Banking union: Strengths and contradictions of the German proposal

Descargar artículo (formato PDF)

Fecha: noviembre 2019

Miguel Carrión Álvarez - Funcas Europe

In preparation for the Eurogroup meeting of November 7, and then for the European Council of December 2019, the German Finance Ministry has prepared a position “non-paper” on banking union (German Federal Ministry of Finance, 2019) . This includes a proposal for a common European Deposit Insurance Scheme (EDIS) based on the principle of reinsurance of national deposit guarantee schemes. What is significant about this is that the common deposit insurance is not made explicitly conditional on the rest of the proposed reforms. Indeed, previously, so-called risk reduction was presented as a precondition for the risk-sharing associated with any common deposit insurance scheme. This had become a stumbling block in earlier discussions on EDIS.

Olaf Scholz, the German Finance Minister, introduced this non-paper with an op-ed in the Financial Times where he urged to break the long-lasting deadlock on banking union (Scholz, 2019) . This is Germany taking the initiative to complete banking union, rather than being seen as stalling it. The non-paper does not lay down any red lines on deposit insurance, and Scholz claims his country understands that completing the banking union will require compromise. This suggests that the non-paper is an initial negotiating position on which Germany is open to further concessions in some areas – including on deposit insurance – in exchange for gains in others.

Most of the political reaction, and even expect commentary, on the German non-paper has focused on deposit insurance. However, the non-paper covers other topics such as harmonisation of insolvency law and tax law as they applies to banks, national ringfencing of liquidity and capital of banks, and the relative scope of national and European responsibilities for bank resolution. These issues may be of greater practical importance than deposit insurance. After all, changes in any of these areas would have an immediate material impact on the banking industry or its supervisors. Deposit insurance has an immediate impact because its presence or absence can affect depositor behaviour, and because it is funded by bank levies that are already being collected, but ultimately it remains a last-resort backstop.

This note reviews the various proposals contained in the German ministry non-paper, not just deposit insurance, with a focus on how they affect the balance of powers and responsibilities of national and European authorities. The main conclusion is that, by insisting on retaining national responsibility for deposit insurance, Germany undermines its own proposals to transfer powers from the member states to the European level in the areas of resolution planning, crisis management and taxation.

1 The proposals of the German non-paper

The German Ministry of Finance presents its proposals for banking union as consisting of four elements:

- Efficient supervision and crisis management, by which they mean common resolution and insolvency mechanisms irrespective of size and location of a bank;

- Further risk reduction, with an emphasis on the treating government debt as risky on bank balance sheets;

- European deposit insurance, though the proposal does not go beyond European reinsurance of essentially national insurance systems;

- Prevention of tax arbitrage, by harmonising taxation of banks across member states in the banking union.

We first analyse the interplay of deposit insurance with risk reduction, and then with one particular aspect of resolution planning which is the national ring-fencing of bank capital and liquidity. We then consider the rest of the proposals on common bank resolution and insolvency law. And finally we briefly consider the issue of tax harmonisation.

2 Risk sharing and risk reduction

The public debate on banking union seems to be stuck in 2015, with a focus on the catchphrases “risk reduction” and “risk sharing”.

