The economic agenda of the new Commission

Descargar artículo (formato PDF)

Fecha: diciembre 2019

Iain Begg, European Institute, London School of Economics and Political Science

The 2019-24 European Commission has now started work after the delay in ratification by the European Parliament’s objection to three of the nominees. Unlike its two predecessor Colleges, the von der Leyen Commission can approach economic governance relatively free from the shadow of acute crisis. The Eurozone has stabilised and, although the same old differences among member states around dilemmas such as how to reconcile risk sharing and risk reduction, continue to bedevil the discourse on reform of its governance, there is at least a clear policy agenda. One perennial challenge, agreeing the EU’s multi-annual budget has reached a crucial stage, and though very late in the usual cycle, should now gravitate towards a settlement.

The new President set out her ambitions for the Commission in her political guidelines, published in the summer of 2019. Six broad areas are put forward as the core of the Commission agenda, the first of which (a European Green Deal) can be seen as a necessary response to the strong showing of green (or green-tinged) parties in the May 2019 European Parliament elections. Her second priority, ‘An economy that works for people’, is the focus of this policy brief, with some comments on the economic aspects of one of the others: ‘A stronger Europe in the world’.

The paper starts by summarising what an economy that works for people means. It then examines the mission letters sent to the two Commissioners most directly involved in delivering on this policy priority, Valdis Dombrovskis and Paolo Gentiloni , also comparing their missions with the corresponding ones set five years ago by Jean-Claude Juncker. A concluding section reviews the new approach.

What is meant by an economy that works for people?

Arguably, a distinction can be made between the ‘an economy that works’ aspect and, with the word ‘works’ doing double duty, ‘works for people’. During the euro crisis and, still, in countries struggling to grow, the EU economy was manifestly not working well. Its shortcomings were a mix of ill-judged policies (both prior to the crisis and in dealing with at EU and national levels), an incomplete policy framework and the impact of long-run trends, including those associated with both European integration and globalisation.

Austerity as a macroeconomic policy stance may be open to intellectual challenge, but would have been hard to avoid politically in a context where trust was lacking between, crudely, creditor and debtor countries. Perhaps the best way to interpret ‘for people’ will be to project it as addressing the well-being of those hit by the years of crisis. What is harder to work out is the division of labour between the Commission and the member states. Care will also be needed to escape the trap of EU initiatives couched in warm-sounding words, yet having little direct effects on citizens’ income, jobs and protections. The mission letters to both Dombrovskis and Gentiloni spell out the aim as an economy which ‘delivers stability, jobs, growth and investment’. Who could object?

A strong message is conveyed in how the chapter in the political guidelines starts, with the expression ‘social market economy’ featuring three times in the opening few lines, Then, the longest section is devoted to ‘Europe’s social pillar’, starting by emphasising the need to reconcile the ‘social’ and the ‘market’ in the economy. This builds on one of the core themes of the Juncker Commission, the agreement concluded in November 2017 on a European Pillar of Social Rights.

‘Working for people’ can be discerned in further sections on equality and fair taxation. An interesting feature of the equality proposals is to go beyond gender pay differences to include board representation and to associate prevention of domestic violence with this section of the political priorities.

Unsurprisingly, deepening monetary union is prominent. Familiar objectives are set out, including completing the banking union, strengthening the international role of the euro and using the flexibility within the Stability and Growth Pact. She promises to deliver a new budgetary instrument designed to help member states in boosting growth and enacting reforms, and to support accession to the euro. There is to be a strategy for supporting smaller, innovative companies, linked to pans to push on with achieving capital markets union.

Further familiar goals in relation to taxation are to arrive at a common consolidated corporate tax base (CCCTB), to find ways of taxing digital businesses and to counter tax fraud. CCCTB is a longstanding goal of the European institutions and has been consistently supported by Germany and France, but it is a contentious issue for many other member states, especially those which have used low corporate tax rates to attract inward investors.

Guidance for Commissioners

The mission letter to incoming ‘Economy’ Commissioner, Paolo Gentiloni, has one apparently significant novelty in calling on him to integrate the UN’s Sustainable Development Goals into the European Semester. It is a connection that is not immediately intuitive, yet could help to establish the economic stance of the incoming Commission by re-purposing the semester and linking it to the ‘green deal’ priority.

A notable development is the assignment to Gentiloni of responsibility for designing a European Unemployment Benefit Reinsurance Scheme. As discussed in an earlier Funcas Europe paper, there has been extensive discussion of a new instrument linked to unemployment to provide macroeconomic stabilisation, not least in the 2018 Madrid declaration issued by Emmanuel Macron and Pedro Sanchez in which they call explicitly for an EU-wide unemployment insurance fund.

