Overcoming the Covid-19 crisis through credit guarantees: rationale and risks

Fecha: mayo 2020

Miguel Carrión Álvarez and Raymond Torres, Funcas Europe

Since the start of the Covid-19 crisis there has been a heated debate regarding the use of government guarantees in order to support lending to the private sector. The debate is not new. It dates back at least to the launch of the “Juncker Plan”in 2014. Since then, European Union investment plans have been based consistently on the idea of channelling public guarantees through the European Investment Bank, in order to “mobilise”, “generate”, “catalyse” or “unlock” both public and private investment, with large implied multiplier effects. This is shown in Table 1 (see detailed explanation in Section 1).

Table 1. Expected multiplier effects of various EIB programmes

| Public guarantee (€billion) | Expected investment (€billion) | Multiplier (ratio) | |

| EFSI (2014-20) | 21 | 315 | 15 |

| InvestEU (2021-27) (*) | 38 | 650 | 14 |

| Green Deal (2021-30) | 20 | 279 | 14 |

| Eurogroup (2020) | 25 | 200 | 8 |

(*) includes Green Deal

Source: Funcas Europe based on EU documents (see text)

This debate came to a head when, on April 23, the European Council reached an agreement of principle on a recovery fund of unspecified size, possibly over €1tn (1). The details were to be worked out by the European Commission, which indicated it was considering to raise the EU’s spending cap up from 1.2% of gross national income to 2%, for two or three years (2). This would add up to more than €300bn over three years, which would have to be leveraged several-fold in order to produce the targeted investment amount of over one trillion euros. The details were not provided, but the principle seemed to be the same as in all the preceding programmes.

This all caused a bit of a public outcry. The European Parliament went so far as to

“[warn] the Commission against the use of financial wizardry and dubious multipliers to advertise ambitious figures; [and] that headline figures of investment to be mobilised do not constitute, and cannot be presented as, the genuine size of a Recovery and Transformation Fund” (3)

Eventually, Angela Merkel and Emmanuel Macron agreed the principle of a €500bn fund, allowed by the aforementioned increase in the EU’s spending ceiling and funded by EU debt issuance (4). The idea of leveraging a guarantee fund seems to be gone, but the size of the expected investment boost has shrunk accordingly, from over €1tn to €500bn.

The purpose of this note is threefold. Section 1 sheds light on the multiplier effect by which public guarantees generate investment in stimulus plans announced by the EU or the EIB. Section 2 examines whether the size of the advertised multiplier effects is realistic, and considers some of the risks associated with these kinds of public guarantees. Finally, section 3 draws some policy conclusions.

1. The role of credit guarantees in EU responses before and after the pandemic

When Jean-Claude Juncker became President of the European Commission in 2014, he recognised that the EU suffered from a dearth of investment. This was a result of both the Great Recession and the eurozone’s government debt crisis. He therefore launched an investment plan based around a European Fund for Strategic Investment (EFSI), advertised to multiply investment 15 times (5).

As part of the preparatory work for the EU’s next multiannual financial framework, the 2021-2027 budget, the time-limited EFSI will be replaced by a new investment facility called InvestEU (6). The EFSI cannot undertake new investments after the end of 2020, but InvestEU looks to become a permanent addition to the Commission’s programmes. In the 2021-2027 budget period, InvestEU expects to use a guarantee fund with a multiplier effect of around 13.7 times.