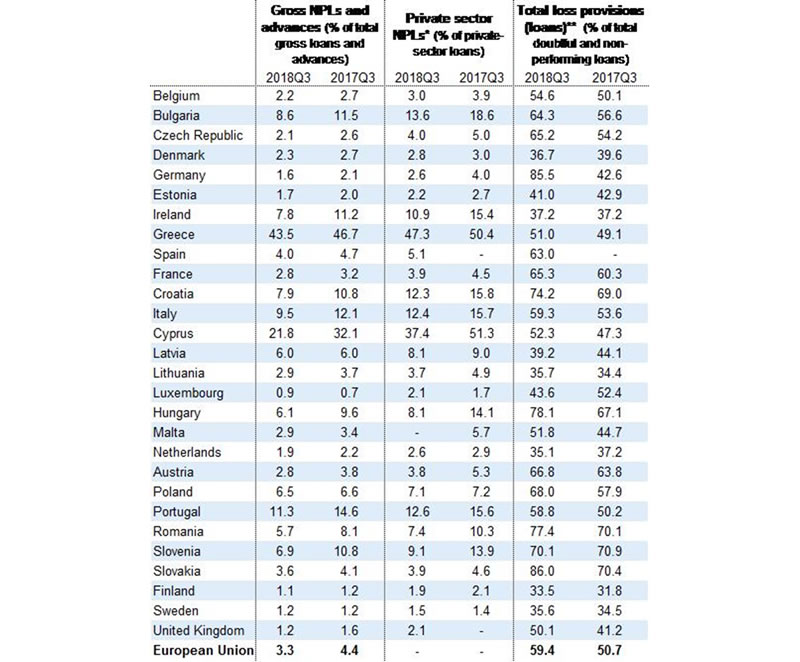

Here risk reduction is a stand-in for two separate aspects of bank asset quality: non-performing loans and government credit risk. For nonperforming loans the issue is that some countries have much higher stocks of nonperforming loans on their banks’ balance sheets (European Commission, 2019).

Table 1: NPLs by member state (European Commission)

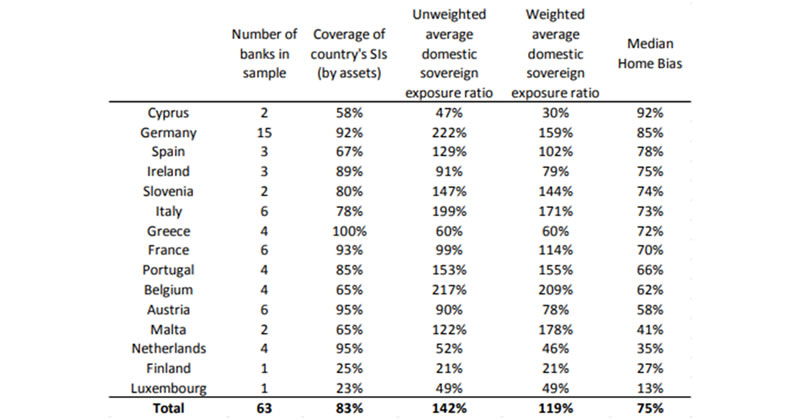

In the case of government debt the issue is the home bias in the holdings of government debt by banks, that is the tendency of banks to lend to their own government. Higher government debt-to GDP-ratios, lower government debt credit quality, and higher nonperforming loan ratios tend to coexist in the same so-called debtor countries – those that suffered the eurozone banking and government-debt crisis more strongly at the start of the decade. For this reason the creditor countries are reluctant to advance on banking union until the debtor countries have reduced the exposure of their banking systems to these risks. But, interestingly, German banks have among the highest home biases in the whole banking union. (Veron, 2017)

Table 2 Bank exposure to government by member state, June 2016 (Bruegel)

Risk sharing refers specifically to deposit insurance, in the understanding that mutualised European deposit insurance would imply that the fiscal authorities of all countries would end up sharing the burden of compensating depositors in case of a bank failure.

The reason one can say the public debate seems stuck in 2015 is the focus on non-performing loans. Even the German non-paper doesn’t devote more than three lines to them.

"The reduction of non-performing loans (NPLs) on banks’ balance sheets that was agreed as part of the banking package must be implemented consistently. An NPL ratio of 5% gross / 2.5% net should be reached in all Member States."

Indeed, a strategy for non-performing loan reduction has been agreed by the eurozone member states for over a year, including a definite calendar for full provisioning of new nonperforming exposures. The countries with the highest nonperforming loan ratios – Italy, Portugal and Greece – are making progress on reducing their nonperforming loan stocks. That this is taking longer than might perhaps be desirable is as much a function of the large size of the initial stocks of nonperforming loans as it is of foot-dragging, of which commentators in the creditor countries regularly accuse the debtor countries. The only thing the German non-paper does about nonperforming loans is to set a target nonperforming loan ratio of below 5% gross and 2.5% net, country by country.

On the reduction of government credit risk on banks’ balance sheets, the German non-paper makes a specific proposal. Currently, government debt is given a zero risk weight in regulatory capital requirements in accordance with the Bank of International Settlements’ guidelines on bank capital adequacy. The German proposal is to introduce non-zero credit risk weights and a concentration charge – that is, an additional capital cost for large exposures to individual countries. Non-zero risk weights would encourage banks to reduce their holdings of government debt from the countries with the lower credit ratings. Concentration charges would deter banks from holding large amounts of debt from any one country. As the largest amount of debt banks typically hold is that of their own government, this would tend to reduce the home bias. Both measures would disproportionately affect Italian government debt.

