Where TLTRO III may be going

Fecha: noviembre 2020

Miguel Carrión Álvarez, Funcas Europe

The ECB’s Targeted Long-Term Refinancing Operations, or TLTRO, are non-standard monetary policy measures adopted in the aftermath of the Eurozone banking crisis. The economic effects of the Covid-19 pandemic have caused to ECB to strengthen the TLTRO when, as recently as 2019, it intended to discontinue it in the medium term. Instead of winding down, it let to the largest infusion of liquidity in the history of the ECB.

This note looks at how, since the start of the pandemic, TLTRO III has become the main lever for the ECB to set interest rates in the real economy. Rather than a temporary instrument as originally envisaged, TLTRO may become a permanent feature of monetary policy.

1. TLTRO before the pandemic

The ECB’s TLTRO is a funding-for-lending programme (1). Funding-for-lending describes subsidised bank liquidity, conditional on increased lending to the real economy, typically to small and medium enterprises. The ECB’s policy originates in the earlier Long-Term Refinancing Operations of LTRO. For the ECB, long-term refinancing operations are any liquidity-providing transactions with a maturity longer than one week, which is the term of the ECB’s main refinancing operations.

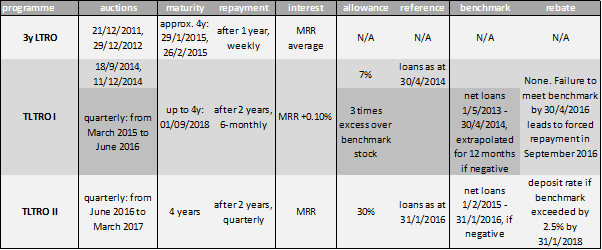

TLTRO features have evolved over successive iterations of the programme. Table 1 summarises the features of the TLRTO and TLTRO II programmes, as well as their forerunner the 3-year LTRO. In this table, MRR refers to the ECB’s main refinancing rate.

Table 1: features of forerunners to TLTRO III (see text)

2. The evolving TLTRO III

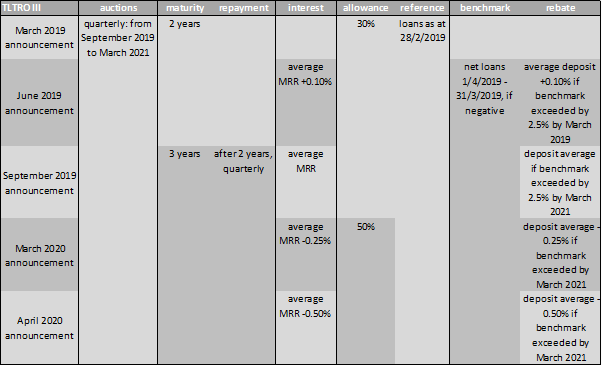

TLTRO III started out as a liquidity-management tool, and gradually morphed into an economic stimulus and interest-rate-setting tool. After eighteen months, the history of TLTRO III, shown in table 3, is already more complex than that of all the previous iterations of the programme.

Table 3: history of TLTRO III (see text)

2.1. TLTRO III as liquidity management

In 2019, the ECB was getting normalising its monetary policy. Net asset purchases had stopped at the end of 2018. However, the end of the TLTRO II programme in 2020-2021 faced the ECB with a possible cliff edge and a credit crunch. The reason this became an issue already in 2019 was banking liquidity regulations. The post-crisis regulatory reform introduced a so-called net stable funding ratio or NSFR, which required banks to keep enough funding with a maturity over one year (2). For this reason, the maturing of the first TLTRO II auction in June 2020 posed a liquidity problem for banks already in 2019.

The NSFR was supposed to applied to internationally active banks from January 2018, and the EU included it in its banking package proposed in November 2016 to apply to all EU banks. In the end, it was decided the NSFR would become fully binding only in June 2021, because the banking package took until mid-2019 to be adopted (3). Nevertheless, banks could start reporting their NSFR earlier than this, so the NSFR could still have an impact on their balance-sheet management in 2019 even while not being strictly binding yet.

Be that as it may, in March 2019, the ECB decided to launch TLTRO III, a series of seven quarterly funding-for-lending operations from September 2019 to March 2021, citing “a congestion of bank funding caused by the coming to maturity of existing TLTROs [and] various regulatory compliances” (4). The maturity was set at two years, which was long enough to help banks manage their net stable funding ratio (5).

