Conjunctural indicators for the Eurozone in September 2021

Fecha: October 2021

Almudena García Sanz, Economist and Researcher, Funcas Europe

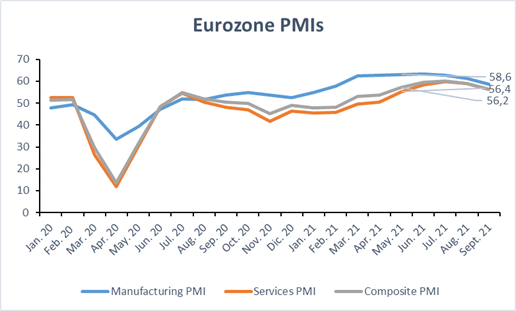

The main short-term indicators, notably PMIs, suggest phase, though still strong is losing momentum as as supply shortages take their toll, especially in manufacturing [1]. In September, the PMI-IHS Markit Composite Output Index of the Eurozone reached 56,2, marking a further retreat from the 15-year peak recorded in July [2]. This suggests that the pace of the recovery has probably peaked, although the index remains well above the 50-mark.

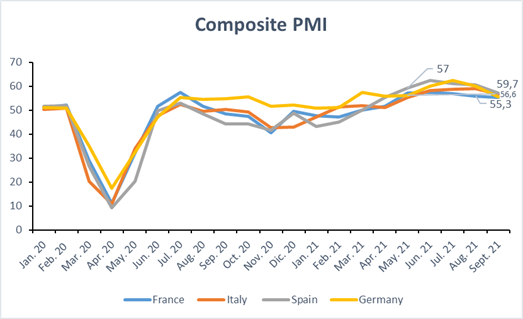

Spain exhibited the highest levels, probably reflecting that they have further to go to regain their pre-virus GDP sizes [1].

The indicators suggest that services grew faster than manufacturing for the first time since the start of the pandemic, reflecting the latter’s sensitivity to ongoing supply-related constraints and rising energy price. Demand for goods and services also rose for a seventh month running in September, but there was a further easing in the pace of expansion. Although goods producers still recorded a stronger rise in sales than their service-providing counterparts, which stresses the resilience of export demand. [3]. Meanwhile, the health crisis and associated lockdown measures has seen production of components and logistical capacity hit hard [2]. Thus, supply chain difficulties persist and the costs of inputs, especially energy, increase at the fastest pace seen over the past decade. Supply shortages are also exacerbated by ever-higher shipping costs. And delivery times continued to lengthen at close to a record pace in almost a quarter of a century of survey data, exceeded only by those recorded in the prior three months [2], and causing manufacturers to run down their stocks of finished goods yet again. Data suggest that services sector is also being affected, but that services firms are raising selling prices more slowly. [1].

Despite this more uncertain outlook, employment continued to grow in September. Firms continue to hire additional staff, although at a rate which slowed to a four-month low [3].

Finally, inflationary pressures mounted in September, with input prices rising at the fastest rate since the series started in (July 1998). It also seems that output prices are gathering momentum, too. [3].

Source: Markit

Source: Markit

References:

[1]https://www.capitaleconomics.com/clients/publications/european-economics/european-data-response/euro-zone-final-pmis-sep/ [2]https://ihsmarkit.com/research-analysis/global-manufacturing-prices-spike-higher-amid-supply-constraints-Oct21.html [3]https://www.markiteconomics.com/Public/Home/PressRelease/ec4f5dbd611a49b39e5847368c0d82c5 [4]https://www.markiteconomics.com/Public/Home/PressRelease/b92d662196d841c1b7446ee98b9abff3