The EU recovery plan: funding arrangements and their impacts

Fecha: agosto 2020

Miguel Carrión Álvarez

The European Council of July 17-21 agreed on a €750bm Covid-19 recovery plan. This was part of a political agreement on the next EU budget (1). The recovery plan, dubbed Next Generation EU, will be managed by the European Commission in addition to the regular budget. To fund it, the European Commission will raise debt in the capital markets. This poses a number of questions, such as: how the EU will carry out this borrowing, how it will be repaid, and what effect it will have on the bond markets given its size. This note attempts to address these questions.

1. The ratification process

As we have noted, the Council conclusions of July 17-21 are just a political agreement. The necessary instruments to give the agreement legal force will be: the 2021-2027 Multiannual Financial Framework, also referred to as the “EU Budget”; a Regulation of the European Parliament and the Council on the Recovery and Resilience Facility, which is the new part of the NGEU recovery plan; and an own-resources decision of the Council.

The own-resources Decision sets spending limits for the Commission and authorises it to request funds from the member states. Under a consultation procedure, the European Parliament must give its opinion on the own-resources decision which means it can propose amendments to it (2). But the Council is the sole legislator even if it cannot approve the Decision without hearing the Parliament first. The current draft own-resources Decision still needs to be agreed by the member states together, and then ratified by each according to its own constitutional procedures. The latest publicly-available draft went through the Committee of Permanent Representatives (CoRePer) at the end of July (3).

The NGEU recovery plan includes the RRF and a top-up of certain EU programmes which are part of the EU budget. The RRF needs to be legislated separately. Under the ordinary legislative procedure the Parliament is a co-legislator with the Council (4). In case of disagreement after two readings, a conciliation committee of the two institutions is established.

The EU budget itself is approved similarly to the ordinary legislative procedure, but expedited so there is only one reading of the proposal before a conciliation committee is convened (5). The budget process also has strict time limits on the various stages to ensure it is not unduly delayed. If a budget fails to be adopted, it is rolled over to the following year.

2. How will the EU borrow?

The Council conclusions on NGEU foresee €390bn being disbursed as grants, and €360bn as loans to member states (1). Of the grants, €312.5bn are to fund member states’ post-Covid reconstruction plans directly, under the so-called Recovery and Resilience Facility. This will be supplemented by the loans, for an RRF total of €672.5bn. The remaining €77.5bn will top up various EU programmes.

Not all of this money will be paid out at the same time, or even early in the 2021-2027 budget period. One reason is that member states may not have enough investment or reform projects ready to be funded next year. Also, long-term projects are funded as they go, in annual instalments if not more frequently, rather than with an initial lump sum. As a result, the fiscal impact of the NGEU recovery fund will be spread out and most of it will happen after 2023.

Member states must submit annual recovery and resilience plans. The European Commission will evaluate funding requests for alignment with country-specific recommendations, as well as with the EU’s green and digital transition goals. In subsequent years assessments will include targets associated to previous funding. Member states may request loans to fund investment and reforms as part of their recovery and resilience plans.

It is not a given that the whole loan budget will be used up. The loans component of the RRF will support additional reforms and investment, but only if member states request it. It is possible that, for political or financial reasons, some member states may not use their proportional share of the loan facility, or they may not use it at all. Politically, the self-described “frugal” states seem the most likely to opt out of the EU loans. Financially, countries with a AAA rating may find it inefficient to borrow from the EU. Countries with poorer credit ratings may borrow more than their proportional shares as a result. The Council conclusions limit loan amounts to 6.8% of GNI for each member state. As €360bn is 3% of the EU’s GNI, there is room for some member states to request loans for more than twice their proportional share if others request proportionally less.

One can safely assume, however, that the grants component of the NGEU recovery fund will be used in full, also by the self-described “frugal” states.

2.1. Commitments and disbursements

One characteristic of the EU budget is that it is largely an investment budget, and spending on investment projects takes place over an extended period of time. The EU budget thus distinguishes commitments, where money is appropriated to cover future expenses on a project, from payment appropriations, for expenses in the current year (5).

The council conclusions give a period of three to four years to execute commitments. Some of the money will be paid in the same year as it is committed, and money will be decommitted if a payment application has not been submitted by the end of the third year following the budget commitment (1). The same rules apply to grants or loans to member states under the RRF, and to the portion of grants intended to top up Commission programmes. For commitments made in 2023, payments must be made by the end of 2026.

