Challenges in designing an industrial decarbonization support scheme: Insights from the German CCfD scheme

Robin A. Blömer*

Papeles de Energía, N.º 29 (octubre 2025)

Abstract**

To support industrial transformation towards climate neutrality, Germany has developed a Carbon Contract for Differences (CCfD) support scheme. The scheme aims to complement the carbon pricing of the EU ETS by subsidizing and de-risking innovative decarbonization technologies in industry. It can become a cornerstone in the German competitiveness and a transformation strategy of the manufacturing sector. The design of the scheme drew inspiration from other support schemes and scientific literature. It is implemented as a two-sided CCfD, with an indexed strike price. Overall, the scheme is rather complex for multiple reasons.

Firstly, it covers different sectors with a technology open design. Secondly, the support is allocated in a multitechnology auction, with possibilities for sectoral and technological differentiation. And thirdly, it aims to not only de-risk projects for carbon prices but also energy prices, while giving projects incentives to use and procure energy efficiently.

The first support round attracted a lot of interest from projects in its pre-phase, but the 4-billion-euros auction round was undersubscribed. The analysis of the first auction round provides valuable insights on decarbonization technologies and how advanced projects in each sector are. The primary objective of adjustments should be to ensure competition in the support auction and reduce complexity. The second support round was delayed, and further rounds are uncertain due to changes in government. Besides Germany, other countries and the European Commission are developing support schemes that use some form of CCfDs, highlighting the relevance and need for further investigation of CCfD design and auction outcomes.

1. CARBON CONTRACTS FOR DIFFERENCE AS AN INDUSTRIAL DECARBONIZATION SUPPORT SCHEME

The idea of using Carbon Contracts for Difference (CCfDs) to support the transformation of the industry was first brought about by Helm et al. (2005). In 2024, the German government signed the first contracts with industry. From the first concept to the implementation, a lot of research and development was conducted. This paper aims to shed some light on the journey and the specific design of the German scheme. Thereby, CCfDs are mostly discussed as support programs, where governments support individual decarbonization projects.

1.1. Industrial transformation: Challenges and barriers

To reach the EU goal of climate neutrality towards the middle of the 21st century, all sectors need to reduce emissions. Thereby, the industry faces specific challenges. Production processes that have been optimized over decades need to be transformed, from fossils to renewable energy, with-in one investment cycle, while competing internationally. Within industry, energy-intensive industries, which mainly produce basic materials, are the biggest emitters and energy consumers. Steel production, chemicals, and cement production are the subsectors with the highest emissions in the EU (Eurostat, 2025c). Typically, these products are at the beginning of industrial value chains, for example, in machinery, pharmaceuticals or electronics.

The most relevant emission reduction technologies in industry are electrification, usage of clean hydrogen and its derivatives, carbon capture and utilization or storage (CCUS), efficiency and circularity, as well as biomass (IPCC, 2022). Besides renewable energy generation, new infrastructure for hydrogen and CO2 is needed, and the electricity infrastructure needs to be reinforced. Due to long technical lifetimes and international competition, investments in clean production technologies need favorable market conditions.

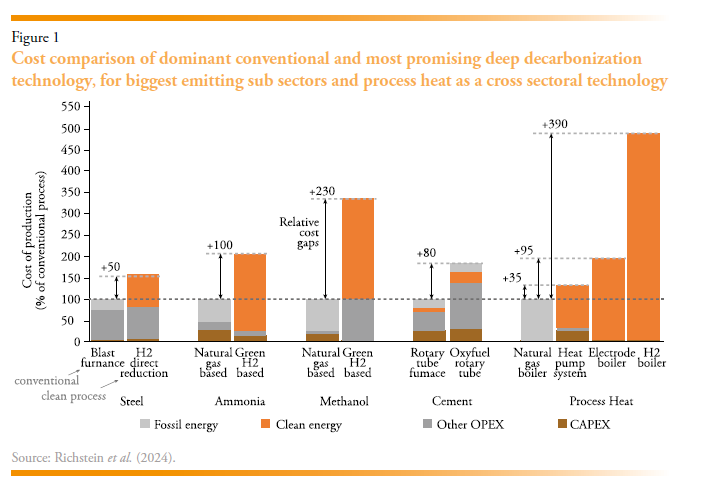

Figure 1 gives an overview of the most relevant clean production routes. Besides a cost gap between clean and conventional production, it illustrates the high share of operational expenditures (OPEX) in production. It shows that the share of energy OPEX typically increases because clean hydrogen tends to be more expensive than fossil energy. If high energy efficiencies are achieved, for example, with heat pumps or in the production process itself, clean production can already be competitive with current CO2 price levels. In CCUS in cement production, the cost disadvantage is caused by high capital expenditures (CAPEX) of the capturing system and non-energy OPEX for transporting and storing CO2.

