State Owned Enterprises and the Energy Transition

Fecha: junio 2022

State enterprise, Energy transition, Oil and natural gas, BRICs, Nationally determined commitments

Amy Myers Jaffe*

Papeles de Energía, N.º 17 (junio 2022)

One key feature of emerging markets with petroleum-linked economies is that state-owned enterprises (SOEs) play a dominant role and represent major emitters. Finding the right formula for these important global energy suppliers to participate in the energy transition is to global climate efforts but remains challenging.

While there is no one size fits all to how governments will choose to integrate their oil and gas SOEs into national decarbonization pathways, several strategies are emerging. Among the many strategies that are gaining headway, three stand out as notable models for sustainable economic development. They are 1) green industrialization 2) shifted decarbonization that leaves room for emissions from oil and gas export activity by rapidly decarbonizing other domestic sectors 3) targeted decarbonization which sets strict low carbon intensity levels for the oil and gas sector. This article outlines a case study on each of these three approaches, followed by a discussion of the implications for managing oil and gas state enterprises.

In the coming years, the BRICS countries (Brazil, Russia, India, China, and South Africa) and a few other large developing economies like Indonesia and Vietnam will replace industrialized economies as the world’s top emitting countries. Ensuring that major emerging economy countries can rapidly curb their emissions is imperative for limiting the rise in global temperatures to 1.5 degrees Celsius by mid-century to prevent catastrophic climate change. This means that the role of the BRICS and other major emerging economies in reducing global emissions has become more critical. For example, BRICS represented 22.2% of the annual CO2 emissions in 1980. This share has now increased to 44.8% in 2020 (Global Carbon Project, 2021). The rising economic and political status of the BRICs and other major emerging economies is altering global climate negotiations and the future frameworks for global climate action. Understanding the domestic political and socio-economic drivers for these important countries is increasingly important to the study of global climate policy.

As they seek to address greenhouse gas emissions, key emerging economies will have to consider a variety of challenges, including the additional pressing priority of how to simultaneously reduce greenhouse gas emissions while at the same time lifting millions of their citizens out of poverty. The problem of climate finance looms large as any effort to decarbonize takes place against the backdrop of mounting costs of adaptation to climate change (Gallagher, 2022).

But finding the right formula for these rising economies to achieve a low carbon economic development strategy that transitions away from fossil fuel industries remains challenging. One major barrier to decarbonization is the fact that many of these emerging market economies benefit greatly from not only the export sales of oil and gas, but also from the direct and indirect jobs that the fossil fuel sector underwrites. World Bank data shows that 27 countries across Latin America, Asia, and Africa depend on oil rents for more than 5% of their GDP, including over half of the Middle East and all of the countries of the Arabian Peninsula except Bahrain (World Bank, 2022a). The potential drop in global oil demand amidst the energy transition, if accompanied by a decline in prices, could produce a significant economic blow to these countries and regions.

The issue is also geopolitical as many of the countries in question are important global suppliers for oil and gas and will likely play a key role in stabilizing global energy markets for years to come (Bordoff and O’Sullivan, 2021). “The combination of pressure on investors to divest from fossil fuels and uncertainty about the future of oil is already raising concerns that investment levels may plummet in the coming years, leading oil supplies to decline faster than demand falls – or to decline even as demand continues to rise…” argues Jason Bordoff and Meghan O’Sullivan in as essay in Foreign Affairs and republished in this issue of Papeles de Energía. They warn that this phenomenon could “augment” the influence of some oil and gas exporters, notably Saudi Arabia, by accentuating the concentration of production to the low-cost producers of the Middle East (Bordoff and O’Sullivan, 2021). This prediction is dependent on the price of oil remaining low and energy saving policy responses directed at oil use from major oil consuming countries failing to gain momentum, neither of which seems to be the state of affairs at present. Many major economies are pursuing electrification of vehicles and diversification of fuels for industry and buildings.

At present, Saudi Arabia and other producers within the Organization of Petroleum Exporting Countries have been seeking to maximize oil prices and as such, stimulating policies that would seek to lower demand for oil in the industrialized West and other major economies like China and India. China, many countries in Europe and the major US state of California, have imposed future bans of the sales of gasoline powered cars by 2035 to 2040 and taken other steps to decouple their economic growth from oil use. A high oil price strategy is likely to hasten the shift away from oil. To reverse this policy, major producers like Saudi Arabia, Iraq, and the United Arab Emirates would have to invest additional billions of dollars to increase oil production capacity to be able to flood markets with cheap priced oil to stave off faster shifting to low carbon fuels. So far, there is no evidence that major producers are taking this approach.