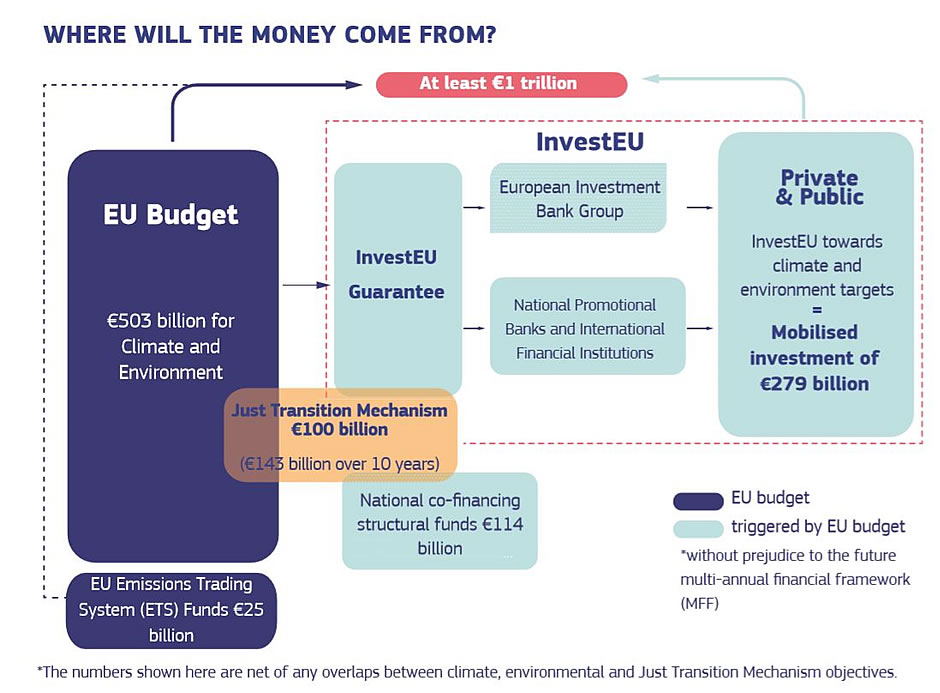

At the start of Ursula von der Leyen’s presidency, the European Commission launched the European Green Deal, an investment programme spanning the decade of 2021-2030. It aims to ensure part of the investment necessary for the EU to achieve its 2030 climate and energy targets. The European Green Deal is officially expected to “mobilise” €1tn of investment over the 10-year period. It involves €279bn of investment “mobilised” through InvestEU (7) as shown in Figure 1.

Figure 1: European green deal and just transition mechanism flow chart (source: European Commission)

The InvestEU part of the European Green Deal is also included in the European Investment bank’s plan to “support” €1tn in environmental investment over the decade to 2030, whose goal it is to help the EU reach its climate and energy goals (8). This means there is double or even triple-counting if one is not careful and adds together the InvestEU programme, the European Green Deal, and the EIB’s climate and environmental ambitions.

On April 3, the European Investment Bank announced it was designing a €25bn guarantee fund (9). This was to be made up from contributions by the EU member states and would “support” an additional €200bn of credit by other public and private financial institutions. The April 9 Eurogroup took this on board and invited the EIB to operationalise its proposal as soon as possible (10). The EIB then approved the plan on April 16 (11).

The mechanism by which European Investment Bank guarantees “mobilise” lending capacity with a large multiplier is by guaranteeing a tranche of some other financial institution’s loan portfolio, securitised or not. Such guarantees are understood to mitigate the credit risk of the portfolio. This frees up regulatory capital which can then support new lending (see Box 1).

Box 1. How can credit guarantees boost banks’ lending capacity?

Normally, “guarantees” act directly on credit exposures. They free up lending capacity of the same amount as the guarantee, thus entailing a small multiplier effect. For EIB or other guarantees to generate multipliers significantly greater than unity, they must be equity-like. A hint is provided by the EIB’s statement that (12):

“by guaranteeing parts of portfolios, our operations under the guarantee fund will free up capital for the financial intermediaries involved to make more financing available for SMEs and mid-caps”.

Indeed, while a guarantee of a portfolio of exposures covers ultimately only the part of the portfolio that actually defaults, it can free capital for most of the portfolio’s exposure. This is so to the extent that not all the individual exposures become delinquent at the same time (i.e. to the extent that credit exposures are uncorrelated).

