The ECB’s decision to maintain its policy stance despite falling inflation: a comment

Fecha: septiembre 2020

Miguel Carrión Álvarez

At its latest meeting on September 9-10, the ECB Governing Council took no monetary policy actions (1), despite the surprise drop in eurozone inflation in August (2) and the rise in the euro’s exchange rate (3). The Governing Council did update its forward guidance, by changing the introductory statement to the press conference by Christine Lagarde, the ECB President (4).

The Governing Council has tightened its forward guidance, and it seems relatively confident that the economy is on the path to recovery from the worst of the Covid-19 pandemic. Philip Lane, the ECB Chief Economist (5), takes a more nuanced view in a blog post as he focuses on uncertainty and the seriousness or the severe scenario of the ECB staff projections (6).

In this note, first we interpret the changes in the language of the Governing Council’s statement; we do this with the help of Christine Lagarde’s responses at her press conference; then we compare this to the subsequent blog post by Philip Lane on the updated macroeconomic projections by ECB staff.

How the forward guidance changed

There is one subtle change in the description of the monetary policy decisions (1), relative to that given the ECB’s previous monetary policy actions in July (7). This relates to the path of inflation as a justification for the Pandemic Emergency Purchase Programme. The relevant part is shown in Table 1, with emphasis added to highlight the changes.

Table 1: ECB language on effect of Pandemic Emergency Purchase Programme

| July | September |

| These purchases contribute to easing the overall monetary policy stance, thereby helping to offset the pandemic-related downward shift in the projected path of inflation. | These purchases contribute to easing the overall monetary policy stance, thereby helping to offset the downward impact of the pandemic on the projected path of inflation. |

One possible interpretation of this change is as follows. Before the August inflation data, the ECB could argue that the pandemic represented a single shock to inflation, which manifested itself in a parallel shift of the projected path of inflation. The events of the Summer, namely the rise in the euro’s exchange rate at the end of July and the drop in eurozone inflation in August, represent a second shock to the inflation outlook, which is no longer simply a shifted version of the pre-crisis projection.

The other change in the introductory statement delivered by Christine Lagarde can be more properly described as affecting the Governing Council’s forward guidance. It is in table 2, again with added emphasis.

Table 2: ECB forward guidance

| July | September |

| At the same time, in the current environment of elevated uncertainty and significant economic slack, the Governing Council remains fully committed to doing everything necessary within its mandate to support all citizens of the euro area through this extremely challenging time. This applies first and foremost to our role in ensuring that our monetary policy is transmitted to all parts of the economy and to all jurisdictions in the pursuit of our price stability mandate. The Governing Council, therefore, continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry. | At the same time, in the current environment of elevated uncertainty, the Governing Council will carefully assess incoming information, including developments in the exchange rate, with regard to its implications for the medium-term inflation outlook. It continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry. |

Gone are the following references:

- Significant economic slack. It is not that the pandemic recession is over, but the baseline scenario of the staff macroeconomic projections assumes that policy and behavioural responses to a second wave of Covid-19 become more efficient and have lower economic costs than in the Spring of 2020 with the response to the first wave (6). It is also assumed that a vaccine or treatment is found by the mid-2021 and deployed by the end of 2021. Accordingly, the staff macroeconomic projections actually improve the GDP outlook for 2020 slightly relative to the June projections. Significant slack obviously still exists, but it is on its way to being repaired, and faster than previously expected. Christine Lagarde celebrated the response of the eurozone fiscal authorities, national and European, as right, timely, and efficient (4).

- Whatever it takes. There is no longer a reference to making it through “extremely challenging times”. This implies the acute, crisis, phase of the pandemic is over. As a result, the governing council no longer feels the need to reassure it “remains fully committed to doing everything necessary”.

- Impaired monetary policy transmission and eurozone fragmentation. The Pandemic Emergency Purchase Programme was introduced on the justification that monetary policy transmission was impaired (8). This is no longer the case. Indeed, financial markets have stabilised since March. The reference to “all jurisdictions” in the July statement points to the fact that widening spreads in the government bond markets cause differences between member states in the funding costs of banks and the real economy. Government bond spreads have narrowed to pre-crisis levels, as overall yields are lower than they were just before the crisis hit. Accordingly, PEPP purchase volumes have declined since June.

The governing council adds:

- Careful assessment of incoming data. The ECB is now in wait-and-see mode, as uncertainty remains high.