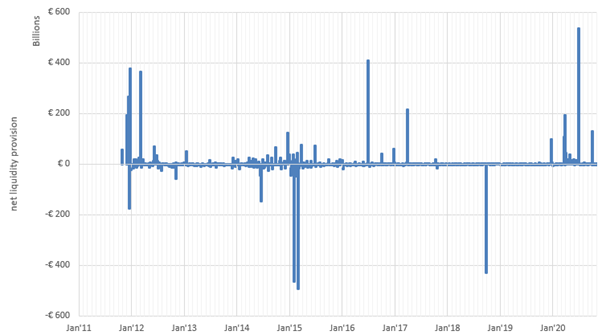

The TLTRO III auction in March 2020 took place after the arrival of the Covid-19 pandemic in the eurozone, but banks had to make their bids before lockdowns were announced. As a result, the take-up of liquidity was low. Being aware that banks were not able to adjust their bids for the March auction, the ECB also introduced a series of weekly LTROs maturing in June, to bridge the gap until the first TLTRO III auction after the pandemic. The June 2020 TLTRO III auction ended up being by far the single largest liquidity injection in the history of the ECB, as shown in Figure 1.

Figure 1: ECB refinancing operations in euro (see text)

The TLTRO III operation in June 2020 saw gross demand for €1.3tn, but in net terms the infusion of liquidity was under €540bn, which is the amount shown in the chart. This is because this date involved the rollover of the first TLTRO II auction from 2016, worth over €400bn, as well as the series of pandemic LTROs in the second quarter of 2020, worth about €500bn altogether.

2.2. TLTRO III as exit strategy

The initial design of TLTRO III attempted to reduce banks’ reliance on central bank funding. Net asset purchases had already stopped at the end of 2018 and the ECB clearly intended to raise rates at some point during the life of the TLTRO III.

After a quarter, the ECB settled on more onerous conditions than those of TLTRO II to discourage banks from relying excessively on central bank funding. In June 2019, the ECB announced that the interest rate on the TLTRO III auctions would be 0.10% higher than the average of the main refinancing rate over the life of the operation (6). As the ECB had signalled its intention to raise interest rates in the medium term, a fixed rate on the TLTRO would have encouraged banks to front-load their borrowing to lock in a low funding rate.

2.3. TLTRO III as economic stimulus

The ECB’s exit strategy from the TLTRO programme was frustrated by a budding eurozone recession. By the end of the summer of 2019, an 18-month manufacturing slowdown was beginning to spill over to the rest of the eurozone economy. The ECB’s last policy action under Mario Draghi’s presidency was to ease monetary policy again. The deposit rate was lowered by 0.10% to -0.50%, and asset purchases would restart at a reduced pace in 2020.

The ECB also extended the maturity of the TLTRO III operations from two to three years, and removed the 0.10% premium on the lending rates (7). The TLTRO III was now very similar to TLTRO II.

The first three TLTRO III operations in September 2019, December 2019, and March 2020 saw relatively low demand from banks, as illustrated in figure 1. This may be an indication that fears of a regulatory cliff effect related to the maturing of the first TLTRO II in June 2020 were overblown.

TLTRO is a funding-for-lending programme, but it does not necessarily increase total lending. It is rather designed to prevent lending from contracting. For banks with positive net lending for about a year prior to each programme’s announcement, the benchmark is net lending is zero. For banks with negative net lending, the benchmark allows the same contraction of lending but over a period of two years. The TLTRO I required zero net lending for the second year of the target period (8).

Under TLTRO I, banks not meeting their targets were required to repay their loans early. For TLTRO II, banks were not penalised for missing their benchmarks, but rather they were rewarded with an interest-rate rebate. The condition was to exceed their benchmark stock of credit by 2.5% by the end of the relevant period (9). This is all summarised in table 1.

TLTRO III started like this but, as seen in table 3, with the advent of the pandemic the requirement to increase the stock of lending by 2.5% was waived (10).

2.4 TLTRO III as rate-setting mechanism

As part of its pandemic stimulus, the ECB set TLTRO lending rates below the key interest rates. This was extraordinary because it made the TLTRO effectively the main refinancing rate until June 2021. In principle the main refinancing rate is still the reference rate because the ECB offers unlimited weekly liquidity at that price. But the ECB also increased the TLRTO III borrowing allowance from 30% to 50% of eligible loans outstanding. As a bank is unlikely to need more ECB liquidity than half the size of its loan book, TLTRO III lending is now effectively unlimited.

