Conjunctural indicators for the Eurozone in October

Fecha: November 2022

Almudena María García Sanz, Economist and Researcher, Funcas Europe

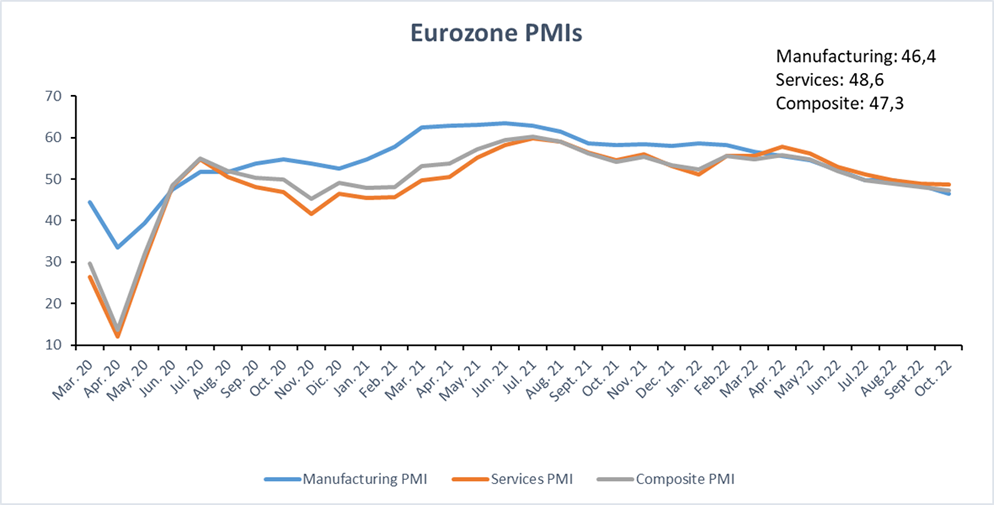

The PMI Composite Index posted 47.3 in October 23-month low. Private sector business activity across the euro area fell at the sharpest pace since November 2020, extending the downturn into a fourth straight month [1].

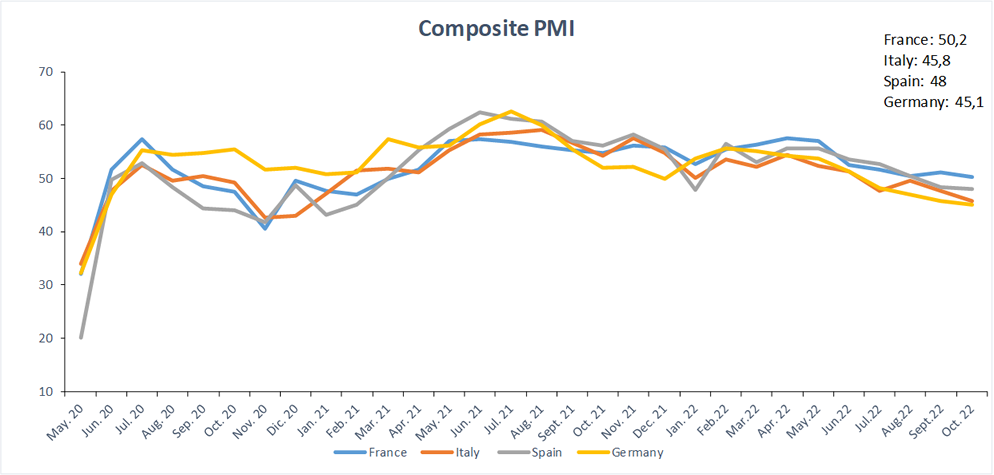

Among the large eurozone countries, France saw private sector business activity levels rise, although rates of growth slowed from September. The scenario was bleak elsewhere as Spain, Italy and Germany all recorded contractions in output. Germany was the worst performer once again in October as the latest survey data pointed to the fastest deterioration in the economy since May 2020.

A sharper reduction in manufacturing output was accompanied by an accelerated decline in service sector activity during October. Underpinning downturns across each sector were further slumps in new orders, with uncertainty, high prices and generally weak underlying demand conditions cited by survey respondents. Consequently, backlogs of work across the euro area continued to fall while business confidence was little changed from September, which was the lowest since the initial COVID-19 shock in the first half of 2020.

Meanwhile, after accelerating in the previous month, input cost and output price inflation rates eased in October. However, overall price pressures remained historically elevated.

Although survey indicators highlighted worsening economic conditions across the euro area in October, PMI data pointed to a twenty-first successive increase in overall employment levels. The rate of job creation was relatively solid overall, though among the weakest seen across the last year-and-a-half.

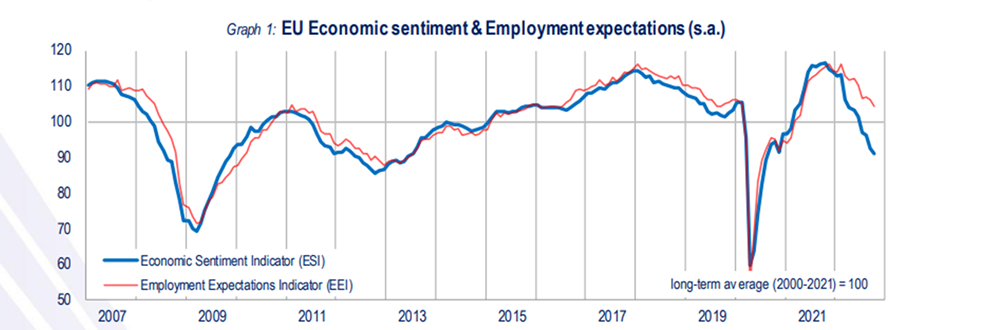

Finally, the Economic Sentiment Indicator[1] (ESI) recorded a further decline in October in both the EU (-1.5 points to 90.9) and the euro area (-1.1 points to 92.5), reaching its lowest level since August and November 2020, respectively [2]. The Employment Expectations Indicator (EEI) also decreased (-1.8 points to 104.5 in the EU and -1.7 points to 104.9 in the euro area) but remained well above its long-term average.

The decreased in the Employment Expectations Indicator[2] (EEI) (-1.8) was driven by worsened employment plans in industry, services, and retail trade, while managers in construction expected employment to increase in their sector over the next three months. Consumers’ expectations, which are not included in the headline indicator, worsened.

[1] The Economic Sentiment Indicator (ESI) is a composite indicator combining judgements and attitudes of businesses (in industry, construction, retail trade, services) and consumers by means of a weighted aggregation of standardized input series.

[2] The Employment Expectations Indicator is constructed as a weighted average of the employment expectations of managers in four surveyed business sectors.

References :

[1] https://www.pmi.spglobal.com/Public/Home/PressRelease/864d8f8f651d47cc98d03ce83a20bfc9 [2]https://economy-finance.ec.europa.eu/economic-forecast-and-surveys/business-and-consumer-surveys/latest-business-and-consumer-surveys_en