One key feature of emerging markets with petroleum-linked economies is that state-owned enterprises (SOEs) play a key role. In the energy world, SOEs are particularly important, especially in the global oil and gas business where they are a dominant force. Countries who are members of the Organization of Petroleum Exporting Countries (OPEC) control more than 80 percent of the world’s remaining oil reserves, a high proportion of which are under the management of the state via their oil and gas SOEs, often referred to as national oil companies (NOCs).

The predominance of NOCs in the ownership of global oil reserves gives them a large stake in the outcome of global efforts to move away from fossil fuels. As the world shifts to lower carbon sources of energy, the financial risk that some portion of large oil and gas reserves will get stranded will affect these state-run entities (Jaffe, 2020, NEIR). Although scholars have assessed that the ultimate owners of today’s producing reserves comprise a high proportion of ownership stakes from private investors from the industrialized west, state ownership in many cases is still significant and for governments like Russia and Iran the risk of economic losses from a rapid energy transition is relatively high (Semieniuk et al., 2022).

To be sure, the petro-states with the most to lose have been tempted to use their geopolitical influence to thwart global climate action to stave off negative economic consequences to their oil dependent economies. A recent assessment by the U.S. National Intelligence Council concluded that “most countries that rely on fossil fuel exports to support their budgets will continue to resist a quick transition to a zero-carbon world because they fear the economic, political, and geopolitical costs of doing so” (National Intelligence Council, 2021: 7).

On the other hand, petro-leaders must also hedge, as the march towards decarbonization of the global economy means they should be preparing for soft landing for their NOCs which both represent large employers in their home countries and often play an outsized role in the domestic resource-linked economy and in their country’s technological innovation system.

Historically, oil and gas state enterprises have many distinctive responsibilities in their home countries. National oil companies often are called upon to fulfill geopolitical goals of the state. (El Gamal and Jaffe, 2010). Moreover, they are usually relied upon to ensure they are securing ongoing fuel requirements of the nation, and this has traditionally been ensuring adequate supply of oil and gas were available. Now, however, responding to national climate policy objectives for fuel mix could become a new mandate now or in the future (Benoit, 2019). Governments now must face difficult choices for how to instruct or regulate their NOCs to prioritize the many demands that are facing them. In fashioning a forward strategy, a number of questions must be considered:

- Would a greener economy provide more or better jobs in society than are now supported by the national oil company?

- Is the national oil company the optimum in-country entity to lead in the energy transition?

- How should governments regulate the direct operating emissions of state-owned enterprises?

- Should the national budget for carbon emissions prioritize the oil and gas export sector and thereby make larger cuts to other sectors to maintain access to oil and gas export revenues?

- How globally competitive are the reserves controlled by the national oil company in terms of cost of development and production? Does it make sense to try to be one of the prominent “last men standing” when it comes to oil exports in the coming decades?

- What other revenue streams can the government plan to use to replace earnings by the national oil company?

Given NOCs’ preeminent role in global energy markets and their importance in their national economies, how NOCs and their governments address these energy transition questions will have large consequences for global action on climate change.

As governments respond to upgrade their nationally determined contributions (NDCs) for more ambition on decarbonization ahead of COP27 and beyond, their guidance to flagship NOCs are shifting. In November 2021, over 100 countries signed the Global Methane Pledge, committing to a collective goal of reducing methane emissions by at least 30% from 2020 levels by 2030 and adopting best available inventory methodologies to quantify methane leakage from high emissions sources. One major source of methane leakage is production of oil and gas, including national oil company producing oil and gas fields. Several nations with important NOCs signed the pledge, including Indonesia, Mexico, Nigeria, Brazil, Colombia, Kuwait, Saudi Arabia, UAE, and Iraq.