2.2. Time profile of NGEU

For NGEU, the Council conclusions foresee that the grants component should be committed over three years, 70% in 2021-2022 and the remaining 30% in 2023 (1). Payments can be made until the end of 2026. This is a slightly accelerated schedule compared to the original Commission proposal (6), which foresaw commitments of 60% in 2021-2022 and the rest until 2024, with payments until the end of the budget period in 2027.

In addition, the Council conclusions foresee 10% of the RFF being paid out in 2021, as “pre-financing”. We understand this as meaning that money will be advanced to member states as a RFF loans to ensure at least 10% of the recovery fund money is paid out in the first year of the programme so as to maximise the fiscal impulse.

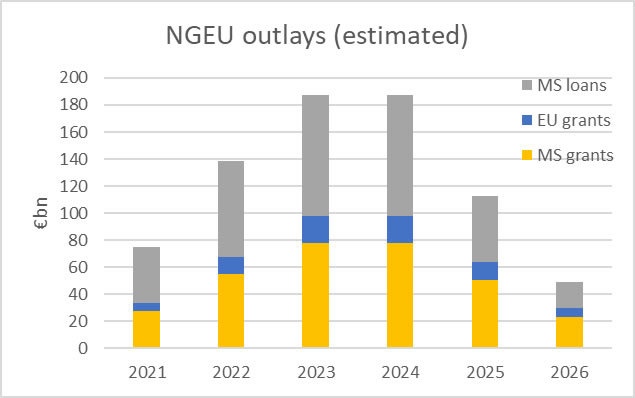

We can now try to estimate the amounts the EU is likely to be disbursing each year from 2021 to 2026 under the NGEU programme. The resulting payment profile is in figure 1.

Figure 1: NGEU expenditures over time (from table 1)

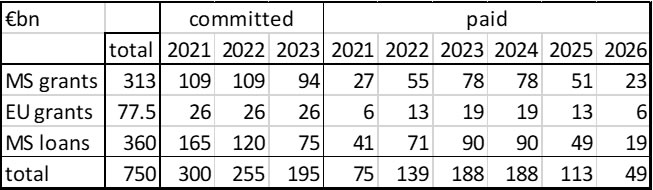

In figure 1 MS refers to member states receiving grants or loans from the RRF, while EU grants refers to NGEU top-ups of existing EU programmes. First, member states will receive €312.5bn in grants. Of this, we assume 35% is committed in 2021, 35% in 2022, and 30% in 2023. We further assume each grant is disbursed in four equal parts, on the year when it is committed and each of the following three years. We assume the EU grants component is equally committed in thirds in the three years 2021-2023, and that each part is then executed in fourths over the year it is committed and the three following years. Finally, we assume the member-state loans component is fully used up over the six years, and front-loaded so that the total outlays in 2021 correspond to the 10% pre-financing of the RRF foreseen by the Council conclusions. The calculation is shown in table 1, with figures rounded to the nearest billion.

Table 1: NGEU commitments and payments over time (own estimate)

The total outlays from table 1 are the amounts the EU would be expected to borrow each year of the NGEU programme. The conclusion is that EU borrowing volumes may peak just below €190bn on each of the two years 2023 and 2024. This peak is about 1.5% of 2019 GDP.

3. How will the EU repay its debt?

At the end of July, the Council proposed a decision on the EU’s system of own resources to underpin the 2021-2027 multiannual financial framework and the NGEU recovery plan (3). According to this draft, net borrowing under NGEU should stop by the end of 2026, and repayment of the principal amounts borrowed should start within the 2021-2027 budget period. That is, there should be some net repayments of the principal in 2027. The money must be repaid by the end of 2058.

On average, repaying €750bn over the 32 years from 2027 to 2058 results in over €23bn a year. The own-resources decision limits the amount of annual repayments to 7.5% of the €390bn allocated to NGEU grants, or just over €29bn a year. This forces the Commission to repay the NGEU debt over at least 26 years, that is starting no later than 2033.

The EU issues bonds with maturities between three and thirty years (7). If the EU keeps this restriction for its NGEU borrowing, its last repayments will be in 2056. The own-resources decision allows the Commission to engage in refinancing operations for the purposes of efficient debt management. This might be used to refinance some of the debt until 2058. Alternatively, the EU might try to issue 35-year bonds in 2022 and 2023.