1.2. Role of CCfDs in the transformation and basic idea

Role of CCfDs in the policy mix

In the EU, the main instrument to incentivize emission reduction in the energy and industry sector is the Emission Trading Scheme (EU ETS1). Being a cap-and-trade scheme, it caps the emissions, and the price of emissions is determined by the demand for emission allowances. Consequently, the cost of conventional production increases compared to clean production. Whereas the EU ETS creates strong incentives for efficiency, it has some drawbacks in triggering investments in innovative clean production technologies. Firstly, the current price of around 70 euros per ton of CO2 (EEX, 2025), does not fill the cost gap between clean and conventional technology in all sectors. Secondly, the uncertainty of future prices is an investment risk for installations with long technical lifetimes. Agora Energiewende et al. (2021) identify a need for investment in new production capacities that could be used for deep-decarbonization technologies. Thirdly, the regulated carbon market is not suited to overcoming market failures of innovations, like incomplete capitalization of gained knowledge, coordination and financial friction in uncertain environments (Armitage et al., 2024).

CCfDs aim to overcome these challenges. By providing financial support and de-risking investments in innovative emission reduction technologies, they aim to trigger investments in them. However, their role should be limited to innovation support, as subsidizing a high share of markets is costly and likely to lead to market distortion. For the diffusion of new clean technologies and efficient exnovation (opposite of innovation, pushing “old” technologies out of markets) of polluting technologies, carbon pricing or green lead markets are more suited (Arne Heyen et al., 2017). Besides support schemes, the regulatory and infrastructural framework enabling transformation is required.

Basic idea of CCfDs as an industrial support scheme

CCfDs are mainly discussed as a support scheme for industrial deep-decarbonization technologies, subsidizing projects and taking the CO2 price risk over a long period (e.g., 15 years). As the name suggests, a carbon contract for difference covers the cost between an agreed strike price and the CO2 price. Projects are paid per emission reduction, compared to a reference, multiplied by the difference between CO2 and strike price (for details on payment and indexation see section 2.3.). Consequently, CCfDs subsidize clean production and cover OPEX as well as CAPEX. Using a project individual strike price over a long period, CCfDs are the opposite of the market-based uncertain CO2 of the EU ETS. The commonly discussed version is a project-specific CCfD, arranged between a decarbonization projects and a government (Richstein, 2017). The mostly considered allocation mechanism is an auction, where the strike price and supported projects are determined (Rilling et al,. 2022). The advantage of such auctions is that the government does not need to make assumptions on support needs, negotiate with projects or check costs excessively, but efficiency incentives are created through competition. In the policy mix, CCfDs typically complement an emission trading scheme and are applied to support the deployment of innovative technologies.

1.3. Literature on CCfD

Helm et al. (2005) introduced the idea of using CCfD to support industrial decarbonization. Richstein (2017) picked up the idea and discussed different design features of the instrument, like the index used for the CO2 price, allocation and linkage to a project. More design elements are discussed in Richstein et al. (2021), Richstein et al. (2022) and Lösch et al. (2022). Richstein et al. (2022) mainly focus on indexation of energy prices, whereas Lösch et al. (2022) discuss system boundaries, reference projects, indexation and auction design. Gerres et al. (2022) provide an overview and discussion of design elements and activities on CCfD in EU Member States. Rilling et al. (2022) give a systematic literature review on CCfDs and discuss design elements as well. The mentioned publications provide more details on design elements and an overview of the literature that goes beyond the scope of this paper. In 2024, a group of authors from different research institutions that consulted the Ministry in designing the German CCfD scheme published a commentary on the CCfD design and the challenges faced (Richstein et al. 2024). Besides explaining the instrument briefly, they discuss the challenges of cost efficiency, market distortion and efficient support allocation.

1.4. Other schemes used for inspiration

Whereas some design elements of the German CCfD scheme are new or adapted from scientific literature, others have been applied in different support schemes. Contracts for Difference (CfD) are widely used in renewables support in electricity (for an overview see: Del Río et al., 2023). CCfDs adapt the principle of a CfD to industry and use the CO2 price instead of the electricity price. Dutch SDE++ supports renewable energy production as well as heat generation, production of molecules and CCUS using an energy CfD mechanism for energy production and a CCfD mechanism for CCUS (RVO, 2024). Different technologies compete for support in an auction that is cleared by the required support per emission reduction. Whereas the scope is beyond industry, the CfD principle and multi-technology auction were used for developing the German scheme. The EU innovation fund is another scheme that was used for orientation (European Commission, 2025b), as it also addresses energy-intensive industry. Unlike the EU Innovation Fund grants program and other national support schemes, the German CCfD scheme is intended to offer full support for additional CAPEX and OPEX of clean technologies. Furthermore, the goal is to keep the administrative burden low.

2. INTRODUCTION OF THE GERMAN CCFD SCHEME

The development of the German CCfD scheme started in a research project, with the ambition to have a small pilot auction for selected sectors. Following the 2021 election and change in government, a strong political push for applying the instrument came (SPD et al., 2021). The German Ministry for Economic Affairs and Climate Action1 (BMWK) started developing the program based on the conducted research. (Main sources for this section are the funding guideline [BMWK, 2024b], the first funding call [BMWK, 2024a] and further information shared by the Ministry [BMWK, 2025b]).