The German government proposal contains a sweetener designed to soften opposition: an exemption from credit and concentration capital requirements for government debt in an amount of up to 33% of a bank’s Tier 1 capital. This is justified by the need for banks to hold government debt as the core of their safe asset portfolio, which fulfils two purposes: it serves as collateral for central bank liquidity, and it meets regulatory liquidity requirements.

3 Deposit insurance and ringfencing

The German non-paper is couched in the language of market integration. But an examination of the various proposals shows that the focus is on easing the cross-border ownership of banks, not the cross-border access to banking services. From the point of view of a retail depositor there is a material difference between holding a deposit in a local bank, including a subsidiary of a cross-border banking group; in a local branch of a foreign bank; or in a bank from another member state. This difference does not stem from barriers to banks' freedom of establishment or freedom of service in different member states. It stems from which national deposit guarantee scheme covers the deposit. And the German proposal explicitly retains primary national responsibility for deposit insurance:

"In order to avoid creating the wrong incentives (shifting of liability to the European level), national responsibility must however continue to be a central element."

The non-paper assumes that, in the course of deepening market integration, national deposit guarantee schemes will continue to have varying capacities. It further assumes that countries with smaller banking sectors will have national deposit guarantee schemes that will be correspondingly smaller, and therefore may not be able to repay loans that they may need to take from a hypothetical European Deposit Insurance Scheme. And yet the non-paper insists on national liability. The proposed solution involves a reinsurance model and ultimately assistance by the European Stability Mechanism for the member state concerned, with the usual conditionality.

On the other hand, the German proposal aims to limit the ability of national authorities to protect local subsidiaries from the effects of banking crises originating from other member states. Currently national authorities insist on national ring-fencing of liquidity and capital, for the purposes of resolution planning of cross-border banking groups. In other words, international banks cannot assume that they will be able to transfer liquidity or capital between subsidiaries in different member states. The German non-paper would eliminate the possibility of this kind of ring-fencing. It proposes to replace it with a waterfall scheme to distribute funds to the various local subsidiaries of a group in case of a crisis.

It is hard to see why a member state would agree to easing the regulatory capital and liquidity conditions for cross-border ownership of banks under its jurisdiction, when it remains explicitly and exclusively liable for deposit insurance of those banks. This is not a hypothetical fear. When Lehman Brothers failed there was a controversy over liquidity transferred from Lehman Brothers International, based in London, which was which was stuck with the New York parent over the weekend on which the group failed (Associated Press, 2008). European-level liability for deposit insurance, contrary to the German non-paper's claim, does not seem to be a wrong incentive but a necessary counterbalance to removing the national ring-fencing of bank liquidity and capital.

The German non-paper presents the issue of national ring-fencing as one pitching home countries (those where parents of cross-border banking groups reside) against host countries (those whose banking systems consist mostly of foreign-owned subsidiaries). This is partly the result of national responsibility for deposit insurance and failed bank liquidation. But it is also a function of the business models of cross-border banks. The assumption is that international banking groups will prefer to pool liquidity and capital at the group level. But an interesting counterexample is provided by Santander. Before the creation of the banking union in 2014-2016, Santander was peculiar in choosing to have separately capitalised subsidiaries as a way to deal with the problem of dual home/host country supervision. Its business model therefore sidestepped the question of ring-fencing. It is true that a European-level system of bank supervision and resolution would be inconsistent with national ring-fencing within the banking union, but it is equally inconsistent with national responsibility for deposit insurance.

4 European resolution and supervision

Perhaps the most ambitious part of the German non-paper is its proposal to strengthen the European bank resolution regime. The philosophy of European banking resolution is currently that a failing bank should be liquidated under national insolvency law unless a restructuring is in the public interest. This restructuring should leave no creditor worse off than they would be under liquidation. This framework has been effective but somewhat unsatisfactory due to the differences in national insolvency laws. These differences give an impression of unfairness. But they also make the principle of no-creditor-worse-off unwieldly in practice when resolving a cross-border banking group, as multiple national and European laws may apply. Therefore, the German non-paper proposes to harmonise national insolvency laws as they apply to banks. This is a major legal undertaking, though.

In addition to this, the German non-paper proposes to give the European resolution authorities the ability to apply resolution tools, such as sale of business or setting up a bridge bank, to small failing institutions before they go to liquidation under national law.