NOCs contribute about 10% of the 6.2 gigatons of carbon dioxide emissions equivalent directly emitted by all types of state-owned enterprises (Clark and Benoit, 2020). To meet international emissions targets of limiting to a 1.5 degrees Celsius increase by mid-century, the world will need to dramatically lower the burning of oil and gas and the oil and gas sector itself will need to reduce its own operational emissions (Dietz et al., 2021). NOCs feature widely on the list of large oil and gas producing companies whose operational carbon intensity is not aligned with net zero goals. Researchers have calculated that most of the companies whose stock shares are traded publicly on formal stock exchanges are not on track to achieve net zero emissions reductions in their businesses (Dietz et al., 2021). Of the 25 of oil and gas firms with the highest emissions intensity, calculated to include Scope 3 from use of sold products, seven are SOEs from emerging economies.

While there is no one size fits all to how governments will choose to integrate their NOCs into national decarbonization pathways, several strategies are emerging. Among the many strategies that are gaining headway, three stand out as notable models for sustainable economic development. They are 1) green industrialization; 2) shifted decarbonization that leaves room for emissions from oil and gas export activity by rapidly decarbonizing other domestic sectors; 3) targeted decarbonization which sets strict low carbon intensity levels for the oil and gas sector. The following section outlines a case study on each of these approaches, followed by a discussion of the implications for managing oil and gas state enterprises.

1. Green Industrialization and the Case of India

In the leadup to the Glasgow global climate meetings in November 2021, India’s Prime Minister Narendra Modi pledged that India would strive to reach net zero emissions by 2070 and promised that India would get 50% of its energy from renewable sources by 2030. India plans to deploy 450 gigawatts of renewables between now and 2030, up from 100GW currently. Starting in 2017 India added more renewables than coal to its energy mix.

India’s climate policy must take into account job creation, since youth represent one third of the 1.38 billion population and youth unemployment remains a key political reality. For India, a green industrialization is an imperative since economic growth is needed to create jobs and low carbon transition must simultaneously find alternative livelihoods for workers from the oil and gas and coal industries. India’s renewable energy policies have helped the country achieve competitively priced electricity but more could be done to grab jobs across the global renewable energy supply chain (Narassimhan et al., 2021). Research by my colleagues at Climate Policy Lab shows that several policy reforms could reap huge gains in delivering employment, income and public health (Narassimhan et al., 2021). These include shifting tax revenue from fossil fuel sales to carbon pricing, retiring coal plants and doubling storage capacity alongside renewable energy development, and incentivizing the buildout of electric vehicle (EV) charging infrastructure alongside EV sales mandates.

As India moves more decisively towards decarbonization strategies, it will impact the business outlook for India’s state oil and gas firm, ONGC. India’s oil consumption and imports rose substantially in the early 2020s due to rising road transportation use and ONGC was charged by the government to work to secure crude oil at home and abroad. ONGC’s crude oil production is sufficient to meet a little more than half of the country’s oil use. In the 2000s and 2010s, the Indian government has pressed ONGC to reverse the fall it has observed in its hydrocarbon output from depleting fields. In 2019, ONGC published its vision for “Energy Strategy 2040” and outlined a growth plan for its energy transition. ONGC aims to double the output of hydrocarbons from it. However, that plan remains focused on enhancing domestic and foreign oil fields and tripling its refining capacity.

Responding to calls that ONGC reconsider its role in India’s energy transition, ONGC has been forced to add renewable energy to its investment portfolio alongside oil and gas expansion plans. ONGC says it will make significant investments in renewable energy to increase its renewable energy generation portfolio to 5-10 GWs, mainly offshore wind power, from 178 megawatts (MW) of renewable energy capacity at the end of 2020. ONGC has also announced a long-term $1 billion research and development (R&D) venture fund for clean energy, artificial intelligence or reservoir/field services technology.

But ONGC will face increasing competition from private sector firms who have announced more ambitious plans to meet India’s net zero goals. For example, Reliance Industries has signed a memorandum of understanding with the Indian state of Gujarat to invest $80 billion in green projects, including $10 billion in renewable energy and additional funds to build out green hydrogen infrastructure. It will also invest $8 billion in solar panel manufacturing. As part of its plan, Reliance is trying to sell a 20% stake in its traditional oil and chemicals business to state enterprise Saudi Aramco. Reliance Industries operates 1.2 million b/d of oil refining in India.