4. The EU as a borrower

The European Commission has legal personality to issue debt in the EU’s name. However, it cannot borrow on its own initiative but only with the Council’s authorisation. The Commission generally keeps a balanced budget. Currently, the EU can only borrow to fund loans to member states or neighbouring countries under specific programmes, and has about €52bn of debt outstanding (7). In April, the EU was authorised to borrow up to €100bn in the short term to fund SURE, an unemployment reinsurance programme (8). Depending on the take-up of SURE, issuing €750bn to fund the NGEU recovery plan will increase the EU’s borrowing 16 to 18-fold. Even though the EU’s borrowing will remain earmarked for spending on specific programmes, the mere size increase does represent a qualitative change.

4.1. The EU’s ability to pay

The EU is rated AAA by all major credit agencies except S&P, which rates it AA (9). There is a question whether expanding its borrowing at least 16-fold would affect this credit rating, but so far Fitch and Moody’s have both reaffirmed their AAA ratings of the EU. S&P has also kept its rating of the EU at AA. The reason the ratings were high was that the EU member states stood behind the Commission’s ability to pay. This is strengthened in the draft decision on own resources from July.

The EU is subject to commitment and spending ceilings set by successive own-resource decisions. According to the Council’s conclusions from the July Summit, the own-resources ceilings will be raised by 0.6% of GNI until the end of 2058, to ensure the debt incurred to fund the recovery plan can be repaid (1). This is about €70bn a year in 2018 prices. The own-resources buffer more than covers the NGEU repayment needs. As we have noted, the decision foresees that no more than about €29bn should be repaid each year.

The own-resources ceiling does not guarantee that the necessary revenue will be available as a result of either dedicated taxes or member-state contributions. But the draft own-resources decision allows the Commission to call on member states to advance the necessary funds if necessary for repayments. This is new. There is no equivalent language in the own-resources decision for the 2014-2020 budget period (10)>.

Should a member state not honour that call, the Commission can ask the remaining member states to make it up proportionally, while the member state that failed to provide the funds would remain liable for them. This means that it is exceedingly unlikely that the EU would default on any debt obligations arising from the borrowing authorised for the recovery fund. The €29bn maximum annual repayment is a bit over 40% of the dedicated own-resources ceiling of about €70bn. Therefore, the Commission will be able to meet its obligations unless member states accounting for nearly 60% of the EU’s GDP fail to honour a cash call. Just Germany and France are sufficient to guarantee the Commission’s repayments of NGEU debt, and politically they are both necessary.

4.2. The EU’s share of the bond markets

As of May 2020, there were €12.2 trillion outstanding in the European public-sector bond market, which includes governments, public agencies and supranational institutions (11). In addition, there were over €5.6tn worth of investment-grade corporate bonds in the European market. Under three-quarters of either were euro-denominated.

By 2026, the EU may be borrowing €800-900bn out of a total European public-sector bond market of at least €13tn, of which about €9tn euro-denominated; and a total investment-grade bond market of about €19tn, of which over €13bn euro-denominated. The EU would become the sixth-largest debt issuer in Europe, after Spain, and the fifth-largest euro issuer as the UK issues mostly in pounds.

Proportionally, the EU could end up accounting for up to 9% of the euro-denominated public-sector bond market, or about 4% of the European investment-grade bond market. This share would be built up over a period of six years, representing an increase in overall bond supply by up to 1.5% a year as estimated based on the figures in table 1.

As regards the pace, ICMA data show that, before the Covid-19 crisis, bond issuance in the international European debt capital market was under €1.8tn annually (12). Of this, about €220bn was central government bonds, and about €290bn other public sector, including agencies and supranational institutions. These volumes have increased substantially in the second quarter of 2020 as a result of measures to support the economy during the Covid-19 pandemic.

We estimated in table 1 that the EU might be issuing €75bn next year, and growing its issuance to under €190bn annually in 2023-2034 before tapering down to zero by 2027. In 2021, the EU will issue an amount equivalent to up to one third of member states’ issuance. It may be responsible for 20% of agency and supranational issuance, and over 10% of all public-sector issuance. In the peak years of 2023-2024, however, the EU could easily account for 30% of euro-denominated public-sector bond issuance. Its issuance on those years would be 40% of the total agency and supranational issuance.