The main goal of the scheme is to support innovative emission reduction technologies that are needed for industrial transformation. Additionally, emissions reduction itself and improving the competitiveness of clean technologies are pursued. Furthermore, first users of new energy and CO2 infrastructure should be supported. Besides subsidization, de-risking plays a prominent role. The program addresses innovative, clean energy-intensive production under the EU ETS. Projects are supported via a two-sided CCfD, which is indexed for energy prices. The support is paid per emission reduction, compared to product benchmarks from the EU ETS (European Commission, 2021). Building on the EU ETS, only direct emissions (scope 1) are considered. The support duration is 15 years. A technology-neutral auction is applied to allocate the support and determine strike prices. Focusing on industrial production, projects can consider all additional costs they have due to the investment they make, the energy they purchase and infrastructure costs in their bid. To understand the German CCfD scheme, it is useful to analyze the manufacturing landscape, challenges of transition and competitiveness, as well as other policy instruments.

2.1. CCfDs in the German climate and industrial policy mix

Manufacturing plays a crucial role in the German economy and has a strong export orientation. In the EU, Germany has the highest absolute gross value added in manufacturing, and the share of manufacturing value added of approximately 27% is among the highest within the EU (Eurostat, 2025a). Thereby, car manufacturing, machinery, chemicals, pharmaceutics and electronics make the greatest contribution (DeStatis, 2025). These sectors require emission-intensive basic materials like steel, chemicals and non-ferrous metals. Decarbonizing basic materials is challenging as they require new production processes and fuel switches. The strong manufacturing base comes with a significant demand for energy. For the transition towards climate-neutral production, direct electrification and hydrogen are essential. The electricity price level in Germany is high compared to other regions in the world, but also within the EU and is expected to remain high in the long-term (Eurostat, 2025b). Consequently, the transition towards clean production comes with the challenges of competitiveness.

Whereas the German Hydrogen strategy acknowledges that Germany needs to import hydrogen and its derivatives (BMWE, 2025b), its industrial strategy aims to keep and strengthen its manufacturing base (BMWE, 2025a). Germany applies instruments that aim to support energy efficiency, innovation, and the competitiveness of industry explicitly (overview see Förster et al., 2024). Some instruments aim to reduce energy costs and increase their availability, like renewables expansion, hydrogen production and infrastructure. Discounts on grid fees for manufacturing and energy tax reductions, which were suggested by the EU Commission (European Commission, 2025c), are also applied. Investments in energy-efficient or decarbonized production are supported by covering some of the investment expenditures (e.g., Federal Fund for Industry and Climate Action, kei, 2025). Besides national schemes, the EU Innovation Fund also supports emission reduction projects in Germany by covering some of the additional costs of clean production (European Commission, 2025b). Further instruments to support competitiveness, such as a dedicated electricity price for manufacturing, are discussed in Germany (CDU et al., 2025).

The German CCfD scheme follows a different approach than other support schemes, as it aims to support all additional costs of innovative decarbonized production. It combines support for emission reduction and innovation with the goal of fostering technology leadership and competitiveness.

2.2. Addressed installations and eligibility criteria

The intention to support innovative deep decarbonization projects is operationalized in the funding guideline (BMWK, 2025a). To address energy-intensive industry and build on the reporting system of the EU ETS, projects must fall under the EU ETS and produce industrial goods. The main production steps and emission savings must occur in Germany and must be within the project’s boundaries. To achieve this, the guideline allows for consortia of companies to participate. Production of secondary energy carriers that are sold as such, for example, in refineries, is explicitly excluded.

To ensure new innovative technologies are supported, multiple restrictions are applied. Firstly, only investments in technology that is not applied widely yet are allowed. Additionally, projects must reduce their emissions compared to the EU ETS product benchmark by at least 90% within the support duration and by 60% within three years of operation. For the scheme to mainly address bigger installations, a threshold for the conventional equivalent of 5 kt CO2 emissions per year and a minimum of 15 million euros for the maximum grant amount is applied.

Whereas the scheme follows a technology-neutral approach, some technology-specific restrictions are made. For example, the used hydrogen must be green or low carbon (EU definition, gas market directive and on delegated acts: European Commission: DG Energy, 2025), CCUS can only be applied if mainly process emissions are captured, biomass must fulfill sustainability criteria and is only eligible if electrification and hydrogen usage is not possible.

2.3. Indexation and payment

In its basic form, a CCfD covers the difference between an agreed strike price and a carbon price index. In the German scheme, the strike price is bid in the award auction, and the EU ETS price is used as the carbon price index. The difference between these prices, multiplied by the achieved emission reduction, is paid by the government to the project. If the CO2 price is higher than the strike price, the direction of payment changes and projects must make a payment to the government. For projects with CCfD, during investment and operation stage, the real CO2 price is not relevant anymore, but the strike price is.