2. Shifted Decarbonization and the Case of Canada

Canada’s oil production is among the most carbon intensive in the world. Canadian firms Suncor and Imperial oil top the list for emissions intensity of public oil and gas producers (Dietz et al., 2021) with Canadian Natural Resources and Cenovus Energy in the top ten. While Canada does not have a national oil company, its plans for decarbonization are a relevant model for major oil and gas exporters. Canada plans to make $9.1 billion on new economy wide investments to target buildings to vehicles to industry and agriculture to lower emissions and create new jobs in the domestic economy while continuing to maintain its oil export industries. In effect, the plan hopes to squeeze emissions across the domestic economy to reach net zero without sacrificing its oil export businesses. Inside Canada, the government is providing incentives for electric vehicles with British Columbia already imposing a ban on gasoline vehicles sales after 2040. Canada will phase out all coal-fired power generation by 2030 and has begun to work on plans to decarbonize heavy industry.

Canada’s carbon price is set to increase to Canadian $170 a ton by 2030, up from C$50 a ton currently. The government also has pitched a tax credit of up to 50% of total capital costs to encourage carbon capture and storage technology in the Canadian oil and gas sector.

Even with Canada’s emerging carbon policies, Canada has said its plans to increase oil exports in the short term will not undermine its longer-term climate commitments. Canada is projected to see a 500,000 b/d increase in oil production by 2030, up from 3.1 million b/d currently, based on current expansion projects. Canada’s oil sands producers themselves have formed a net zero initiative for their operational emissions, with an initial goal to cut 22 million tons of CO2 a year by 2030 (https://www.ft.com/content/276ecc11-15cd-45ef-8e10-5f64dcde77da). The dialogue between the Canadian government and the Canadian oil industry continues with an eye to sustaining the industry in a manner that does not conflict with the country’s wider climate action commitments.

3. Targeted Decarbonization and the Case of Saudi Aramco

Saudi Arabia has pledged to reach net zero by 2060 but is actively working to lower the carbon intensity of its oil production in the immediate term. The country’s national oil company, Saudi Aramco, has a targeted decarbonization strategy which aims to achieve a strict low carbon intensity level for the oil and gas sector.

Saudi Arabia’s government has pitched its NOC Saudi Aramco to sustain its long-term market share by ensuring it has the lowest cost, low carbon oil production in order to lengthen the runway for its oil exports and ensure it can sustain its position as the world’s major oil supplier, even as demand for oil wanes. The idea is that some demand for oil will remain well into the next several decades, and Saudi Arabia will take steps to ensure that its oil exports will be able to be the oil the world uses, even as the total global demand for oil overall is falling. That includes ensuring that Saudi Aramco has both the lowest cost production so it can beat out other high-cost suppliers to a shrinking pie but also the lowest carbon intensity oil to be able to tap markets where carbon border taxes would hold out more carbon intensive competitors like Canadian oil sands.

In a report released in June of 2022, Saudi Aramco noted, “In support of the corporate strategy to maintain an industry-leading position as a lowest carbon intensity major producer of oil and gas, we have set a target to reduce our upstream carbon intensity by at least 15% by 2035, against our 2018 baseline. This target accounts for anticipated increases in oil production and maximum sustainable capacity, and the expansion of our gas business.” (Saadi, 2022).

To achieve its low carbon oil production targets, Saudi Aramco plans to invest in 12 GW of solar and wind projects. It is also investing to produce 11 million metric tons a year of blue ammonia by 2030 for export. Saudi Aramco plans to reduce or mitigate more than 50 million tons of CO2 equivalent annually. That plan includes carbon capture, utilization and storage for more than 11 million metric tons of CO2 equivalent by 2035, according to the company’s sustainability reporting.

Saudi Aramco has invested consistently in clean energy for over a decade as part of its strategy to prepare for the energy transition. For many years, Saudi Aramco has invested in mobile carbon capture technology which would capture CO2 from a vehicle’s exhaust, store it onboard and offload it for sale for use in industrial and commercial applications. The Saudi state oil company also invested in a major pilot carbon sequestration and use project in 2015.

Confirming Saudi Aramco’s success to hold down the carbon intensity of its oil production, Stanford University found that Saudi Arabia ranked highest among major producers in the lowest carbon intensity for its upstream oil extraction and processing facilities (Brandt, 2018). Saudi Aramco attributes its low carbon intensity for its oil production to “implementation of best in-class reservoir management practices, flare minimization, energy efficiency, greenhouse gas management, and methane leak detection and repair (LDAR).”

4. Unequal landscape

As these case studies highlight, major oil exporting countries have multiple options to address the energy transition. However, the playing field for implementation of such strategies is very uneven.