This was an alternative to making the main refinancing rate negative. The ECB was also reluctant to lower the deposit rate below -0.50% because of the effect this would have had on bank profitability. If the ECB had both increased the amount of its asset purchases and lowered the deposit rate, it would have substantially reduced banks’ net interest income.

Instead, in March the ECB set the premium on TLTRO III lending to ‑0.25% for any operations outstanding between June 2020 and June 2021. This meant that banks could now borrow below the reference rates (10).

As the seriousness of the Covid-19 economic crisis exceeded initial expectations, just six weeks later, the ECB would lower the borrowing rates on TLTRO III by an additional 0.25%, so that banks could now borrow at ‑0.50% without conditions and at ‑1% if they met their lending targets (11). But the main refinancing rate remained at 0%. This reinforced the use of the TLTRO rate as a tool for setting bank interest rates.

3. Some forward-looking conclusions

The ECB governing council has announced its intention to recalibrate all its monetary policy instruments at its next meeting (12). To address the worsening economic outlook due to the second wave of Covid-19, the ECB may want to lower rates. But there are good reasons to avoid making the main refinancing rate negative, or to lower the deposit rate further while also presumably increasing the pace of its asset purchases. The ECB has already shown the way forward: it can lower the TLTRO rates, or apply the already very favourable rates for longer, beyond June 2021.

Looking further ahead, TLTRO III lending will start maturing in 2023, and the €1.3tn borrowed by banks in June 2020 will need to be repaid by June 2024. The NSFR regulation will again set up a cliff effect. The ECB is likely to need a TLTRO IV along the lines of the original design of the TLTRO III.

It may make more sense for the ECB to considering TLTRO a regular policy instrument rather than an extraordinary crisis-fighting instrument. Auctions could run quarterly, with two-year maturities, and at a premium over the main refinancing operations. The TLTRO rate for two-year liquidity would become an additional key interest rate. There is no limit to how low the TLTRO lending rates could go.

References

1. Nygaard, Kaleb. Central Banks Launch Funding for Lending Programs. Yale Program on Financial Stability. [Online] 23 March 2020. https://som.yale.edu/blog/central-banks-launch-funding-for-lending-programs.

2. Bank for International Settlements. Net Stable Funding Ratio (NSFR) - Executive Summary. Financial Stability Institute Publications. [Online] 28 June 2018. https://www.bis.org/fsi/fsisummaries/nsfr.htm.

3. European Parliament. Amendments of the Capital Requirements Regulation. Legislative Train. [Online] 20 November 2019. https://www.europarl.europa.eu/legislative-train/theme-deeper-and-fairer-internal-market-with-a-strengthened-industrial-base-financial-services/file-jd-crr-amending-capital-requirements.

4. European Central Bank. Press Conference. Media. [Online] 7 March 2019. https://www.ecb.europa.eu/press/pressconf/2019/html/ecb.is190307~de1fdbd0b0.en.html.

5. —. Monetary policy decisions. Media. [Online] 7 March 2019. https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.mp190307~7d8a9d2665.en.html.

6. —. ECB announces details of new targeted longer-term refinancing operations (TLTRO III). Media. [Online] 6 June 2019. https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.pr190606~d1b6e3247d.en.html.

7. —. ECB announces changes to new targeted longer-term refinancing operations (TLTRO III). Media. [Online] 12 September 2019. https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.pr190912~19ac2682ff.en.html.

8. —. ECB announces measures to support bank lending and money market activity. Media. [Online] 8 December 2011. https://www.ecb.europa.eu/press/pr/date/2011/html/pr111208_1.en.html.

9. —. ECB announces further details of the targeted longer-term refinancing operations. Media. [Online] 3 July 2014. https://www.ecb.europa.eu/press/pr/date/2014/html/pr140703_2.en.html.

10. —. ECB announces easing of conditions for targeted longer-term refinancing operations (TLTRO III). Media. [Online] 12 March 2020. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200312_1~39db50b717.en.html.

11. —. ECB recalibrates targeted lending operations to further support real economy. Media. [Online] 30 April 2020. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200430~fa46f38486.en.html.

12. —. Press Conference. Media. [Online] 29 October 2020. https://www.ecb.europa.eu/press/pressconf/2020/html/ecb.is201029~80b00b5789.en.html.