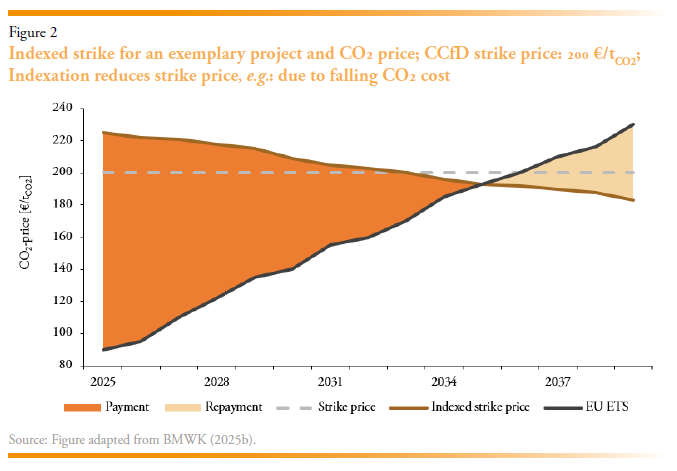

Instead of using a fixed CCfD strike price, in the German scheme, the strike price itself is indexed for changes in energy prices. Consequently, the payment is adjusted for changes in energy prices. The idea behind this is to further de-risk projects and adjust the level of support towards the level required. As prices of electricity and hydrogen are highly uncertain and have a significant impact on cost (see section 1.1 and Figure 1), energy price risk can be similar to CO2 price risk. Besides changes in the energy cost of the project, indexation also considers the energy costs from a conventional reference project. For example, in a project producing ammonia from green hydrogen, if the green hydrogen price decreases, the payment goes down as well. If natural gas prices fall, the payment would increase, as conventional technology gets cheaper and the need for support of clean production increases.

Figure 2 illustrates the indexed CCfD for an exemplary project. In the beginning, the project receives significant payments. Due to an increasing CO2 price and decreasing indexed strike price, from 2035, the direction of payment changes. Instead of receiving support, the project must repay the government. This should indicate that the project does not need support anymore, as it is competitive compared to conventional production.

Market indices are used for energy price indexation, as this allows for keeping an incentive to purchase energy efficiently. Other cost components of energy cost, like taxes, levies and grid fees, are not indexed.

This design comes with some challenges. Firstly, the indexation energy price indices must be identified. To optimally de-risk projects, they should reflect the true procurement cost of projects or the conventional reference. For electricity, natural gas and coal market indices are available. For hydrogen, however, no market-based index is available, due to the early market stage. Consequently, a cost-based index is used, and the possibility of changing the index during the support is introduced. Secondly, indexation adds a layer of complexity to the scheme. For incentive compatibility, projects must indicate a planned energy and production level for all 15 years. For innovative technologies, this comes with uncertainties and rules for adjustments must be introduced. Forecasting support payments becomes more challenging, but the degree of de-risking increases. Thirdly, for the government, the annual payment is highly uncertain. To be able to make the payment in adverse developments, additional budget must be reserved. To limit this, the scheme uses an annual maximum grant amount that covers most scenarios.

Considered emission reduction and budget per project

To subsidize emission reduction of clean industrial production, the German CCfD scheme builds upon the EU ETS. The emission reduction is calculated for the actual project compared to the EU ETS benchmarks used for free allocation of allowances (European Commission, 2021). Where possible, product benchmarks are used; otherwise, fallback benchmarks for heat or fuel are applied. For the annual payment, the emission reduction compared to the benchmark is multiplied by the difference between the strike price and the CO2 price. (More details on the payment can be found in the Annex of the funding guideline BMWK, 2025a).

Payment = (EmissionsBenchmark– EmissionsProject ) * (Strike price – CO2priceEU ETS )

As the CO2 price is uncertain and CCfDs aim to de-risk projects, more budget than expected to be paid must be reserved in the federal budget. The German scheme applies a formula and price time series for each energy carrier to calculate the maximum grant amount. To ensure implementation and production in the repayment phase, awarded projects must pay penalties or receive less support if they do not achieve the claimed performance, such as emission reduction.

2.4. Auction design

The support is allocated via a multi-technology, static, put auction. After a mandatory pre-phase, projects bid the strike price they are willing to accept to make the investment, as well as some project parameters. In the first auction round, bids were evaluated for cost efficiency (80 %) and emission reduction during the first five years of operation (20 %). For the second auction round, cost efficiency is the only award criterion. Eligible projects are heterogeneous regarding sector technology and project size. This translates into differences in emission abatement cost as well as the required budget (see Section 1.1). A combined auction comes with the challenge of ensuring fair competition between heterogeneous projects. This has been studied for multi-technology auctions in electricity (e.g., Del Río, 2017).

As the goal of the scheme is to support innovative emission reduction technologies in each sector rather than short-term cost-efficient ones, these heterogeneities are considered in the auction design. The Guideline introduces a variety of possibilities for steering the auction. Firstly, baskets for different technologies or sectors can be introduced. Secondly, sector or technology-specific ceiling prices can be applied. Thirdly, a quota, limiting the allocation for one sector or technology, can be introduced. And lastly, a new scaling approach to bids, based on ceiling prices, can be applied to level the playing field. The usage of these approaches is decided in each call for tenders.

In the first auction round, a common ceiling price of 600 €/tCO2 for all projects was used. The only restriction that applied was a quota of one-third of the budget being available for each group of sectors defined in the call for tenders. Neither baskets nor scaling factors were applied. Consequently, projects were first evaluated for eligibility, then evaluated based on the award criteria. Afterwards, they were ranked and awarded until all projects were awarded or the overall budget or the quota was fulfilled.

