Eurozone PMIs in November 2020

Fecha: diciembre 2020

Pamina Lantos, Research Assistant, Funcas Europe

In order to analyse the current state of the Eurozone economy and detect any cross-country divergences, this note uses the Purchasing Managers Index (PMI), a high frequency indicator published by IHS Markit.

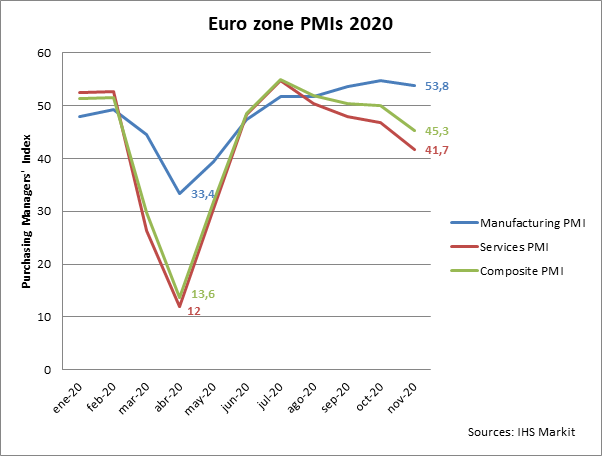

Following the tendency of the latest reports, the Eurozone Composite PMI declined for the 4th month in a row in November. However, it is the first time in 5 months that the composite index returned to contraction with a value below the threshold. Hence, the Composite PMI of the Eurozone moved from a plain 50,0 in October to a 45,3 in November, indicating the reappearance of a tightening economy. Yet, differences between sectors and countries persist and even seem to be widening.[1]

After 6 months of uninterrupted growth, even the Eurozone Manufacturing PMI has declined by one point this month, moving from a 54,8 in October to a 53,8 in November. Nevertheless, the manufacturing sector remains the least affected. Albeit the slight descent, the Manufacturing PMI is indicative of growth with an overall gain in output and new orders.[2]

At the same time, the Service Sector PMI of the Eurozone suffered a great loss this month, shrinking from a 46,9 in October to a 41,7 in November. Declining by a total of 5,2 points, the Service Sector PMI remains below the threshold of 50 for the 3rd consecutive month. The four largest Eurozone economies, namely France, Germany, Italy and Spain, have only moved further below the threshold in their Services PMI.[3]

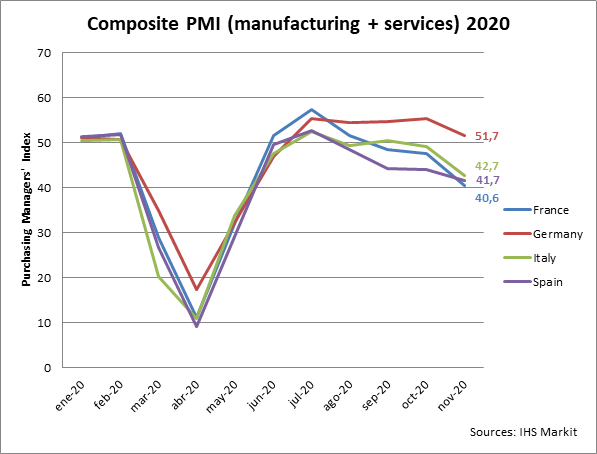

Even though Germany also experienced a significant decline in the Services PMI, its loss is by far the weakest of the four economies. While France, Italy and Spain have all fallen to values below 40 in their Service PMI, Germany remained at 46,0 in November. The reason for this relatively strong service sector is the “lighter” lockdown restrictions in Germany combined with the news of a possible Covid-19 vaccine, enabling a modest rise in service sector employment and a rather positive lookout for the future.[4]

Being the only country above the threshold, Germany is left with a Composite PMI of 51,7, around 10 points above the other economies. In contrast, the situation in France and Italy seems to deteriorate, while Spain has managed to contain the decline in its relative position.

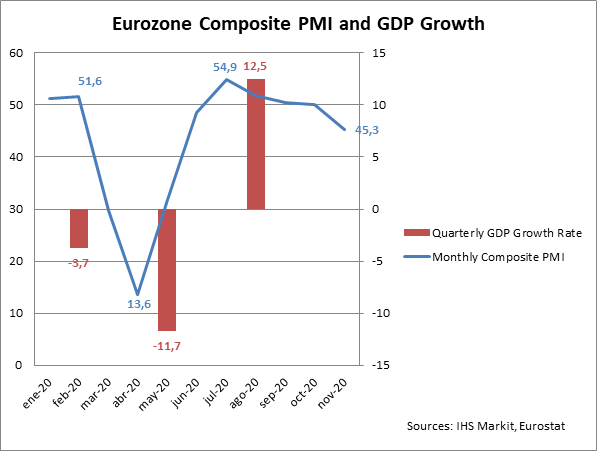

Table 3 indicates the conjunct development of the Eurozone Composite PMI and the quarterly GDP growth rates throughout this year. The lowest value of a quarter to quarter GDP growth rate can be detected in Q2 of this year. This coincides with the deepest plunge for the Eurozone Composite PMI in April of this year. While both seem to have recovered in Q3, the final value for Q4 is yet to be determined.

Examining impending progresses, the second wave of Covid-19 infections seems to have its adverse effect on the Eurozone and its PMI. While the service sector has been suffering from losses in new businesses for a few months, the manufacturing sector is now also experiencing slackening activity in new orders. The actual developments of PMIs will depend greatly on the persistence of lockdowns as well as the approval of incoming vaccines.

Table 1

Table 2

Tabla 3

[1] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 3rd December 2020.

[2] IHS Markit Eurozone Manufacturing PMI – final data. IHS Markit. 1st December 2020.

[3] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 3rd December 2020.

[4] IHS Markit Germany Services PMI. IHS Markit. 3rd December 2020.