Eurozone PMIs in September 2020

Fecha: octubre 2020

Pamina Lantos, Research Assistant, Funcas Europe

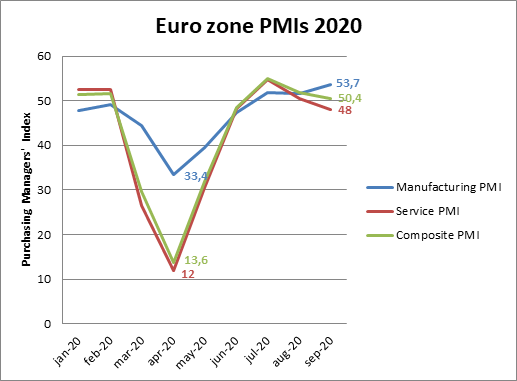

Computed by IHR Markit, the PMI Composite Output Index for the Eurozone has decreased from 51.9 in August to 50.4 in September. Even though, values remain “positive” (above the benchmark value of 50), it seems like the recovery period experienced in the third quarter of 2020 is coming to an end due to the renewed increase in Covid-19 cases, and thus new restrictions across various member states which are impacting economic activity. Overall, incoming new business in the Eurozone service sector experienced the slowest growth rate in 3 months and employment numbers fell for the seventh consecutive month in September.[1] This raises the risk of a premature slowdown in the recovery phase –if not a double dip in some cases.

Nevertheless, these values vary drastically across economic sectors and members of the Eurozone. The Eurozone PMI of the service sector has suffered the most in this last month decreasing by 2.5 points from 50.5 to 48. Simultaneously, the PMI of the construction sector only saw a slight decrease of 0.2 points, while remaining negative at 47.5.[2] The only sector continuing on a positive trend is manufacturing, where the Eurozone PMI increased from 51.7 to 53.7 in a month and accordingly recorded the most intense growth over two years.[3]

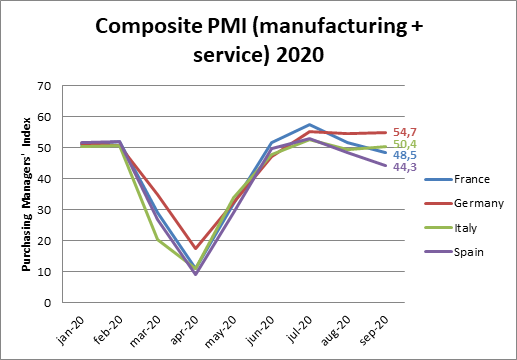

The relative importance of services sectors are reflected in cross-country performance. Germany, which has a smaller service sector (as well as relatively limited Covid-19 cases), recorded a Composite PMI of 54.7 in September, is the country’s highest value in 2 months. Despite their decreasing values in the construction (from 48 to 45.5) and service (from 52.5 to 50.6) divisions, Germany has been able to hold up their encouraging developments due to their manufacturing sector which was able to record a 26-month high in the last month and ended up at 56.4. This is partly due to an increase in new orders, both internally and in export markets.[4]

In contrast, countries like France, Italy and Spain have larger service sectors and depend to a significant extent on tourism. As a result, France and Spain are both left with a Composite PMI below 50 as of September, with 48.5 and 44.3 respectively, while Italy is scraping the surface with 50.4, the country’s highest value in 2 months.[5] Even though all three countries experienced a slight growth in their national manufacturing PMI, these modest gains got lost with their stumbling service sector.[6]

Looking ahead, the growth in new orders suggests that manufacturing may continue to recover in coming months. By contrast, the service sector is currently confronting the lowest PMI values and the steady decline in “new business” points to a further weakening in activity.[7] The marked sectoral divergence is likely to continue to shape cross-country differences in performance at least until the end of the year.

[1] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 5th October 2020.

[2] IHS Markit Eurozone Construction PMI. IHS Markit. 6th October 2020.

[3] IHS Markit Eurozone Manufacturing PMI – final data. IHS Markit. 1st October 2020.

[4] IHS Markit / BME Germany Manufacturing PMI. HIS Markit. 1st October 2020.

[5] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 5th October 2020.

[6] IHS Markit France Services PMI. IHS Markit Spain Services PMI. IHS Markit. 5th October 2020.

[7] Williamson, Chris. Eurozone Economic Rebound Stalls in September Amid Renewed Fall in Service Sector Activity. IHS Markit. 5th October 2020.