3. FIRST AUCTION RESULTS AND ADJUSTMENTS FOR FUTURE ROUNDS

The administrative process of an auction is illustrated using the first auction round. The first auc-tion round started with the mandatory pre-phase in June 2023 (BMWK, 2024a). The pre-phase gives companies a three-month period to submit sketches of projects. These are analyzed and evaluated by the administering body. Afterwards, projects are notified about their eligibility and the sector and benchmark they are assigned to. Based on the information gathered in the pre-phase, the call for proposals is designed, and the notification by the EU Commission is prepared. After the notification by the EU Commission in March 2024 (European Commission, 2024), the first call for proposals was published a month later. The selected projects from the pre-phase had three months to finalize their application and bid. In the next stage, the projects were evaluated for eligibility, and the auction was conducted. In October 2024, the contracts between the German Ministry and the successful projects were signed. Some information about the successful projects was published, but not all details, like the bid price.

3.1. Auction outcomes

In the pre-phase of the first round, approximately 100 projects participated. In the final call for tenders, CCUS was excluded due to a lack of a regulatory framework. Additionally, the maximum grant amount per project was limited to one billion euros, which is likely to exclude big steel direct reduction (DRI) projects and some bigger projects in chemistry. The budget for the first funding call was four billion euros. 17 projects submitted bids, with a total maximum grant amount of 5.3 billion euros. 15 projects and a total budget of 2.8 billion euros were awarded (BMWK, 2025c). This discrepancy between awarded projects and budget indicates that some submissions failed final eligibility or were above the threshold of one billion euros. Overall, the level of competition was low.

Sectoral distribution

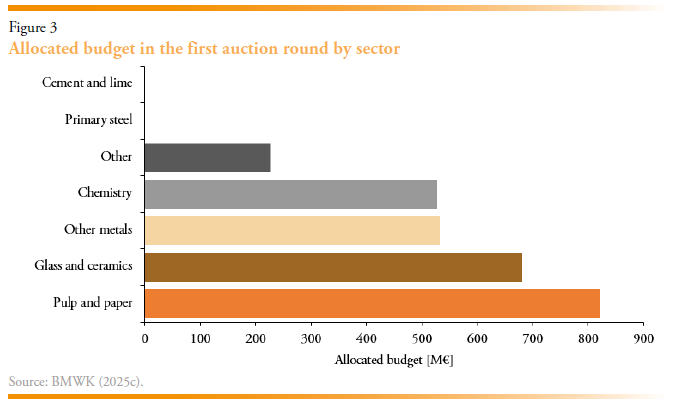

Figure 3 illustrates the distribution of budget to different sectors. It shows that the support was distributed between 5 of the 7 defined sectors. Primary steel, cement and lime did not receive funding, due to the design features discussed above.

From the awarded sectors, all but “other” received between 500 and 820 million euros. This indicates that in all sectors, some projects were able to participate, but overall, not enough for a competitive auction. Within each awarded sector, one project accounted for more than half the overall budget of the sector. This is most likely caused by differences in total emission reduction by the projects. Heterogeneities in size are very typical for industrial production plants.

Technological distribution

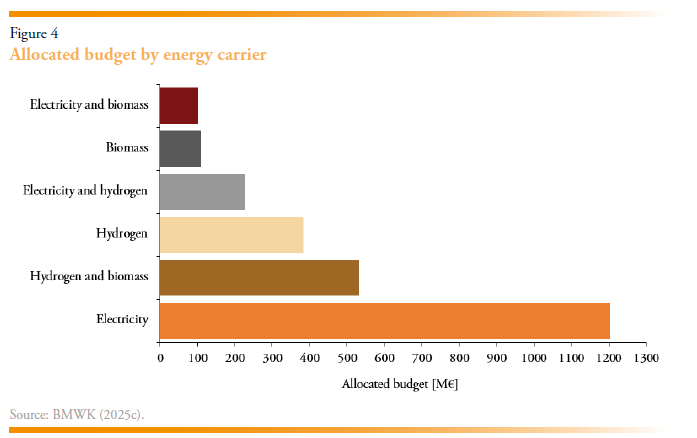

The budget distribution by energy carrier is visualized in Figure 4. It shows that electrification is the most important emission reduction strategy. It accounts for approximately half of the allocated budget and the number of projects. Hydrogen is used in some projects but often combined with biomass or electrification. Besides costs, infrastructure restrictions have an impact on hydrogen projects.

From the published auction results, neither the individual bid prices nor the clearing price can be guessed. The same holds true of the cost efficiency of emission reduction, as the allocated budget reflects the maximum grant amount, not the actual or anticipated payments. For an in-depth analysis of the competitiveness of the auction and abatement cost, more information needs to be published.

To evaluate the auction outcome, the implementation and performance of the supported projects are relevant as well. This can only be done in a few years, when plants are built and production starts. The German Ministry has more detailed insights that can be utilized to adjust the scheme’s design for future rounds.