There are two noteworthy aspects of this element of the mission letter. First, it signals an acceptance by the Commission – and, tacitly, by the Germans – of the need not only for a fiscal stabilisation instrument, but also for it to be linked to the labour market. The parallel proposal for a competitiveness and convergence instrument could also play some role in stabilisation, but insofar as the structural reforms it is intended to support can result in job losses, a measure sensitive to workers will be welcomed.

Second, ‘reinsurance’ implies a relatively limited ambition for the scheme in macroeconomic stabilisation. By pitching the scheme as reinsurance, it would only be activated if a corresponding national scheme were unable to cope. Consequently, its stabilisation role would be most likely to be for instances of an asymmetric shock affecting one, or a small number of, Member States. Although its design could, conceivably, allow for a common fiscal stimulus if all national schemes face stress, this is implausible in practice. A stabilisation instrument should, in principle, also work to dampen demand in periods of economic over-heating, but a pure reinsurance scheme (as opposed to one which member states pay into in good times and draw from in bad times), will not easily achieve this objective.

The mission letter to Valdis Dombrovskis, who is starting his second term as Latvian Commissioner, puts him in charge (as one of three Executive Vice-Presidents) of delivering on ‘an economy that works for people’, while continuing to be responsible for the financial services portfolio he has overseen since 2016. The aspect of the first of these roles highlighted is ‘deepening our Economic and Monetary Union’. The letter nevertheless dwells on the social dimension, emphasising the same points as those in the Political Guidelines about the European Pillar of Social Rights and the social dialogue, but (perhaps oddly) not the unemployment reinsurance scheme.

He is also charged with ‘strengthening the role of the euro as a strategic asset’, explained as boosting its international role and with improving the EU’s resilience to ‘extra-territorial sanctions’. These are potentially significant developments. Hitherto, the EU has been rather ambivalent about internationalising the euro, but both the ECB (though still broadly agnostic) and the Commission have become keener in the last year to change this.

Jean-Claude Juncker initially appointed Dombrovskis in 2014 to be the Vice President for ‘the Euro and Social Dialogue’, part of which was oversight of the financial portfolios. When the UK Commissioner (Lord Hill) resigned after the 2016 Brexit referendum, Dombrovskis also took over direct responsibility for financial services, including Capital Markets Unions. In over-arching terms, therefore, his brief remains much the same as during the later years of the 2014-19 Commission. In contrast to the 2019 letter, there is only a passing mention of the external representation of the euro.

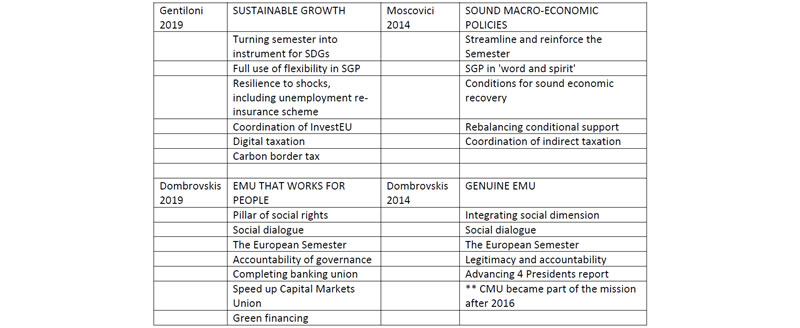

Elements of what is now ‘works for people’ can be discerned in some of the framing of the 2014 letters – see table below. Thus, while stressing the importance of consolidating the measures to strengthen EMU, and achieving stability and sound public finances, the 2014 letter to Dombrovskis refers to making them ‘more socially legitimate’ and ‘social fairness in implementing the necessary structural reforms’. There are further references to ‘engaging with social partners’, to ‘integrating the social dimension’ of a ‘deep and genuine’ EMU, and to ‘re-balancing …of [how] conditional stability support is granted to Euro area countries in difficulty’. A key goal was to replace the Troika approach with ‘a more democratically legitimate and more accountable structure’. Running through these orientations is a tacit message that the adverse social consequences of austerity had to be redressed.

Similarly, in the 2014 mission letter to Pierre Moscovici, the Ecfin Commissioner in the previous Commission, the issue of easing the burden on countries in difficulty is mentioned. However, the emphasis is more on stability and rules and the references to consolidation of public finances and structural reforms are about macroeconomic discipline.