- Inflation implications of the exchange rate. The Governing Council acknowledges that the rise in the euro’s exchange rate during the summer puts downward pressure on inflation. But the ECB does not target an exchange rate, and it also does not intervene in the currency markets. It only allows itself to act on the exchange rate indirectly by expanding or contracting the money supply. The direct effects of monetary policy measures on inflation likely outweigh the indirect effects through the exchange rate. Therefore, ECB policy cannot be based directly on the exchange rate outlook, but on the inflation outlook which itself has the exchange rate as an input.

Let us now look at the explanations of the inflation and exchange-rate outlook given by Christine Lagarde at her press conference and by Philip Lane in his recent blog post.

Why no reaction to dropping inflation

Christine Lagarde said that the August drop in eurozone core inflation to 0.4% was as expected (4). This is an exaggeration. Perhaps it was expected that inflation would drop, but the size of the drop caught everyone by surprise. HICP inflation excluding energy, food, alcohol and tobacco dropped from 1.2% in July to 0.4% in August (2).

Christine Lagarde attributed the drop in core inflation partly to the German cut in VAT, and partly to the postponement of garment sales from July to August in two of the major eurozone countries.

As the German VAT cut is a temporary measure due to expire at the end of the year, the ECB does not consider it a factor affecting the medium-term inflation outlook. However, the drop in German inflation because of the VAT change was already seen in July, when Eurostat’s estimate of core HICP inflation for Germany was 0.7%, down from 1.1% in June. It seems unlikely that the German VAT change caused monthly drops for two consecutive months. In his ECB blog post, Philip Lane explained that the German VAT cut is expected to keep headline eurozone inflation negative for the rest of the year (5). The expiration of the VAT cut will then cause a mechanical rise in inflation at the start of 2021.

The biggest drops in both core HICP inflation, according to Eurostat data, were seen in Belgium (from 3.1% in July to 0.7% in August) and in Italy (from 2.0% to 0.3%). The Netherlands posted a similar drop to Italy, and France saw a 0.8% monthly drop in the core inflation rate. An explanation of the core inflation drop limited to just two of the major countries seems too limited.

At her press conference (4), Christine Lagarde noted the Next Generation EU recovery fund will have an effect that is not included in the staff macroeconomic projections just published (6). Philip Lane explains this is due to the spending plans not being finalised, as well as them extending well beyond the two-year horizon of the ECB projections. We have previously estimated that in 2021 no more than 10% of the Next Generation EU fund, or €75bn, need be spent (9).

How serious is the exchange rate pressure?

As to the exchange rate, Christine Lagarde said it is clear that the negative pressure on the inflation rate is largely attributable to the exchange rate (4). However, she reiterated that the ECB does not target the exchange rate but will closely monitor it.

The euro’s exchange rate relative to the US dollar has risen by about 10% since May, but perhaps a more appropriate measure of the exchange rate pressure on inflation would come from the trade-weighted exchange rate of the euro calculated by the ECB. This rose by about 2% at the end of May, presumably as a positive market reaction to the political agreement between Germany and France on the EU recovery fund. Then, at the end of July, it rose by another 2% when the European Council agreed on the same. Figure 1, an interactive chart from the ECB, shows the euro’s nominal effective exchange rate over the past year (3).

Figure 1: euro nominal effective exchange rate (ECB interactive chart)

The base period is the first quarter of 1999 (i.e. 1999 Q1 = 100).

A recent article by the ECB notes that evidence suggests a 1% change in the euro exchange rate leads to a 0.3% change in import prices within a year, and a 0.04% change in inflation over the same period (10). Based on the Euro’s 4% appreciation in trade-weighted terms, one could expect a 0.2% downward pressure on eurozone prices over the next year.

What to expect in the coming months

Philip Lane conveyed a stronger sense of urgency by saying there is no room for complacency (5). This is because uncertainty over the course of the Covid-19 pandemic remains high, and the ECB staff macroeconomic projections still have GDP 5% below the 2019 at the end of 2022 in the severe scenario (6).

