Conjunctural indicators for the Eurozone in December

Fecha: January 2023

Almudena María García Sanz, Economist and Researcher, Funcas Europe

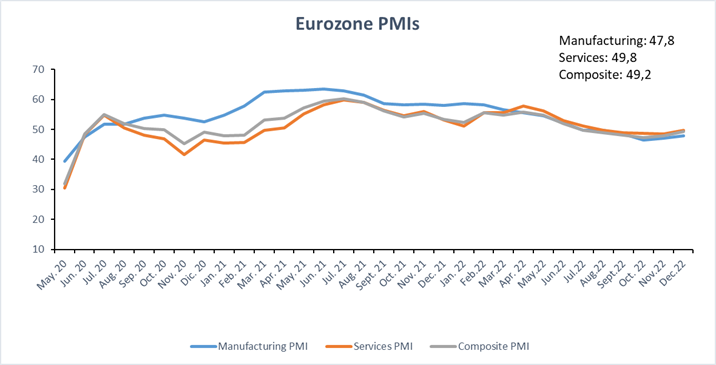

The PMI Composite Index posted 49.3 on December. The decrease has now softened in each of the past two survey periods, suggesting that the eurozone economy may be doing better than expected.

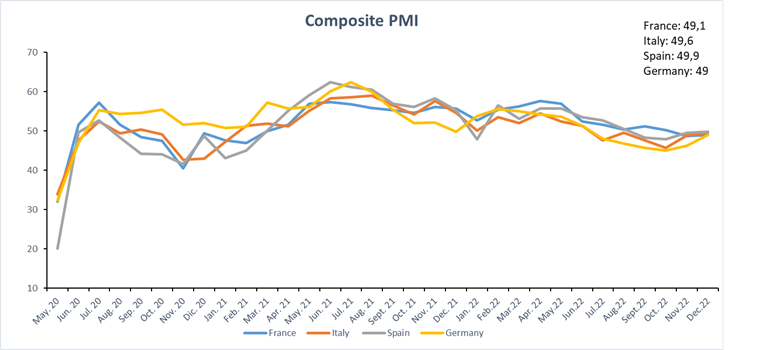

Across the monitored euro area nations during December Spain was only fractionally inside contraction territory, while Italy also moved closer to the 50.0 mark. Germany and France saw slightly faster deteriorations in output than Italy and Spain, although they were nonetheless only modest.

Manufacturing was once again the principal drag on overall output during December, although services activity also continued to fall. These decreases extended their respective sector-level downturns into a seventh and fifth consecutive month respectively. Nevertheless, rates of decline moderated in both cases.

Despite an overall better situation compared with expectations, a strong deterioration in external demand for goods and services has been recorded, according to the December survey. Subdued demand conditions were cited by survey respondents as a major factor holding back output volumes, although some companies also mentioned higher interest rates as a key negative factor. With inflation remaining elevated, reduced client purchasing power also restricted overall activity levels.

A further expansion in staffing levels in December took place, extending the current run of job creation that started almost two years ago. Rising workforce numbers remained a feature of both sectors at the end of 2022. The overall rate of job creation was broadly unchanged from the 21-month low recorded in the previous survey period, however.

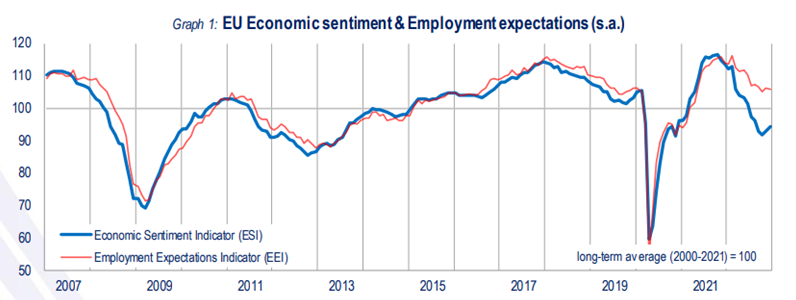

Finally, these results are in line with the improvement of the Economic Sentiment Indicator[1] in December, driven by upturns in all surveyed sectors as well as among consumers. Amongst the largest EU economies, the ESI increased in Germany, Spain, and Italy, while easing slightly in France.

The Employment Expectations Indicator[2] remained almost unchanged (at -0.4) as a result of an improved employment outlook in construction, offset by a deterioration in services. Managers in the retail trade and industry sectors expected employment in their firms to remain broadly unchanged over the next three months.

[1] The Economic Sentiment Indicator (ESI) is a composite indicator combining judgements and attitudes of businesses (in industry, construction, retail trade, services) and consumers by means of a weighted aggregation of standardized input series.

[2] The Employment Expectations Indicator is constructed as a weighted average of the employment expectations of managers in four surveyed business sectors.

References:

[1]https://www.pmi.spglobal.com/Public/Home/PressRelease/a7b8833a56df49d696286f25ebcd1977 [2]Latest business and consumer surveys (europa.eu)