3.2. Lessons from the first auction and adjustments for further auction rounds

Just after the bidding phase of the first auction, the pre-phase of the second round started in July 2024. The announcement included some additional information about changes in the program. The low participation rate of projects from the pre-phase and low competition in the first round were investigated, and changes for the second round were announced (BMWK, 2025a, 2025d). CCUS projects, as well as projects with a maximum grant amount above one billion euros, were encouraged to participate. The minimum size was reduced from 10 to 5 kt CO2 per year to be more open for smaller installations and companies. More flexibility regarding the time until entry into operation was adopted. Delayed infrastructure availability was explicitly recognized as not being a responsibility of projects by allowing projects to be delayed without penalties. A new reference system for industrial steam was introduced to allow chemical parks and others to participate. Lastly, fast emission reduction was dropped as an award criterion. So, the bids are only ranked based on cost efficiency. In the second pre-phase 130 projects submitted sketches.

Due to governmental changes, the second call for tenders has been delayed. In November 2024, the coalition dissolved before passing the 2025 budgetary law. Nevertheless, a pre-phase and a consultation were held, and the second round with a budget of up to five billion euros was notified by the EU Commission in March 2025 (European Commission, 2025a). The coalition agreement of the newly elected government stated that the CCfD program should be continued, but adjust-ments will be considered (CDU et al., 2025). The final auction design and details of the second call for tenders are yet to be communicated. Future developments regarding time, budget and scope of the scheme are unclear as well.

4. CONCLUSIONS AND OUTLOOK

As decarbonization of industry requires a wide range of technological developments, infrastructures and regulations, a scheme supporting it must reflect these framework conditions. Implementing it into a stringent and attractive support scheme that achieves its goals is not trivial. The complexity of the German CCfD scheme and the challenges it faces illustrate this. Whereas in some design elements the scheme makes use of findings from other schemes and literature, the implementation comes with novelties. The biggest novelties are indexation of strike prices to de-risk projects and the steering of multi-technology auctions using different approaches.

The pre-phase of the first auction round attracted high interest from the industry, but in the actual auction, a small share of projects submitted a bid. Nonetheless, many sectors received funding for innovative projects. An in-depth analysis of auction results requires greater detail on submitted bids. The focus of adjustments for the second auction round was put on addressing more sectors, expanding eligibility and relaxation of requirements. Due to political imponderables, the second call for tenders was delayed, but the new government intends to conduct further rounds.

Besides Germany, other countries have progressed in designing industrial support schemes which make use of a CCfD mechanism. Austria introduced a CCfD with similar properties called “Transformation of Industry” in 2023 (BMWET, 2025c). In France, the program GPID was announced to start in 2024. It uses a CCfD logic, but the CO2 price is given ex-ante (ADEME, 2025). Both schemes have less ambitious emission reduction targets, indicating a stronger focus on emission reduction than innovation support. Korea also announced its ambition to develop a CCfD scheme (Jeong et al., 2025). The German CCfD scheme might have been a blueprint for these schemes. The EU considered introducing CCfDs in the framework of the innovation fund (European Commission, 2022). However, little progress was made, but a hydrogen support auction was introduced, and two rounds were held. Additionally, a process heat support scheme was announced in 2025 (European Commission, 2025d). On the EU level, the complexity of a CCfD would be even greater than on the national level. Nevertheless, it could be an option under the Clean Industrial Deal and the Industrial Decarbonization Bank (European Commission, 2025c).

In this regard, it should be noted that, besides their climate policy dimension, CCfDs have an industrial political dimension. As they support technological development and explicitly subsidize clean production, they can improve the competitiveness of the industry in one country. In the last few years, competitiveness and industrial policy have been discussed more prominently, for example, in the Draghi report (Draghi, 2024), and regulations have been implemented in the EU and other regions.

ReferencES

ADEME. (2025). Call for tenders – Major Industrial Decarbonization Projects 2024. https://agir.ademe.fr/aides-financieres/aap/appel-doffres-grands-projets-industriels-de-decarbonation-2024, accessed 13.07.2025.

Agora Energiewende, Wuppertal Institute. (2021). Breakthrough Strategies for Climate Neutral Industry in Europe: Policy and Technology Pathways for Raising EU Climate Ambition. https://www.agora-industry.org/fileadmin/Projekte/2020/2020_10_Clean_Industry_Package/A-EW_208_Strategies-Climate-Neutral-Industry-EU_Study_WEB.pdf, accessed 14.04.2025.

Armitage, S., Bakhtian, N., Jaffe, A. (2024). Innovation Market Failures & Newly Scaled Policy Instruments. https://thedocs.worldbank.org/en/doc/f3083debb41ac5d3e3d81a069e817d0e-0080012024/original/ECAProductivity-Session2-Sarah-Armitage.pdf, accessed 18.07.2025.