Securitisation is another way to boost the multiplier effect of a guarantee. A securitisation distributes the cash flows from servicing a loan portfolio into tranches of different seniorities, with the more senior being paid first. In that way, the more senior tranches have very low credit risk and most of the capital cost is incurred by the lower-rated equity tranche or the junior/mezzanine tranches. It is thus possible to free up most of the capital for the whole volume of lending by guaranteeing only lower-rated tranches.

In fact, the regulatory treatment of portfolio-level first-loss guarantees is modelled after the way securitisations work (13):

“Where the bank transfers a portion of the risk of an exposure in one or more tranches to a protection seller or sellers and retains some level of risk of the loan and the risk transferred and the risk retained are of different seniority, banks may obtain credit protection for either the senior tranches (e.g. second loss portion) or the junior tranche (e.g. first loss portion). In this case the rules as set out in the securitisation chapters of the credit risk standard will apply”.

2. Risks of credit guarantees for the EIB and the financial system

Typically, the regulatory capital charge for a portfolio of performing loans will be 8%, that is 12.5 times smaller, than the loan amount (14). For loans of lower credit rating, with a 150% credit risk weight, the capital multiplier would be a bit over 8 times. This multiplier comes close to some of the EIB programmes mentioned above. The effect is strongest when the guarantee applies to lower-ranked securitisation tranches that consume the most capital, or to first-loss guarantees in the case of loan portfolios that have not been securitised. Guarantees of higher-seniority tranches of securitisations ease their sale and therefore the issuing bank’s access to liquidity, but most of the capital relief comes from equity tranches.

Default correlation

The assumptions underlying this multiplier effect are reasonable in normal times, but the behaviour of credit guarantees can be quite different in crisis times such as now. As noted, loan guarantees can achieve leverage by covering the expected losses on a well-diversified portfolio. What diversification achieves in this instance is that defaults on the underlying loans are not correlated. This means that knowing one borrower is in default does not make it any more likely that others will default as well. This is true in normal times, more so if the loans are diversified geographically and by business sector.

However, default correlation is effectively impossible to estimate, and capital charges depend on it as much as they do on default probabilities. Moreover, as default probability rises, as is likely to happen in the present pandemic context, so does default correlation. This has two implications. First, there is a risk that higher-seniority portfolio tranches will be undercapitalised. Second, this is more likely to be the case in a crisis or downturn, when both default probability and correlation are at their highest.

For these reasons, the regulatory capital model includes some buffers and safeguards. But these are insufficient protection in the event of a deep crisis, when default probabilities and correlations become unusually high. This became apparent during the global financial crisis starting in 2007, as US subprime mortgages underwent a wave of defaults, with cascading effects through securitisation practices. Since then, securitisation has been more tightly regulated, but the risk of default correlations remains and is especially acute in recession times.

It should be obvious that the Covid-19 pandemic constitutes a broad-based geographical and sectoral shock to the liquidity and solvency of SMEs, and that this shock is unusually strong, too. Therefore, default rate and correlation are likely to well exceed the safety margins in the regulatory capital models which underpin the guarantee multiplier strategy of European institutions.

Large potential losses

In addition, the Covid-19 crisis poses a challenge both to the EIB’s existing portfolio of loan guarantees (such as that arising from the Juncker plan), and to the coronavirus crisis support schemes (such as the Eurogroup’s €200bn plan).

First, the EIB has become the leading provider of credit enhancement SME loan securitisations (15). Typically, the EIB has guaranteed the mezzanine or senior tranches of securitisations. These tranches have been sold to investors as having the EIB’s AAA credit rating, and the EIB has collected a fee to cover the higher credit risk of the tranche. In the Covid-19 crisis, loans will default more often than expected, and this will cause the securitisation tranches guaranteed by the EIB, in particular mezzanine tranches, to default more often than expected. In that case, the EIB will incur losses not covered by the fees it has collected. Mezzanine tranches are the most sensitive to uncertainty in model parameters such as default rate and correlation.

