Middle Distillates Market Situation: A Global, not only European Problem

Fecha: junio 2022

Oil markets, Middle distillates, Oil dependance, War

Antonio Merino Garcia* and Jose Alfredo Peral Partida**

Papeles de Energía, N.º 17 (junio 2022)

The invasion of Ukraine by Russia is shaking energy markets across the globe, and crude oil and petroleum markets are no exemption. This article explores the impact of the conflict on oil markets both globally and at a European level. The main conclusion is that the scarcity of petroleum products, such as middle distillates, is concerning in Europe, but certainly it is not a European problem exclusively. Other geographies, such as the United States, are experiencing multi-decade high prices. This article sheds light on the fundamental-related factors, as well as on other elements that contribute to exacerbate the situation.

1. OIL PRODUCTS MARKETS: A WAR AFTER A POST PANDEMIC RECOVERY

Russian invasion of Ukraine is shaking oil markets in multiple ways, and its consequences are having a profound impact not only on crude oil prices, which soared to their highest level since 2008, but also on petroleum product prices. This is the case for diesel, particularly in Europe. But why? According, to the International Energy Agency (IEA), it is estimated that global oil markets may lose as much as 2.5 mb/d oil exports from Russia due to sanctions, 40 % of that amount corresponding to petroleum products. The effect on oil markets is significant as, even before Putin’s invasion of Ukraine, oil markets were undersupplied due mainly to:

A solid oil demand consumption –although threatened by the recent surge of COVID-19 cases in China. OPEC+’s producing less oil than its declared quota; and falling OECD total oil stocks, which stand at their lowest level since 2014.

Regarding Middle Distillates, –a concept that describes a range of refined products obtained in the “middle” boiling range during the crude distillation process, such as gasoil, heating oil, diesel and jet fuel– , the market was already tight before the invasion began, and hence “a potential loss of 1 mb/d of Russian diesel exports” (IEA, 2022), according to the IEA, poses a major challenge for refiners as they struggle to find alternative feedstocks together with a limited operable refining capacity. On paper, global crude distillation capacity excess stands at 20 mb/d, calculated from a nameplate capacity of 101 mb/d and a seasonal peak in crude processing of 82 mb/d. However, unused crude distillation capacity is due to bottlenecks in secondary processing units, where transport fuels such as gasoline and diesel are produced.

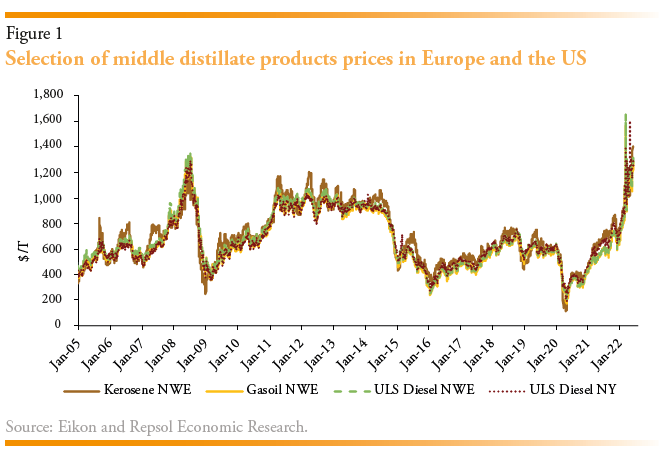

European middle distillates markets are not the only ones affected. Judging from the evolution of various middle distillate product prices around the world, other geographies, and countries, such as the United States, are experiencing multi- decade high prices.

How are the markets to function without Russian oil and product or with less Russian exports?

2. EUROPE’S DEPENDENCE ON RUSSIAN OIL

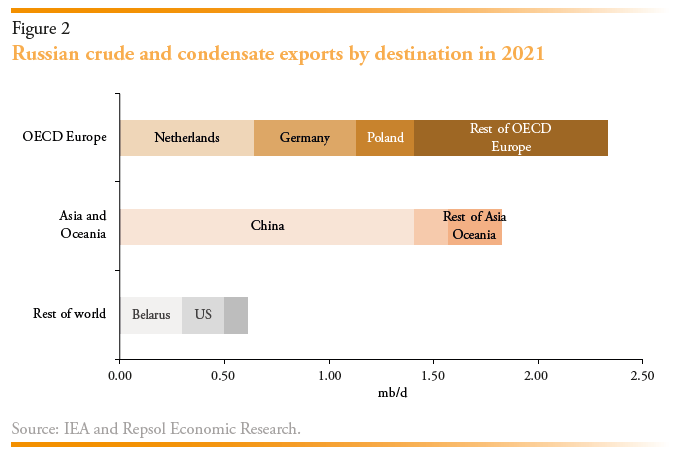

First, let’s assess the dependance of Europe from Russian oil. In 2021, Russia exported 4.7 mb/d of crude and condensate, with almost half of it being exported to OECD Europe (EIA, 2021). Netherlands, Germany, and Poland accounted for more than 50 % of Russia’s crude oil exports in the region.

