MODIFICACIONAUTORES

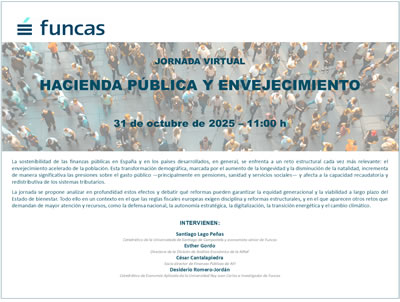

Public revenue in Spain: Strong momentum meets demographic headwinds

Tax receipts continue to surge on the back of job creation, corporate profits, and fiscal drag. Yet, the ageing population is quietly reshaping personal income tax dynamics,

posing long-term sustainability risks.