In fact, the high guarantee multipliers advertised in connection with the Juncker plan are unlikely to be achieved by guaranteeing senior tranches. The Juncker plan guarantees are almost certainly at least of mezzanine if not of junior or equity tranches., and junior tranches are very likely to be wiped out by the Covid-19 crisis. Therefore, the EIB is likely to incur a high rate of losses on its Juncker plan investments.

Second, sometimes the EIB will have covered the mezzanine tranche of a securitisation because the senior tranche has a high credit rating by itself. This credit rating, however, is model-based, and has almost certainly underestimated the default rates and correlations that will be seen in the Covid-19 crisis. Investors will therefore see higher-than-expected defaults on senior tranches which they will have overpaid for. There is scant information on who actually holds these kinds of senior tranches, but it may well include insurance companies and pension funds as was the case with US subprime CDOs in 2007.

When the EIB has guaranteed not a securitisation but an ordinary loan portfolio, first the EIB’s guarantee will be wiped out more often than the EIB expected; and second, excess losses will be borne by the originating bank. In that case, the lender will have been encouraged by the EIB guarantee into a false sense of security, and it will likely have committed the capital freed by the EIB guarantee to back a whole new portfolio of loans. After all, this form of capital recycling is the whole basis of the European Union’s guarantee-multiplier investment strategy. The risk is that participating banks may have been left inadequately capitalised to withstand high credit losses due to the Covid-19 crisis.

It could be argued that European governments have rolled out massive programmes of loan guarantees intended to tide SMEs over the crisis by incentivising loan refinancing and restructuring, and loan payment moratoriums. But consider the following. Securitisations are pass-through devices for the cash flows coming from the underlying loans. Banks may restructure loans to prevent SMEs falling into default, but this will not preserve the cash flows. Restructuring a loan attempts to protect the borrower’s long-term viability by making allowances for its reduced ability to pay. This means SMEs may not default on their loans, but still existing SME loan securitisations may fail.

3. Policy implications

It is crucial to ensure that the EIB is as insulated as possible from the originate-and-distribute lending model, whose failure in the US subprime mortgage market 2007 was a key contributor to the Global Financial Crisis. Under this business model, banks used securitisations to take credit risk off their balance sheets. Repeated application of this method allowed the same amount of capital to be recycled endlessly for new lending. At present, however, the European Investment Bank has become the EU’s main provider of credit enhancement for SME loan securitisations (15). The introduction of simple and transparent securitisations, and a more conservative regulatory capital treatment of securitisation exposures since the Global Financial Crisis, have not taken away the possibility of recycling bank capital, which is what the EIB is exploiting.

Moreover, the risk profile of securitisations is model-dependent and strongly sensitive to uncertain parameters of default probability and correlation. In the Covid-19 crisis, firms are coming under funding pressure regardless of industry or geography. This implies increased default probability and correlation, with no benefit from portfolio diversification. So, the EIB’s capital multipliers may ultimately result in under-capitalisation of loan portfolios. In this crisis, this may cause unexpected losses to the EIB itself, to originating banks, and to any investors who have purchased SME loan securitisations guaranteed by the EIB in the past.

In short, policy makers may need to consider whether the pre-crisis capital multiplication strategy is a sound basis for future investment policy, notably in the context of the Eurogroup’s crisis support strategy and the Commission’s recovery fund. A safer way to obtain high lending multipliers on public funding would be for the EU simply to recapitalise the EIB, in order for it to lend to banks which would then lend on to SMEs. This has the advantage of offering an adequate multiplier effect: the Basel capital standards, on which EU bank regulations are based, foresee lending volumes of 12.5 times the tier-1 capital of a bank. So, even with a 150% risk weight (which applies to the lower-rated exposures) the multiplier still exceeds 8 times. Moreover, a recapitalisation of the EIB would be a safer approach from the point of view of financial stability, vis-à-vis the present strategy of leveraging through first-loss portfolio guarantees.