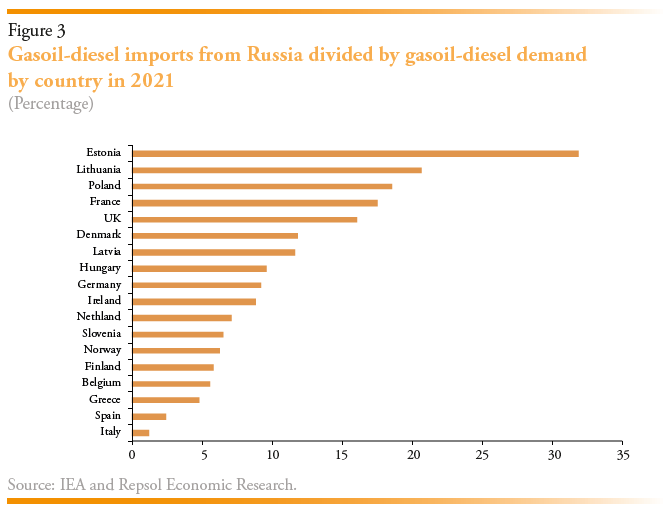

Europe also relies on Russian petroleum products, as it imports almost 50 % of its diesel needs from Russia, while the Middle East provides about half of Europe’s imports of diesel. More specifically, diesel and gasoil consumption in OECD Europe averaged 6.3 mb/d in 2021, and Russia provided 39 % of this demand, according to IEA data.1 As the chart below shows, countries such as Poland or Lithuania rely heavily on Russia’s petroleum products exports

2.1. Europe’s vehicle fleet dependence on diesel

Europe needs Russian and other diesel suppliers because of a reduction in European refining capacity, although not in Spain. According to the report Vehicles in use Europe 2022 from the European Automobile Manufacturers Association (ACEA, 2022), the EU passenger vehicle car fleet stood at 246 million in 2020, with over 40 % of them consuming diesel. But the importance of diesel is also found across the UE’s fleet size. Out of 29 million vans in circulation in the European Union, 91 % of them use diesel, while 96 % of 6 million trucks and 94 % of 0.7 million buses rely on diesel. This highlights the strong dependance of the European transport sector on diesel, which may lead to protests and strikes (as seen in Spain) should diesel markets tight further.

3. RUSSIAN OIL STILL FLOWS TO EUROPE

Despite the war, during the first half of April, around 1.8 m tons of Urals crude, a medium sour Russian crude benchmark, which is typically used in Europe and is Russia’s flagship grade for exports, were destined for Europe, or 57 % of the 3.16 m tons loaded from Russia’s three main western ports. However, 26 major refining companies with combined capacity of 14 mb/d in Europe have either suspended spot purchases or expressed their intent to do so in the foreseeable future.

The reluctance to take Russian oil prompted Platts to revise down its forecasts of Russian crude oil production, with a significant drop in Urals supply from May on. However, the extreme discounts of Urals versus Dated Brent, –an international benchmark assessment that represents the value of physical crude oil trading for prompt delivery in the open spot market–, suggest there are very few buyers willing to take Russian crude due to sanctions, so it is likely that those volumes come down in the near future, as there are still complications to buy Russian crude on existing sanctions, some banks are not issuing letters of credit to cover purchases of Russian crude, as well as the self-sanctioning announcements from traders, energy companies and governments.

The fourth package of European sanctions exempted oil purchases from Rosneft or Gazpromneft, which were deemed “strictly necessary” to ensure Europe’s energy security. It may be allowed to receive Russian crude from a pipeline, but it may not cover buying and selling Russian crude by intermediaries. This is why energy trading firms such as Vitol and Trafigura may decrease significantly its traded volumes from May 15, as the fourth package of EU sanctions, announced on March 15, exempts the execution of contracts entered into before March 16, 2022. Vitol had previously expressed its willingness to “significantly diminish” the traded volumes of Russian oil in the second quarter as its contractual obligations decline, and to cease trading Russian oil by the end of 2022. However, despite Western sanctions, Russia’s oil loading plan from Baltic ports is expected to match the initial plan, as Asian buyers, –mainly China and India–, have increased its purchases of Russian oil.