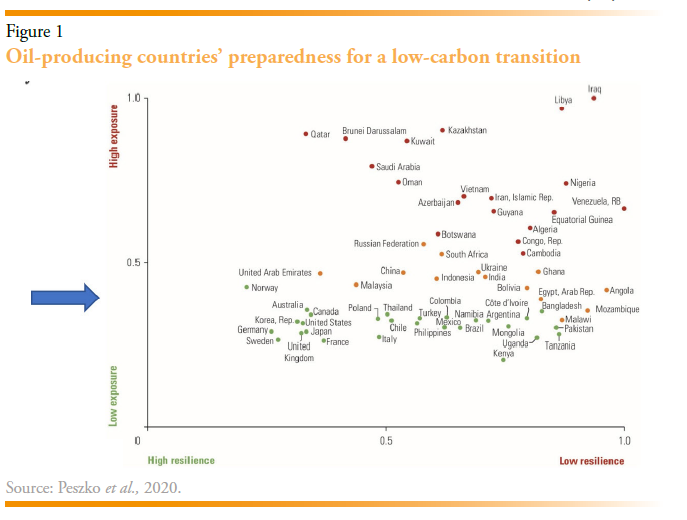

Research from the World Bank reveals there is a considerable gap in the level of preparedness for a low-carbon transition among various state oil and gas enterprises. Some countries like the United Arab Emirates, Norway, and Malaysia are already undertaking major initiatives related to the energy transition. Others like Venezuela, Iraq, and Nigeria are considered ‘less prepared’ (Peszko et al., 2020) and highly vulnerable to climate change risk due to ongoing challenges related to poverty and internal conflicts.

The financial destabilization of Venezuela in the aftermath of the 2014 oil price collapse is a warning to the kind of economic catastrophe that could hit unprepared oil revenue dependent economies as the demand for their oil wanes (Buxton, 2020). Amid hyperinflation and rampant corruption, Venezuela’s gross domestic product (GDP) has fallen more than 60% since 2014. The country suffers from severe shortages of basic goods, widespread hunger, looting, and debilitating poverty (Kurmanaev, 2019).

5. Conclusion

To date, global climate negotiations have not focused squarely on the consequences of the energy transition on major oil dependent economies. As this essay has laid out, lack of focus on the energy transition strategies of the state enterprises of those countries remains a pressing, missed opportunity. More study is needed on the important role SOEs can play in the energy transition and on the policy frameworks needed to ensure their role is constructive to climate action.

With COP27 to be held in Egypt on the African continent, the issue will likely get more attention. Several African countries have argued that natural gas should continue as a major fuel on the continent and that the industrialized West should do more to help African petro-states transition to clean energy. OPEC’s Secretary General called on Egypt to use the COP process to elevate the issue of continued oil and gas use as part of the climate process. Such a discussion might focus on a number of topics, such as multinational support for carbon sequestration and capture technology, continued investment in lowering the carbon intensity of crude oil production, and petro-state investment spending on R&D for future clean energy technology. All of these topics would benefit from active engagement of oil and gas state enterprises from major oil exporting countries.

The role of oil and gas SOEs remains a geopolitically untapped potential in the possibility of strengthening and accelerating the energy transition. As the above case studies suggest, these national oil companies have an important role to play in reducing global carbon emissions. In a misalignment to their paramount status in the global energy world, NOCs receive relatively less attention in global climate negotiations compared to other kinds of entities. Several major oil exporter governments have exhibited a willingness to support their NOCs to take carbon mitigation actions. The upcoming climate meetings in Egypt in 2022 and the United Arab Emirates in 2023 are an opportunity for concerted diplomatic action to widen the engagement of NOCs into the climate action process. The initial steps outlined in the case studies presented could be broadened to countries that have not yet tackled the challenges ahead for their NOCs. Moreover, those countries that are already pro-actively responding to the energy transition could be engaged to focus on accelerating progress and raising ambition, rather than using the next two global climate meetings to try to advocate for continued use of oil and gas.

One key area for engagement would be to lobby NOCs and their home governments to integrate a larger share of renewable energy into the ongoing operations as part of nationally determined contributions (NDCs). The greater use of renewable energy will not only reduce the carbon intensity of oil production. It also builds the human resources needed to help the NOCs transition their businesses to greener energy sources. Clean energy technology transfer and capacity building could be part of the transaction of trade relations between industrialized countries and major economies like China and oil dependent states in Africa and the Middle East.