References

1. European Council. Conclusions of the President of the European Council following the video conference of the members of the European Council. Press. [Online] April 23, 2020. https://www.consilium.europa.eu/en/press/press-releases/2020/04/23/conclusions-by-president-charles-michel-following-the-video-conference-with-members-of-the-european-council-on-23-april-2020/.

2. European Commission. Statement by President von der Leyen at the joint press conference with President Michel, following the EU Leaders' videoconference on coronavirus. Press corner. [Online] April 23, 2020. https://ec.europa.eu/commission/presscorner/detail/en/statement_20_733.

3. European Parliament. New MFF, own resources and Recovery plan. Texts adopted. [Online] May 15, 2020. https://www.europarl.europa.eu/doceo/document/TA-9-2020-05-15_EN.html.

4. Élysée. Initiative franco-allemande pour la relance européenne face à la crise du coronavirus. Actualités. [Online] May 18, 2020. https://www.elysee.fr/emmanuel-macron/2020/05/18/initiative-franco-allemande-pour-la-relance-europeenne-face-a-la-crise-du-coronavirus.

5. European Commission. EU launches Investment Offensive to boost jobs and growth. Press corner. [Online] November 26, 2014. https://ec.europa.eu/commission/presscorner/detail/en/ip_14_2128.

6. —. The InvestEU Programme: Questions and Answers. Press corner. [Online] April 18, 2019. https://ec.europa.eu/commission/presscorner/detail/en/MEMO_19_2135.

7. —. The European Green Deal Investment Plan and Just Transition Mechanism explained. Press Corner. [Online] January 14, 2020. https://ec.europa.eu/commission/presscorner/detail/en/qanda_20_24.

8. European Investment Bank. >€1 TRILLION FOR <1.5°C: Climate and environmental ambitions of the European Investment Bank Group. Media centre. [Online] January 29, 2020. https://www.eib.org/en/publications/eib-climate-and-environmental-ambitions.

9. —. EIB Group moves to scale up economic response to COVID-19 crisis. Media centre. [Online] April 3, 2020. https://www.eib.org/en/press/all/2020-094-eib-group-moves-to-scale-up-economic-response-to-covid-19-crisis.

10. European Council. Report on the comprehensive economic policy response to the COVID-19 pandemic. Eurogroup. [Online] April 9, 2020. https://www.consilium.europa.eu/en/press/press-releases/2020/04/09/report-on-the-comprehensive-economic-policy-response-to-the-covid-19-pandemic/.

11. European Investment Bank. EIB Group establishes EUR 25 billion guarantee fund to deploy new investments in response to COVID-19 crisis. Media centre. [Online] April 16, 2020. https://www.eib.org/en/press/all/2020-100-eib-group-establishes-eur-25-billion-guarantee-fund-to-deploy-new-investments-in-response-to-covid-19-crisis.

12. —. Coronavirus outbreak: EIB Group’s response. EIB at a glance. [Online] April 16, 2020. https://www.eib.org/en/about/initiatives/covid-19-response/index.htm.

13. Bank of International Settlements. Calculation of RWA for credit risk - standardised approach: credit risk mitigation. Basel Framework. [Online] December 15, 2019. https://www.bis.org/basel_framework/chapter/CRE/22.htm?inforce=20191215#paragraph_CRE_22_20191215_Guarantees_and_credit_derivatives.

14. Bank for International Settlements. Minimum risk-based capital requirements. Basel Framework. [Online] December 15, 2019. https://www.bis.org/basel_framework/chapter/RBC/20.htm?inforce=20191215.

15. European Investment Fund. Portfolio Guarantees & Credit enhancement / Securitisation. What we do. [Online] May 4, 2018. https://www.eif.org/what_we_do/guarantees/index.htm.