At the time of writing this report, the EU is still negotiating the sixth round of sanctions, which would impose an embargo on Russian oil imports. European countries that rely heavily on Russian oil, such as Hungary, would not back the plan in its current form and ask the EU for financing to adapt its refineries to non-Russian oil and build new pipelines to import alternative supplies into the country.

So, to what extent European buyers can move away from Urals crude? Given that Urals crude has a prominent position in European refining system, finding a good substitute becomes a challenge. Refiners may have to seek a variety of crude grades from different locations. The US may cover part of the Russian crude loss with WTI grades, whose relative low sulfur content makes it cheaper to process, although has a lower middle distillate yield than Urals.

Additionally, Iran could help replace Urals crude as its quality is similar to Urals’ and, should the Nuclear Deal is renewed, it could add (potentially) up to 1 mb/d of light and heavy grades. Arab light grades have the advantage of having the largest production base and similar API to Urals, but most of cargoes flow to Asia and the high sulfur content makes them not so attractive, especially in an environment of high prices of natural gas, as it is the main feedstock to produce the hydrogen needed during the hydrodesulfurization process. West African grades, such as Forcados and Qua Iboe, are popular among European refiners. Over half of West Africa’s exports hit Asian markets so there is room for more European imports, and their sulfur content is low (Vortesa, 2022).

On the petroleum product side, diesel cargoes also keep hitting European markets despite many oil & gas companies implement self-imposed embargoes on Russian oil. The question of “strictly necessary to keep energy Security” is giving an excuse to companies to import.

3.1. Lower refinery utilization in Russia

But obviously, the diesel flows to Europe will depend on how much of that fuel is produced in the origin, and the ripple effects of the war are reaching Russian refiners as well. Russian and Belarusian refiners are reducing throughput as they struggle to place their output due to international buyers’ reluctance to take cargoes with Russian origin. According to estimates, around 4 million metric ton (mt) of capacity has been shut in since February 24 (the day Russia invaded Ukraine). That represents more than 15 % of Russia’s 25 million mt/month processing (around 6 mb/d). The exports of Russian VGO, or vacuum gasoil, a feedstock of cracking units such as FCC and Hydrocracker to produce gasoline and diesel, to Northwest Europe have also dropped as many European refiners took the decision to self-sanction Russian-origin products in response to the invasion of Ukraine.

4. LOW STOCKS AND HIGH PRICES

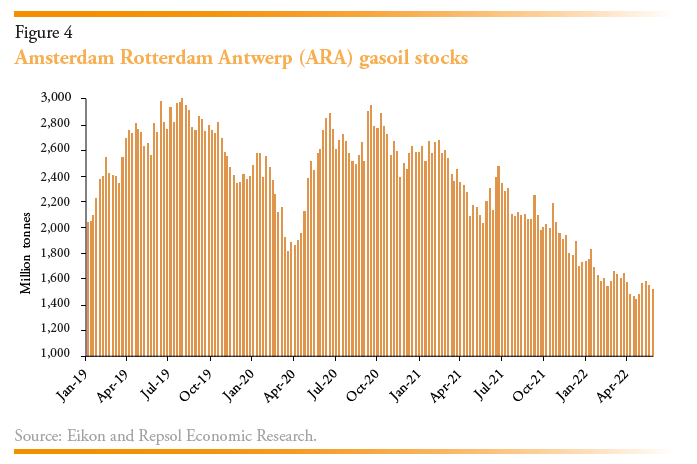

Following sanctions on Russia, global markets may face a squeeze on diesel that could lead to fuel rationing. Executives of the world’s largest independent oil trading firms also have warned of a “systemic shortfall of diesel” (Financial Times, 2022) in Europe, which imports around 1 mb/d of Russian diesel. The conflict has but exacerbated an already tight middle distillate market with stocks at multi-year lows. According to Platts, global diesel demand hovered at 98 % of pre-COVID level at the end of 2021. This shortage of diesel led to Austria’s energy giant OMV to limit spot sales of heating oil and diesel until further notice. It follows announcements of Shell and BP, which did not offer spot diesel cargoes for sale in Germany for fear of supply shortage.