So, while in terms of debt outstanding the EU will become a significant but not overwhelming issuer, in terms of borrowing volumes the EU will at one point briefly become by far the largest issuer in the euro public-sector debt market. At its peak, the EU’s issuance may be equal 80% of the volume issued by eurozone national governments. So, the substitution effect of EU loans on member states’ borrowing will be significant.

The emergence of the EU as such a large borrower with a AA/AAA credit rating may partially crowd out some of the member states with poorer credit ratings. This will not prevent these member states from borrowing, but it may raise their borrowing costs. If that is the case, it would strengthen the incentive for member states with poorer credit rating to borrow from the NGEU loan facility rather than from the bond market directly.

5. Fiscal effects

We can now attempt to give a plausible scenario for the effect of the NGEU recovery plan on the fiscal stances of individual member states and of the EU as a whole.

The EU is likely to require a significant fiscal stimulus in 2021 in order for GDP to bounce back as close as possible to its 2019 level. Our estimate from Table 1 is that the contribution of the NGEU recovery plan to this fiscal impulse may be limited to the “pre-financing” of 10% of the total, or €75bn. This is because of the expectation that member states will lack enough shovel-ready investment and reform projects to justify higher outlays in the first year of NGEU. For this reason, we also estimated that more than half of this pre-financing will be in the form of loans.

At this point, the EU will be a large but not overwhelming issuer in the euro public-sector bond market, so its borrowing and spending €75bn may be considered additional to that of the member states. This amounts to about 0.6% of EU GDP.

However, at the peak of the NGEU programme in 2023-2024, the EU’s issuance is likely to overwhelm that of the member states. This may not necessarily be a bad thing. At that time, the EU will probably no longer be applying the general escape clause from the fiscal compact, and member states will be required to engage in substantial debt reduction due to the debt brake. The EU’s net borrowing will need to make up for the fiscal consolidation by the member states in order to sustain aggregate demand.

We have estimated that the EU will be borrowing about 1.5% of GDP each year in 2023-2024. Under half of this would fund loans to member states, which would contribute to the member states’ debt-to-GDP ratios for the purposes of the stability and growth pact. This means EU loans would replace an equal amount of deficit-financed spending by member states, and not be additional to it. However, the grants component of the NGEU would be a genuine fiscal impulse as it would fund spending without increasing the debt or deficit ratios for the purposes of the stability and growth pact. According to Table 1, NGEU grants will add up to under €100bn, or 0.8% of EU GDP, in each of 2023 and 2024.

The year 2022 will be one of transition between these two scenarios, as NGEU borrowing ramps up while the Commission weighs whether it is time yet to reactivate the debt brake.

After 2024, however, the EU will start quickly tapering its net borrowing to zero while member states remain under pressure to reduce debt due to the debt brake in the fiscal compact. This effect will be strongest in 2027, towards the end of the multiannual financial framework, when the EU is expected to start its net repayments of NGEU funds.

For the following 30 years the EU will be repaying about €25bn a year from its regular budget. The revenue for this is as-yet uncertain. Under 50% of this will come from repayments of NGEU loans. This will constitute a fiscal drain from the countries most affected by the Covid-19 crisis and with a poorer credit rating, as those will be the primary users of the NGEU loan facility.

Then, €10-15bn a year will need to be made up from new own resources agreed by the Council. In the draft own-resource decision from July, the Council agreed to introduce a tax on non-recyclable plastic packaging already in 2021, and to study a border tax on carbon emissions and a digital levy to be introduced by 2023. Unless the own-resources ceiling for the regular EU budget is increased by 0.1% in the 2028-2034 and subsequent budget periods, NGEU repayments will result in an effective reduction of the EU budget.

We observe that the own-resources ceilings for payments and commitments were 1.23% and 1.29% of GNI respectively in the 2013-2020 budget period (10), and they are proposed to increase to 1.40% and 1.46% in the 2021-2027 budget period (3). A further increase will be necessary in order for the NGEU repayments not to eat into the EU budget. This promises to lead to as contentious a budget debate as was seen in the Council this year. Further calls for rebates for net contributors or self-described “frugals” are likely. One reason for this is that the expansion of the own resources will be to repay the borrowing for the grants component of the NGEU plan, from which the self-described “frugal” countries are expected to benefit less.