How different is the emerging approach?

After the range of governance reforms of the last decade, the outlook for an ‘economy that works’ is improved. But the ambition of what is now proposed can still be questioned. A clear message is that this Commission will give renewed impetus to social initiatives, building on initiatives launched by the previous College. Yet this is likely to be tempered by the need for trade-offs between objectives and difficult judgements regarding where the balance is struck. After the trials and tribulations of the previous decade and the many transformations of the EMU policy framework, the social dimension warrants attention. Scrutiny of the document suggests the new Commission will indeed be well disposed to the social dimension of EMU.

While there is an evident risk of reading too much into the precise drafting of the mission letters, tone can matter. A concluding bullet point for Dombrovskis refers to supporting structural reform ‘aimed at speeding up inclusive growth and territorial cohesion [emphasis in original text]. It does not make reference to Cohesion Policy as such, nor does it refer to the latter’s economic and social dimensions. Moreover, in the new Commission structure, the mission letter to Elisa Ferreira states that she is to work ‘under the guidance of the Executive Vice-President for an Economy that Works for People,’, namely Dombrovskis.

Table Key points in mission letters, 2019 and 2014

Source: Mission letters

Source: Mission letters

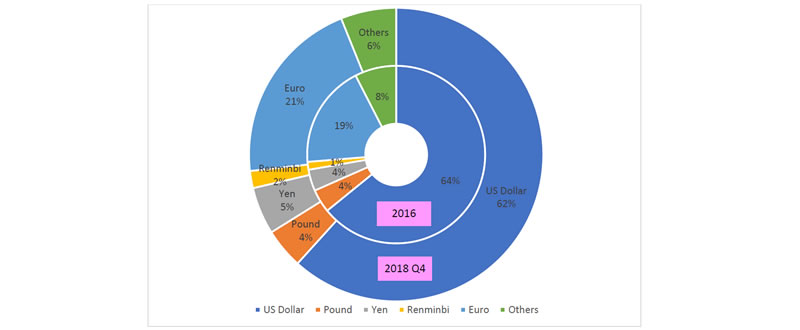

The focus on the international dimension of the euro is consistent with the wider aims of the Commission to lead in the world – a geo-political Commission. As the figure below shows, the euro lags well behind the US as an international reserve currency, but there has been a slight increase in recent years as the euro crisis abated and the Trump factor weighed on the dollar. However, other data collated by the ECB show it has an even smaller role in a range of other facets of internationalisation.

Already in December 2018, the Commission had published a communication setting out the case for a stronger international role and identifying some steps to take, largely technical in nature. More fundamentally, significant progress on completing EMU will be required. Therefore, the combination of completing EMU – including banking union – making real progress on arriving at a capital markets union, and promoting internationalisation could become a defining component of the economic dimension of the 2019-24 Commission.

Finding ways to insulate the EU from secondary sanctions by third countries will be challenging, especially when the US is the third country. In this regard, the EU struggles to exercise its potential power, because of divisions among member states, as opposed to the unitary power of the US (or, indeed, China). It will be intriguing to see how this can be advanced.

Figure Use of major currencies in international reserves

Source: ECB 2019

Source: ECB 2019

Long-time observers of intra-Commission politicking will know that there has been a persistent tension between the Regional Policy and Economic and Financial Affairs Directorates-General. It stems from the dual role of Cohesion Policy as an instrument to reduce regional disparities (as provided for in Article 174 of the Treaty) and to promote the supply-side of the EU economy by underpinning the Lisbon Strategy (after 2007) and, now, the Europe 2020 strategy. This second goal has led to Cohesion Policy becoming known as the investment policy of the EU.

In the negotiations of both the current and forthcoming Multi-annual Financial Frameworks, lively debate arose on the role of conditionalities of different sorts in the operation of what are now known as the European Structural and Investment Funds. By placing Cohesion Policy under the Economy Vice-President and referring to reform, the emphasis appears to be less on regional disparities. The wording of Ferreira’s mission includes reference to a Just Transition Fund to support phasing out of coal and structural reforms. Again with the caveat of over-interpretation, the implication is a greater emphasis on the Ecfin rather than Regio priorities.

To conclude, ‘an economy that works for people’ is a phrase which could resonate with citizens and be the basis for economic policies which are more inclusive and orientated towards their day-to-day concerns, but there is always a danger that warm-sounding words are not matched by concrete actions. How initiatives like unemployment insurance, the focus on equality and sustainability, and internationalisation of the euro work in practice will be the litmus test.