There is even a proposal to allow the Single Resolution Board to assume responsibility for supervising a bank as a pre-emptive measure. Smaller banks which are not systemically important are still supervised by their national authorities, not by the European Single Supervisory Mechanism. But here the German position runs into a bit of a contradiction. Germany has a large number of small banks of regional scope, and it was in the interest of Germany that such small banks remain under national supervision. Now the German government is suggesting that European supervision of small banks may be a good emergency measure. This is clearly motivated by misgivings about how other countries may supervise and liquidate small banks. But supervision is also a very different activity from resolution and it is not clear that the Single Resolution Board would be well equipped to take on that function, particularly for a bank under stress.

5 Tax harmonisation

In addition, the German government proposes to harmonise taxation of banks, including especially the tax treatment of bank levies such as those used to fund national deposit insurance schemes.

Another area where the German government is concerned about competitive distortions of the single market is taxation. The German non-paper proposes to harmonise tax law as it applies to banks to prevent member states from using tax competition to attract banks to their territory. This would be the thin edge of the wedge for tax harmonisation in the EU, as the proposal would harmonise even tax rates for banks, going well beyond the common consolidated corporate tax base (CCCTB) that the European Commission is advocating. Tax harmonisation tends to pitch large countries against the smaller ones that are more likely to use tax competition to attract international firms. For this reason, while smaller creditor countries such as the Netherlands may support the German proposals on risk reduction, they oppose Germany on tax harmonisation. In this way Germany is making it harder for its whole package of proposals to be adopted, and is setting up a possible trade-off between tax harmonisation and risk reduction in the political negotiations to come.

6 Summary and Conclusion

Though the German position has not changed in some of the most substantive issues, the country no longer wishes to be seen as blocking progress on banking union. The German proposal is therefore primarily a way to increase the pressure on other countries to also compromise on issues such as the regulatory treatment of government debt, or tax harmonization.

That Germany insists on keeping full national responsibility for deposit insurance sits uncomfortably with other proposals which would prevent national authorities from protecting bank subsidiaries under their jurisdiction. It is hard to see why a country would give up the practice of ringfencing capital and liquidity of subsidiaries of transnational banking groups, if it remains explicitly and exclusively responsible for dealing with the increased risk.

And therein lies the problem with the German proposal. It makes each member state responsible for protecting its own resident bank depositors, while at the same time proposing to take away a member state’s ability to reduce the exposure of their domestic banking system to risks stemming from other member states.

The German proposal makes allowances for banks' use of government debt for liquidity purposes, but does not consider the possibility of a single safe asset. On this, as well as on deposit insurance, the proposal falls short of expectations.

Creditor countries might be tempted to form a united front on most of these reforms, but Germany makes this less likely by raising the issue of tax harmonization to avoid tax incentives being used to attract banks to a particular country. For instance, the Netherlands agrees with Germany on risk reduction, but not on tax harmonisation.

Finally, Germany proposes to devolve to European authorities the power to apply resolution tools to smaller banks –an issue hitherto treated under national liquidation arrangements, which Germany also proposes to harmonise. This is possibly the most far-reaching part of the whole proposal.

References

Associated Press. (2008, September 21). Send back $8B, Lehman Brothers Europe tells parent. Retrieved from Fox News: https://www.foxnews.com/printer_friendly_wires/2008Sep21/0,4675,LehmanBrothersBankruptcy,00.html

European Commission. (2019, June 12). Fourth progress report on the reduction of non-performing loans (NPLs) and further risk reduction in the Banking Union. Retrieved from Publications: https://ec.europa.eu/info/publications/190612-non-performing-loans-progress-report_en

German Federal Ministry of Finance. (2019, November 5). Position paper on the goals of the banking union. Retrieved from Financial Times: http://prod-upp-image-read.ft.com/b750c7e4-ffba-11e9-b7bc-f3fa4e77dd47

Scholz, O. (2019, November 5). Germany will consider EU-wide bank deposit reinsurance. Retrieved from Opinion: https://www.ft.com/content/82624c98-ff14-11e9-a530-16c6c29e70ca

Veron, N. (2017, November 17). Sovereign Concentration Charges: A New Regime for Banks’ Sovereign Exposures. Retrieved from Bruegel: https://bruegel.org/2017/11/sovereign-concentration-charges-a-new-regime-for-banks-sovereign-exposures/