PMIs October 2020

Fecha: octubre 2020

Pamina Lantos, Research Assistant, Funcas Europe

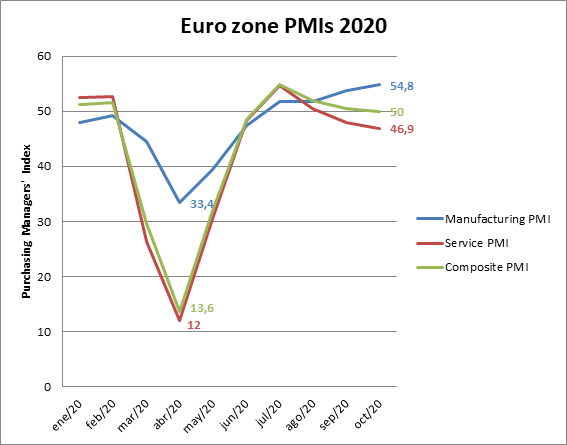

As predicted by the IHS Markit analysis of September, the Composite Output PMI for the Eurozone shrunk again in October, namely from a 50.4 to a plain 50. Their records reveal that the amount of total new incoming business in the Eurozone decreased for the first time in four months, while employment recorded its eight consecutive month of cutbacks.[1]

What seems to be entirely responsible for this decline is the continuously deteriorating Eurozone service sector PMI. This month the sector has descended to the lowest recorded value since May, namely 46.9. Accordingly, all major European economies have shifted to recessionary territory in the services sector. Worst hit remains Spain with 41.4, followed by France and Italy (46.5 and 46.7, repectively), which are all suffering from rising infection numbers, consumer worries and new restrictions following the 2nd wave of Covid-19.[2]

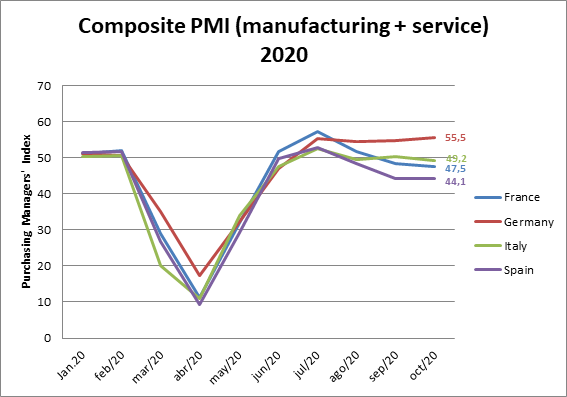

On the positive side, the 0.4 overall Eurozone decline this month seems to indicate a softer impact on the economy than the lockdown experienced earlier this year. The limited effect originates from the Eurozone manufacturing sector, which is continuously improving and ended up with a rate of 54.8 in October. All major European economies have experienced a boost in their manufacturing PMI and are left with positive developments, with values above the threshold of 50. Especially Germany’s and Spain’s manufacturing sector augmented significantly by 1.8 and 1.7, respectively, due to their gains in new orders both domestically and abroad.[3]

Looking at near-term developments, the records of new orders suggest the persistence of a booming manufacturing sector, which seems to be recovering relatively well from the downfall it experienced in Q2 of 2020. At the same time, new business in the service sector is steadily falling and future developments will greatly depend on the magnitude of the second wave and the consequences it brings about.

Meanwhile, significant cross-country differences persist. Germany’s Composite PMI is the only one out of the four major Eurozone economies remaining above 50. The divergence between member states is accumulating with differences in restrictions and exposure to the sectors most hit by the pandemic.

[1] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 4th November 2020.

[2] IHS Markit Spain Services PMI. IHS Markit. 4th November 2020.

[3] IHS Markit Eurozone Manufacturing PMI – final data. IHS Markit. 2nd November 2020.