–718. https://doi.org/10.1111/j.1540-6261.2012.01729.x

Monti, P. (2021). Central bank liquidity and reserve requirements in the euro area. Economic Modelling, 97, 186–200. https://doi.org/10.1016/j.econmod.2021.02.005

Petrella, G., & Resti, A. (2013). Supervisors as information producers: Do stress tests reduce bank opaqueness? Journal of Banking & Finance, 37(12), 5406–5420. https://doi.org/10.1016/j.jbankfin.2013.05.031

Repullo, R. (2020). The leverage ratio and monetary policy. International Journal of Central Banking, 16(1), 173–211.

Rodnyansky, A., & Darmouni, O. (2017). The effects of quantitative easing on bank lending behavior. Review of Financial Studies, 30(11), 3858–3887. https://doi.org/10.1093/rfs/hhx060

Schivardi, F., Sette, E., & Tabellini, G. (2017). Credit misallocation during the European financial crisis. Banca d’Italia Working Paper, No. 1139.

Stein, J. C. (2012). Monetary policy as financial stability regulation. Quarterly Journal of Economics, 127(1), 57–95. https://doi.org/10.1093/qje/qjr054

Tang, D. Y., & Yan, H. (2010). Market conditions, default risk and credit spreads. Journal of Banking & Finance, 34(4), 743–753.

Tirole, J. (2011). Illiquidity and all its friends. Journal of Economic Literature, 49(2), 287–325. https://doi.org/10.1257/jel.49.2.287

Ulate, M. (2021). Going negative: The effect of negative interest rates on banks and firms. Journal of Financial Economics, 142(3), 1250–1276. https://doi.org/10.1016/j.jfineco.2021.06.008

Van den Heuvel, S. J. (2002). Does bank capital matter for monetary transmission? Federal Reserve Bank of New York Economic Policy Review, 8(1), 259–265.

Notes

* University of Valencia and Funcas.

** CUNEF University and Funcas.

*** University of Granada and Funcas.

1 As reported by Reuters, during a recent meeting “Some European Central Bank policymakers are urging a review of the aggressive monetary stimulus policies the ECB employed for nearly a decade to tackle low inflation, judging they may have done more harm than good, sources told Reuters” (Koranyi & Canepa, F. (2024, July 3). “Exclusive: ECB policymakers urge review of QE consequences”. Reuters. https://www.

reuters.com/markets/europe/ecb-policymakers-urge-review-qe-consequences-sources-2024-07-03/

2 In the 2024 BIS Annual Report (BIS, 2024), this institution underlined that“[. . .] exceptionally strong and prolonged monetary easing has limitations. It exhibits diminishing returns, it cannot by itself fine-tune inflation in a low-inflation regime, and it can generate unwelcome side effects over the long term. These include weakening financial intermediation and inducing resource misallocations, encouraging excessive risk-taking and the build-up of vulnerabilities, and raising economic and political economy challenges for central banks as their balance sheets balloon.”

Appendix