6. Benefits and risks of the recovery plan

The EU’s Covid recovery plan (NGEU) involves a substantial amount of resources but will be spread out over a period of six years due to the way the EU budget process works. The funds will be committed during the initial three years, but actual spending for individual projects can be spread over another three years. We estimate the EU will pay no more than 10% of the total funds, that is €75bn, during 2021; and under €190bn during each of the peak years of 2023 and 2024.

The fiscal impulse from NGEU will therefore be delayed. Its main effect will not be to contribute to the immediate recovery in 2021. That year, the Maastricht deficit limit and the debt brake from the fiscal compact are likely to remain suspended. It is only in subsequent years that NGEU will contribute to sustain aggregate demand, hopefully compensating for member states’ debt reduction efforts during that period. In addition, assuming NGEU loans contribute to the debt and deficit ratios of member states for the purposes of the stability and growth pact, only the grants component of the recovery plan will constitute a genuine fiscal stimulus, by which we mean a net contributor to aggregate demand. In both 2023 and 2024, NGEU will entail spending of about 1.5% of GDP, but only 0.8% of GDP will be in the form of grants and thus contribute a genuine fiscal stimulus.

Overall, NGEU debt will end up being a significant but not overwhelming share of outstanding public-sector bonds denominated in Euro. However, EU issuance during the peak years of 2023-2024 will likely overwhelm that by the member states. During that time member states will be under pressure from the fiscal compact to reduce debt, so the EU’s large debt issuance will contribute to stabilising the available amount of public-sector bonds.

The NGEU borrowing will be paid back over some thirty years, starting with the 2028-2034 multiannual financial framework. The EU will need to repay at least €25bn each year, of which under half will come from repayments of NGEU loans by member states. The remainder, some 0.1% of GDP, will need to be paid from the regular EU budget. If the EU does not agree a commensurate increase in own resources, the NGEU programme will result in an effective reduction of the EU budget. This is likely to lead to another budget and rebate battle in the European Council, as this increase in own resources will be to pay for the grants component of NGEU, which will have benefitted some member states more than others.

References

1. European Council. European Council conclusions, 17-21 July 2020. Press. [Online] 21 July 2020. https://www.consilium.europa.eu/en/press/press-releases/2020/07/21/european-council-conclusions-17-21-july-2020/.

2 -. Special legislative procedures. The Council of the EU. [Online] 1 October 2018. https://www.consilium.europa.eu/en/council-eu/decision-making/special-legislative-procedures/.

3. Council of the European Union. Proposal for a Council Decision on the system of Own Resources of the. Documents and Publications. [Online] 29 July 2020. https://data.consilium.europa.eu/doc/document/ST-10025-2020-INIT/en/pdf.

4. European Commission. Adopting EU law. Law. [Online] https://ec.europa.eu/info/law/law-making-process/adopting-eu-law_en.

5. -. How is the EU budget prepared? Strategy. [Online] https://ec.europa.eu/info/strategy/eu-budget/how-it-works/annual-lifecycle/preparation_en.

6. -. Proposal for a regulation of the European Parliament and of the Council establishing a Recovery and Resilience Facility. Publications. [Online] 28 May 2020. https://ec.europa.eu/info/sites/info/files/com_2020_408_en_act_part1_v9.pdf.

7. -. Funding characteristics of the EU. Business, Economy, Euro. [Online] 15 July 2020. https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/financial-assistance-eu/funding-mechanisms-and-facilities/eu-borrower/funding-characteristics-eu_en#:~:text=The%20EU%20issues%20bonds%20under,Programme%20governed%20by.

8. -. Support to mitigate Unemployment Risks in an Emergency (SURE). Business, Economy, Euro. [Online] 2 April 2020. https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/financial-assistance-eu/funding-mechanisms-and-facilities/sure_en.

9. The EU’s credit rating. Business, Economy, Euro. [Online] 13 August 2020. https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/financial-assistance-eu/funding-mechanisms-and-facilities/eu-borrower/eus-credit-rating_en.

10. Council of the European Union. Decision on the system of own resources of the European Union. Eur-Lex home. [Online] 26 May 2014. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32014D0335.

11. International Capital Markets Association. European Bond Market Size. Market Practice and Regulatory Policy. [Online] May 2020. https://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/Secondary-Markets/bond-market-size/.

12. -. Dealogic market data. Resources. [Online] July 2020. https://www.icmagroup.org/resources/market-data/Market-Data-Dealogic/.