Eurozone PMIs in February 2021

Date: February 2021

Pamina Lantos, Research Assistant, Funcas Europe

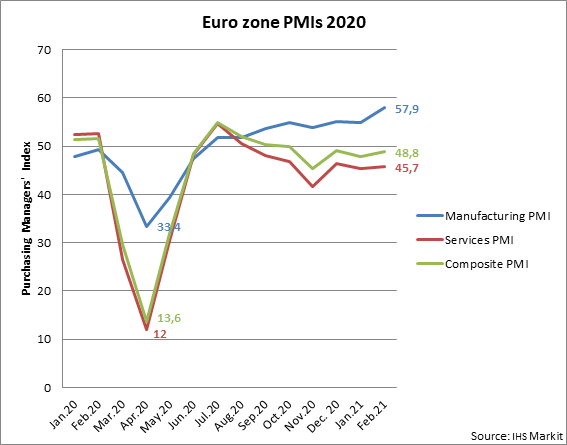

Even though the IHS Markit Composite Output Index of the Eurozone demonstrated a slower rate of contraction, shifting from 47,8 in January to 48,8 in February, the indicator remains below the no-change mark of 50 for the fourth consecutive month. In addition, the latest data suggests a sustained two-speed economy with a manufacturing and service sector that keep moving further apart (see table 1). (1)

On the one hand, the Eurozone service sector, in particular the parts most impacted by Covid-19 constraints, underwent the sixth successive month of contraction with a score of 45,7. The four largest Eurozone economies recorded a reduction in both activity and new orders – led by Spain, which was left at 43,1. Also Germany experienced its worst Service PMI since last May with a value of 45,7. (2)

In contrast, the manufacturing sector registered noticeable advances in output as well as new orders, resulting in a final value of 57,9. All four economies experienced an expanding manufacturing sector – Germany leading the way with a Manufacturing PMI of 60,7, its highest value in three years. This is fuelled by a continuously growing demand in both the Eurozone and abroad. The contribution of exports was the strongest since January 2018. Accordingly, February recorded rising levels of staffing in the manufacturing sector for the first time in nearly two years, with Spain as only exception. (3)

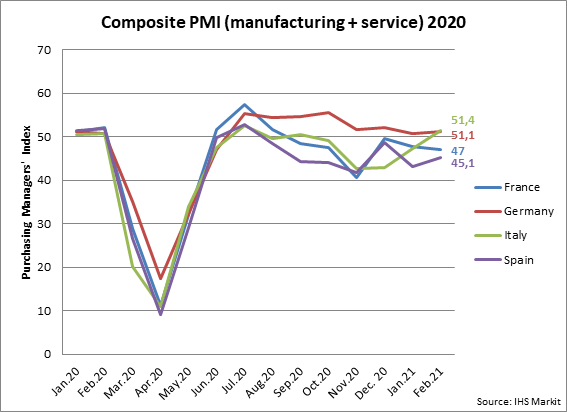

Italy, who to date has improved its Composite PMI the most this year, overtook Germany for the first time this month, by just 0,3 points (see table 2). This can be explained by the loosened restrictions applied in Italy by the beginning of February, which slowed the service sector’s rate of decline from 44,7 to 48,8 and left the manufacturing PMI at 56,9, a three year high. (4) However, with mounting cases of Covid-19 and talk about renewed restrictions in the country, this growth is rather improbable to be sustained in the near future.

Furthermore, the supply-side challenges mentioned in last month’s note remained in February. The Eurozone is encountering a continued expansion of delivery times as well as input costs, due to difficulties in sourcing inputs and transporting goods in the midst of international Covid-19 restrictions. (3) This month’s data further corroborates the Eurozone’s weak start into the new year. The stagnant development of vaccine rollouts combined with a repeated rise in the number of cases in various member states will be a recurrent challenge for the Eurozone and most probably delay its full economic recovery to later in the year than originally expected.

Table 1

Table 2

Source:

[1] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 3rd March 2021.

[2] IHS Markit Eurozone Service PMI. IHS Markit. 3rd March 2021.

[3] IHS Markit Eurozone Manufacturing PMI – final data. IHS Markit. 1st March 2021.

[4] IHS Markit Italy Services PMI. IHS Markit. 3rd March 2021.