Conjunctural indicators for the Eurozone in October 2021

Fecha: November 2021

Almudena García Sanz, Economist and Researcher, Funcas Europe

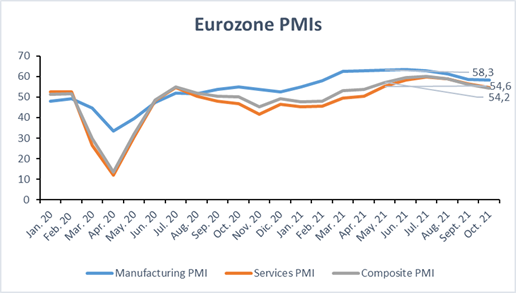

The main short-term indicators suggest the euro-zone’s economic recovery might slow markedly in Q4, as supply shortages intensified [1], which caused a slowdown in manufacturing and service sectors [2]. In October, the PMI-HIS Markit Composite output index of the Eurozone reached 56,2, which is a six-month low [1]. Moreover, growth at goods producers slowed significantly, easing to the weakest pace since the recovery in manufacturing began last July (it reached a 15-year high) [2].

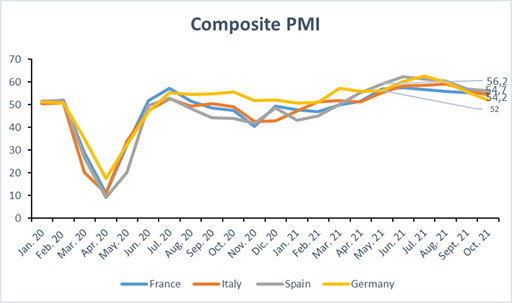

The Composite Markit Index for the four largest economies of the Eurozone fell in October, especially in the case of Italy reflecting the drop in the services component. On the other hand, Spain continues to exhibit a relatively brisk record possibly owing to the low post-covid activity level [1].

The indicators suggest that service sector continued to be the main driver of economic growth at the beginning of this fourth quarter, despite the expansion weakening. While supply shortages, low shipping container availability and a range of bottlenecks squeezed manufacturing production [2]. Moreover, the slowing trend in business activity was also mirrored in new orders during October. Demand for eurozone goods and services increased at the lowest rate in six months. However, new export orders rose a solid rate, broadly unchanged since September [2]. Nevertheless, backlogs of work continued to rise at an elevated pace in October, particularly in the manufacturing sector [3], as shortages and significant lead times on input deliveries weighed on production schedules [2]. On the other hand, overall manufacturing jobs growth strengthened across the eurozone and was among the fastest since data collection began in 1998 [2]. Also, in the case of service sector, with staffing levels rising at the quickest pace since October 2007.

Finally, inflationary pressures intensified across the euro area, with both input costs and output prices rising at new survey-record rates in October. [3]. As a result of the intense supply-side issues, but also as a consequence of rising costs for energy, fuel and labor, input price inflation hit a fresh series record in October. To combat greater cost burdens, service sectors firms also increased their selling charges at the fastest pace on record.

Source: Markit

Source: Markit

References:

[1]https://www.capitaleconomics.com/clients/publications/european-economics/european-data-response/euro-zone-final-pmis-oct-2/ [2]https://www.markiteconomics.com/Public/Home/PressRelease/4c3c5a41ff2d4585b8d92767419b06ca [3]https://www.markiteconomics.com/Public/Home/PressRelease/d1e6b09a9eea4993bb787845fb55233f