Arne Heyen, D., Hermwille, L., Wehnert, T. (2017). Out of the Comfort Zone! Governing the Exnovation of Unsustainable Technologies and Practices. GAIA – Ecological Perspectives for Science and Society, 26(4), 326–331. https://doi.org/10.14512/gaia.26.4.9

BMWE. (2025a). A modern industrial policy. https://www.bundeswirtschaftsministerium.de/Redaktion/EN/Dossier/modern-industry-policy.html

BMWE. (2025b). The National Hydrogen Strategy. https://www.bundeswirtschaftsministerium.de/Redaktion/EN/Hydrogen/Dossiers/national-hydrogen-strategy.html, accessed 12.08.2025.

BMWET. (2025c). Transformation der Industrie. https://www.bmwet.gv.at/Themen/Energie/effizienz/transformation-industrie.html and https://www.umweltfoerderung.at/betriebe/transformation-der-industrie-februar-2025, accessed 13.07.2025.

BMWK. (2025a). Funding guideline for Carbon Contracts for Difference – FRL CCfD. https://www.klimaschutzvertraege.info/lw_resource/datapool/systemfiles/agent/ewbpublications/d7fe5f86-6316-11f0-a303-fa163ebab5e5/live/document/draft_courtesy_translation_funding_guideline_second_bidding_procedure.pdf, accessed 18.07.2025.

BMWK. (2025b). Klimaschutzverträge – Eine erste Bilanz und der Start des nächsten vorberei-tenden Verfahrens (German only). https://legal.pwc.de/de/news/fachbeitraege/klimaschutzvertrage-eine-erste-bilanz-und-der-start-des-naechsten-vorbereitenden-verfahrens, accessed 25.04.2025.

BMWK. (2025c). Projektsteckbriefe | project profiles. https://www.klimaschutzvertraege.info/lw_resource/datapool/systemfiles/elements/files/b1904cbd-0651-11f0-a8e4-a0369fe1b534/live/document/BMWK_A4-Template_Projektsteckbriefe_bf_final.pdf, accessed 25.04.2025.

BMWK. (2025d). Bewertung des ersten Gebotsverfahrens Klimaschutzverträge: Lektionen aus der Pilot-Auktion. https://www.klimaschutzvertraege.info/lw_resource/datapool/systemfiles/agent/ewbpublications/5cd30603-f2be-11ef-be5b-a0369fe1b534/live/document/Bewertung_erstes_Gebotsverfahren_KSV.pdf, accessed 18.07.2025.

CDU, CSU, SPD. (2025). Verantwortung für Deutschland. https://www.cdu.de/app/uploads/2025/04/KoaV-2025-Gesamt-final-0424.pdf, accessed 18.07.2025.

Del Río, P. (2017). Designing auctions for renewable electricity support. Best practices from around the world. Energy for Sustainable Development, 41, 1–13. https://doi.org/10.1016/j.esd.2017.05.006

Del Río, P., Kiefer, C. P. (2023). Academic research on renewable electricity auctions: Taking stock and looking forward. Energy Policy, 173, 113305. https://doi.org/10.1016/j.enpol.2022.113305

DeStatis. (2025). Enterprises (EU), persons employed, turnover, production value and other business figures: Germany, years, economic activities (WZ2008 1-4-digit hierarchy). https://www-genesis.destatis.de/datenbank/online/statistic/48112/table/48112-0002, accessed 12.08.2025.

Draghi, M. (2024). The future of European competitiveness. https://commission.europa.eu/topics/eu-competitiveness/draghi-report_en#paragraph_47059

EEX. (2025). EUA Spot Price. https://www.eex.com/en/market-data/market-data-hub/environmentals/spot, accessed 18.07.2025.

European Commission. (2021). Update of benchmark values for the years 2021 – 2025 of phase 4 of the EU ETS. https://climate.ec.europa.eu/system/files/2021-10/policy_ets_allowances_bm_curve_factsheets_en.pdf, accessed 28.08.2025.

European Commission. (2022). Workshop Presentation: CfDs and CCfDs under the Innovation Fund. https://climate.ec.europa.eu/system/files/2022-11/event_20221028_workshop_presentations_en.pdf, accessed 01.06.2023.

European Commission. (2024). €4 billion German State aid scheme. https://ec.europa.eu/commission/presscorner/detail/en/ip_24_845

European Commission. (2025a). Commission approves €5 billion German State aid scheme to help industries decarbonise production processes. https://ec.europa.eu/commission/presscorner/detail/en/ip_25_846, accessed 18.07.2025.

European Commission. (2025b). What is the Innovation Fund? https://climate.ec.europa.eu/eu-action/eu-funding-climate-action/innovation-fund/what-innovation-fund_en, accessed 25.04.2025.

European Commission. (2025c). Clean Industrial Deal. https://ec.europa.eu/commission/presscorner/detail/en/ip_25_550, accessed 18.07.2025.

European Commission. (2025d). Competitive bidding. https://climate.ec.europa.eu/eu-action/eu-funding-climate-action/innovation-fund/competitive-bidding_en#if23-hydrogen-auction, accessed 18.07.2025.

European Commission, DG Energy. (2025). Hydrogen and decarbonised gas market. https://energy.ec.europa.eu/topics/markets-and-consumers/hydrogen-and-decarbonised-gas-market_en, accessed 18.07.2025.