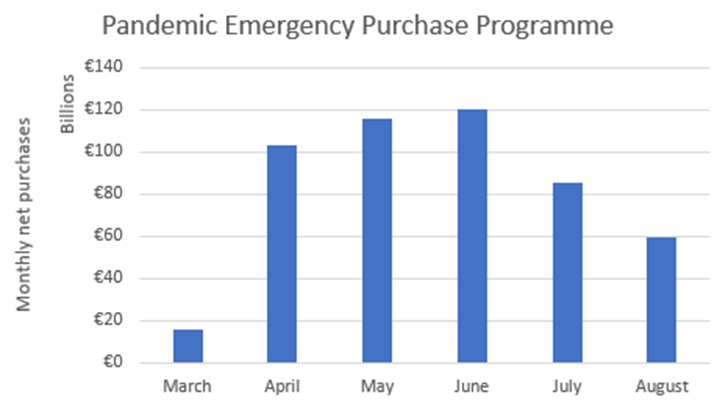

The ECB Chief Economist also argues that the recalibration of the PEPP in June has fostered more favourable financial conditions and helped keep the expected path of inflation higher than it would otherwise be. The Governing Council decided to expand the maximum amount of PEPP bond purchases by €600bn to €1.35tn, and to extend until mid-2021 the duration of the programme (11). This would be a testament to the power of expectation, since in fact the ECB has bought a declining amount of bonds in July and August than in the Spring months (12), as shown in figure 2. This is possible a consequence of a seasonal lull in the bond market, however.

Figure 2: PEPP monthly net purchases (source: ECB)

Regarding the envelope of the PEPP, Christine Lagarde said at her press conference that the ECB is very likely to use the €1.35tn in full, whereas up to now the message was that this was a ceiling. What the Governing Council has not done yet, according to Christine Lagarde, is to discuss an expansion of the envelope of asset purchases.

In conclusion, the message conveyed by Philip Lane based on the ECB staff projections is much more nuanced than that of the Governing Council’s statement and Christine Lagarde’s press conference. The baseline scenario of the ECB justified no policy action this month. However, in view of the uncertainty and the seriousness of the ECB staff’s severe scenario, the Governing Council was perhaps too quick to tone down its forward guidance relative to the health crisis and its willingness to do whatever it takes. Direct action on the exchange rate is very unlikely, though if the euro continues to appreciate in trade-weighted terms it may also force the ECB to loosen policy.

References

1. European Central Bank. Monetary policy decisions. Media. [Online] 10 September 2020. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.mp200910~f4a8da495e.en.html.

2 -. Eurostat. Euro area annual inflation down to -0.2%. News releases. [Online] 1 September 2020. https://ec.europa.eu/eurostat/documents/2995521/10545459/2-01092020-AP-EN.pdf/7c0db6bb-3974-ce20-a7f0-6281743d0d7c.

3. European Central Bank. Daily nominal effective exchange rate of the euro. Statistics. [Online] 11 September 2020. https://www.ecb.europa.eu/stats/balance_of_payments_and_external/eer/html/index.en.html.

4. Lagarde, Christine and de Guindos, Luis. Introductory statement to the press conference (with Q&A). European Central Bank. [Online] 10 September 2020. https://www.ecb.europa.eu/press/pressconf/2020/html/ecb.is200910~5c43e3a591.en.html.

5. Lane, Philip. The outlook for the euro area. Media. [Online] 11 September 2020. https://www.ecb.europa.eu/press/blog/date/2020/html/ecb.blog200911~9864e7ae6d.en.html.

6. European Central Bank. Staff macroeconomic projections for the euro area. Research & Publications. [Online] 10 September 2020. https://www.ecb.europa.eu/pub/projections/html/ecb.projections202009_ecbstaff~0940bca288.en.html.

7. —. Monetary policy decisions. Media. [Online] 2016 July 2020. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.mp200716~fc5fbe06d9.en.html.

8. —. ECB announces €750 billion Pandemic Emergency Purchase Programme (PEPP). Media. [Online] 18 March 2020. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200318_1~3949d6f266.en.html.

9. Carrión Álvarez, Miguel. The EU recovery plan: funding arrangements and their impacts. Funcas Europe. [Online] August 2020. https://www.funcas.es/articulos/the-eu-recovery-plan-funding-arrangements-and-their-impacts/.

10. Ortage, Eva, Osbat, Chiara and Rubene, Ieva. The transmission of exchange rate changes to euro area inflation. European Central Bank. [Online] 11 May 2020. https://www.ecb.europa.eu/pub/economic-bulletin/articles/2020/html/ecb.ebart202003_01~7fc0abdec2.en.html#toc1.

11. European Central Bank. Monetary policy decisions. Media. [Online] 4 June 2020. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.mp200604~a307d3429c.en.html.

12. —. Pandemic emergency purchase programme (PEPP). Monetary Policy. [Online] 4 September 2020. https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html.