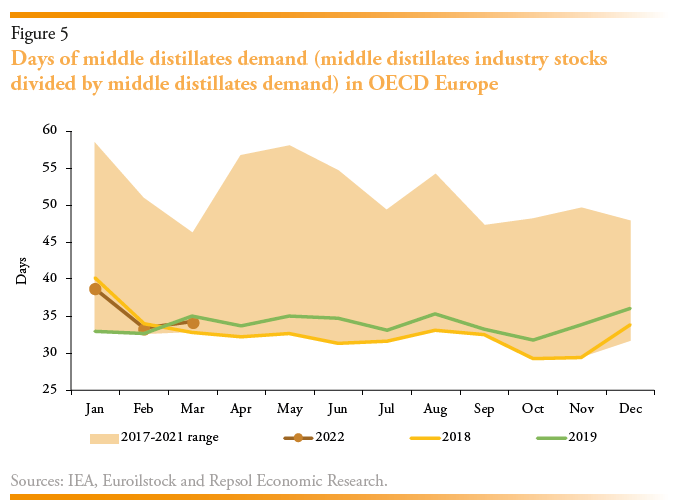

In terms of days of demand, –the result of dividing middle distillates industry stocks by middle distillates demand–, OECD Europe levels hovered around 34 days in March, close to the bottom of the 2017-2021 range, and 12 days lower than in March 2021. However, comparing current days of demand levels with those of 2018 and 2019, –less, volatile years than 2020 and 2021–, the conclusion is rather different, as today’s levels hover around levels of normal or more stable times. In any case, the chart below reflects the dynamics of the middle distillates markets in Europe during the last few years: in 2020 the pandemic, via lower demand, accelerated the accumulation of unused diesel and gasoil barrels into inventories (shown by the upper bounds of the five-year range). This trend continued in early 2021 with the emergence of new coronavirus variants, but the consumption of middle distillates in Europe began to recover as progress in vaccination programs gathered pace, especially in developed countries such as the U.S. and European economies. The strong economic growth entailed strong consumption, leading to middle distillates draws, as was the case for other petroleum products. Besides, during the winter season last year, demand for diesel and fuel oil had already risen due to fuel switching triggered by high natural gas prices, especially in Europe and Asia. Paradoxically, although product demand was strong refiners did not significantly increase its petroleum product production because margins were not attractive enough at that time. Therefore, they continued to draw down their inventories of refined products. Fast forward to early 2022, inventories of diesel, gasoil, and jet kerosene in Europe, already tight, face a delicate situation exacerbated by the war in Ukraine.

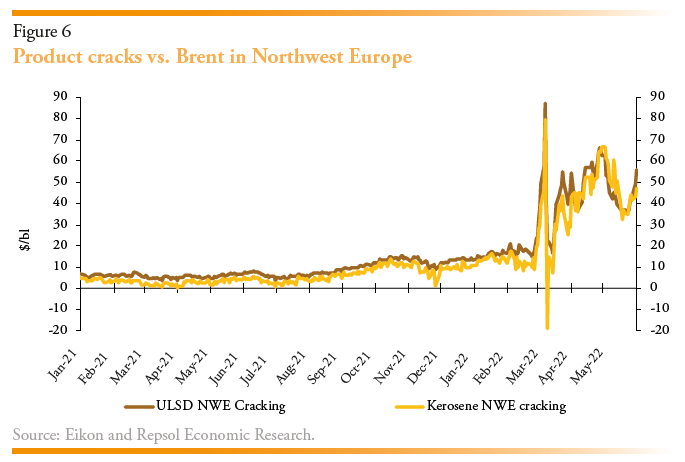

The fears of a diesel shortage in Europe are captured by diesel cracks, the difference between the wholesale price of diesel and the crude oil price, in Northwest Europe, which set a record of 37.6 $/bbl in March, up by 24 $/bbl from February. On its part, the cracks of jet kerosene, benefited from continued recovery in air traffic, almost tripled from 12 $/bbl in February to 30 $/bbl in March. This adds more pressure on middle distillates markets, which may prompt diesel yields to decline in favor of higher jet kerosene output.

But the war in Ukraine has significant implications for future diesel prices in Europe as well. The front of the curve has shifted up by almost 50 % compared to the forward curve on February 1st, which highlights the steep backwardation (structure by which spot prices are higher than the prices of the futures contract) of diesel markets in Europe. Whether or not futures curves are a good predictor of future spot prices, they do reflect one of the multi-faceted consequences of Putin’s war.