Eurostat. (2025a). Businesses in the manufacturing sector. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Businesses_in_the_manufacturing_sector, accessed 12.08.2025.

Eurostat. (2025b). Electricity price statistics. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Electricity_price_statistics, accessed 12.08.2025.

Eurostat. (2025c). Greenhouse gas emissions by source sector. https://ec.europa.eu/eurostat/databrowser/view/ENV_AIR_GGE__custom_217936/default/table?lang=en, accessed 18.07.2025.

Förster, H., Repenning, J., Braungardt, S., Bürger, V.,Görz, W. K., Harthan, R.,Hermann, H., Jörß, W.; Kasten, P., Ludig, S., Matthes, F., Mendelevitch, R., Scheffler, M., Bei der Wieden, M., Wiegmann, K., Blömer, R., Brugger, H., Eckstein, J., Fleiter, T., Fritz, M., Krail, M., Mandel, T., Rehfeldt, M., Lütz, L., Rohde, C., Deurer, J., Steinbach, J., Osterburg, B., Rieger, J., Rock, J., Kemmler, A., Kreidelmeyer, S., Thamling, N., Schade, W., Haug, I., Streif, M., Walther, C., Gocht, A., Stepanyan, D. (2024). Instrumente für die Treibhausgas-Projektionen 2025. https://doi.org/10.60810/openumwelt-7632.

Gerres, T., Linares, P. (2022). Carbon Contracts for Differences (CCfDs) in a European context. https://henrike-hahn.eu/files/upload/aktuelles/dateien/Study_CCfD_Henrike-Hahn_6.2022.pdf, accessed 01.06.2023

Helm, D., Hepburn, C. (2005). Carbon-Carbon contracts and energy policy: An outline proposal. Oxford University, Department of Economics.

IPCC. (2022). IPCC Report 2022; Chapter 11 Industry. https://doi.org/10.1017/9781009157926.013

Jeong, S., Chang, E. (2025). Industrial concentration in South Korea: implications for the auction design of carbon contracts for difference scheme. Climate Policy, 1–11. https://doi.org/10.1080/14693062.2025.2475039.

Kei. (2025). Federal Fund for Industry and Climate Action. https://www.klimaschutz-industrie.de/en/funding/, accessed 12.08.2025.

Lösch, O., Friedrichsen, N., Eckstein, J., Richstein, J. (2022). Carbon Contracts for Difference as essential instrument to decarbonize basic materials industries. https://publica-rest.fraunhofer.de/server/api/core/bitstreams/b3a1949c-97f6-4d69-a37d-9cb2458fb03b/content, accessed 01.06.2023

Richstein, J. (2017). Project-Based Carbon Contracts: A Way to Finance Innovative Low-Carbon Investments. Discussion Paper. https://www.diw.de/documents/publikationen/73/diw_01.c.575021.de/dp1714.pdf, accessed 14.06.2023

Richstein, J., Kröger, M., Neuhoff, K., Chiappinelli, O., Lettow, F. (2021). Carbon Contracts for Difference. An assessment of selected socioeconomic impacts for Germany. https://www.diw.de/documents/dokumentenarchiv/17/diw_01.c.816075.de/cfm_traction_germany_april2021.pdf, accessed 01.06.2023

Richstein, J., Neuhoff, K. (2022). Carbon contracts-for-difference: How to de-risk innovative investments for a low-carbon industry? iScience, 25(8), 104700. https://doi.org/10.1016/j.isci.2022.104700.

Richstein, J. C., Anatolitis, V., Blömer, R., Bunnenberg, L., Dürrwächter, J., Eckstein, J., Ehrhart, K.-M., Friedrichsen, N., Köveker, T., Lehmann, S., Lösch, O., Matthes, F. C., Neuhoff, K., Niemöller, P., Riemer, M., Ueckerdt, F., Wachsmuth, J., Wang, R., Winkler, J. (2024). Catalyzing the transition to a climate-neutral industry with carbon contracts for difference. Joule, 8(12), 3233–3238. https://doi.org/10.1016/j.joule.2024.11.003

Rilling, A., Anatolitis, V., Zheng, L. (2022). How to design Carbon Contracts for Difference – A systematic literature review and evaluation of design proposals, 1–8. https://doi.org/10.1109/EEM54602.2022.9921044.

RVO. (2024). SDE ++ 2024 Brochure. https://english.rvo.nl/sites/default/files/2024-09/Brochure_SDE_English_20240906.pdf, accessed 25.04.2025.

SPD; Bündnis 90/Die Grünen; FDP. (2021). Mehr Fortschritt wagen Koalitionsvertrag 2021-2025. https://www.spd.de/fileadmin/Dokumente/Koalitionsvertrag/Koalitionsvertrag_2021-2025.pdf, accessed 12.08.2025.

NOTES

* Fraunhofer Institute for Systems and Innovation Research (ISI) and Universidad Pontificia Comillas (robin.bloemer@isi.fraunhofer.de; robin.bloemer@alu.comillas.edu).

** Financial support was provided by the German Federal Ministry for Economic Affairs and Energy. Additionally, the author consulted the Ministry in designing the support instrument.