5. AGGRAVATING THE CHALLENGES

Although the war is a major factor behind the extreme volatility in oil markets, there are other elements that help exacerbate the problem.

One of them is the Chinese ban on diesel exports, in April, China told its independent refiners to pause gasoline and diesel exports to prevent a domestic shortage of those fuels. In fact, exports of diesel plunged to 530.000 tons in April, compared to 2.72 million tons in April 2021, while exports of gasoline were 980.000 tons in April, versus 1.47 million tons in the same month in 2021. Considering the first four months of 2022, exports of diesel and gasoline fell by 82 % and 39 %, respectively, below the level for the same period last year.

Strong middle distillates consumption in other regions. At the port of Fujairah, on the UAE’s east coast, gasoil and other middle distillates slumped to record low in mid-March. With European buyers avoiding Russian diesel, they have to draw from somewhere else and Fujairah was the best alternative.

As regards Asian markets, Singapore’s middle distillate inventories have plunged to their lowest in more than eight years on the back of strong exports of automotive diesel to the Netherlands. Although middle distillates stocks have been drawing since early 2021, the most recent trend points to a relative stable stock level, reversing the downward trend seen in late-April and early-May.

In the US, inventories of middle distillates, used in manufacturing, freight transport, mining, farming, as well as heating homes and buildings, stand at their lowest level since August 2008, on the back of a strong rebound of its economic activity following the pandemic.

6. CONCLUSIONS

Diesel scarcity is certainly a growing concern in Europe, but it is not only a European problem. Inventory levels are at multi-year lows across the globe due to robust demand and tight supply. And the ripple effects of tight middle distillates markets extend through the global economy leading to higher inflation. For instance, higher diesel prices are passed from shippers and trucking companies to retailers, which are in turn passing them to the final consumer. Argentina, the world’s largest exporter of soy oil and soy flour, is rationing diesel due to a growing mismatch between the domestic selling price and the importing price, which jeopardizes the country’s cropping season.

But, above all, the war in Ukraine has shown the world how Russia uses its energy supplies as a weapon in war. Ironically, due to the war itself governments around the globe are accelerating the process of phasing out their dependance on Russian energy exports. Country members of the International Energy Agency have so far agreed to release from May to October a total of 240 million barrels of oil from their Strategic Petroleum Reserves, or SPR, (including the additional contribution from US’s SPR) in response to the market turmoil caused by Russia’s invasion of Ukraine. More specifically, most of the stocks made available in Europe will consist of oil products, particularly diesel. These actions underscore the commitment to stabilize global energy markets against Putin’s unprecedented and unprovoked military attack of Ukraine.

The current situation in oil markets reflect a petroleum product market tighter than the crude oil one. The fact that crude oil futures have been trading around 100-110 $/bl for two months highlights the expectation of insufficient upstream investment, which might keep crude oil markets tight in the coming years. However, petroleum product markets are tight because refiners are not converting crude into refined products quickly enough to keep up with demand. In the short term, theoretically, the world must either slow down its consumption of petroleum products or increase its supply. The former, could find answers in: A potential China demand contraction, an inflationary environment, or a high price-demand elasticity. The latter may find some relieve with new refineries coming online during summer, which would help alleviate the petroleum product market tightness by 2023. In any case, high uncertainty is prevailing in the market. Also, it should be mentioned that refiners need high nominal margins to increase its operations, which is the difference between the price of diesel and oil, because one of the most relevant costs for this conversion is natural gas price that are much more expensive in historical terms than oil.

REFERENCES

European Automobile Manufacturers Association, ACEA (2022). Vehicles in use Europe 2022. https://www.acea.auto/publication/report-vehicles-in-use-europe-2022/

Financial Times (2022). Traders warn of looming global diesel shortage, 22 March 2022. https://www.ft.com/content/31f73f95-d914-46a1-b610-0c7fc5da493c

International Energy Agency, IEA (2022). Oil Market Report, 16 March 2022.

U.S. Energy Information Administration, EIA (2021). Country Analysis Executive Summary: Russia, 13 December 2021. https://www.eia.gov/international/content/analysis/countries_long/Russia/russia.pdf

Vortexa (2022). European refiners can live without Russian Urals, 2 March 2022. https://www.vortexa.com/insight/european-refiners-can-live-without-russian-urals

NOTAS

* Director of the economic research division and Chief Economist Repsol.

** Senior Energy Analyst Repsol.

1 International Energy Agency Monthly Oil Data Service (MODS) – Trade, April 2022.