Another key area for engagement of oil and gas SOEs within the institutions of global climate negotiations is in the area of research, development and demonstration (RD&D). Several major oil exporting nations, including Brazil and Saudi Arabia, are members of Mission Innovation (MI), a multinational institution whose membership includes 22 countries and the European Union with the aim to accelerate development of the breakthrough technologies needed to tackle climate change mitigation. In its seventh year, MI is now embarked on creating multinational collaboratives for technology research and demonstration. Global climate negotiators should focus on getting stronger oil and gas SOE participation in clean energy innovation within and outside MI to shift more state dollars to low carbon technology RD&D investment. Stronger NOC participation in multinational energy research, development and demonstration projects would help improve the engagement of these entities in solutions to the energy transition. It would also increase the potential for technology transfer and training to build energy transition capacity within the NOCs.

In conclusion, several NOCs have active energy transition strategies and can serve as role models for other similar entities that have made less progress. Lessons from their engagement have big implications for raising ambition for climate action. The strategies of state enterprises should be added to the agenda at the upcoming climate negotiations and countries should be encouraged to define the role of their oil and gas SOEs as they articulate implementation of NDCs.

REFERENCES

Benoit, P. (2020). State-owned enterprises: No climate success without them. Journal of International Affairs, 73(1), pp. 135-143, 343.

Bordoff, J. and O’Sullivan, L. (2022). La nueva geopolítica de la energía. Papeles de Energía, 17. Madrid: Funcas.

Bordoff, J. and O’Sullivan, M. L. (2022, June 8). Green Upheaval. Foreign Affairs. https://www.foreignaffairs.com/articles/world/2021-11-30/geopolitics-energy-green-upheaval

Brower, D. (2022, June 9). Canada’s oil sands: Why some of the world’s dirtiest fuel is now in hot demand. Financial Times.

Buxton, J. (2020). Continuity and change in Venezuela’s Bolivarian Revolution. Third World Quarterly, 41(8), pp. 1371–1387. https://doi.org/10.1080/01436597.2019.1653179

Clark, A. and Benoit, P. (2022). Greenhouse Gas Emissions from State-Owned Enterprises: A Preliminary Inventory. Columbia SIPA Center on Global Energy Policy.

Dietz, S., Gardiner, D., Jahn, V. and Noels, J. (2021). How ambitious are oil and gas companies’ climate goals? Science, 374(6566), pp. 405–408. https://doi.org/10.1126/science.abh0687

El-Gamal, M. A., Jaffe, A. M. and Baker III, J. A. (2009). Oil, Dollars, Debt, and Crises: The Global Curse of Black Gold (0 edition). Cambridge University Press.

Gallagher, K. S. (2022, January 3). The Coming Carbon Tsunami. Foreign Affairs, January/February 2022, pp. 151–164.

Global Carbon Project (2021). Supplemental data of Global Carbon Project 2021 (1.0) [MS Excel]. Global Carbon Project. https://doi.org/10.18160/GCP-2021

Jaffe, A. M. (2020). Stranded assets and sovereign states. National Institute Economic Review, 251, R25–R36. https://doi.org/10.1017/nie.2020.4

Kurmanaev, A. (2019, May 17). Venezuela’s Collapse Is the Worst Outside of War in Decades, Economists Say. The New York Times. https://www.nytimes.com/2019/05/17/world/americas/venezuela-economy.html

Masnadi, M. S., El-Houjeiri, H. M., Schunack, D., Li, Y., Englander, J. G., Badahdah, A., Monfort, J.-C., Anderson, J. E., Wallington, T. J., Bergerson, J. A., Gordon, D., Koomey, J., Przesmitzki, S., Azevedo, I. L., Bi, X. T., Duffy, J. E., Heath, G. A., Keoleian, G. A., McGlade, C., … Brandt, A. R. (2018). Global carbon intensity of crude oil production. Science, 361(6405), pp. 851–853. https://doi.org/10.1126/science.aar6859

Narassimhan, E., Gallagher, K. S. and Gopalakrishnan, T. (2021, November 11). India’s policy pathways for deep decarbonisation. ORF. https://www.orfonline.org/expert-speak/indias-policy-pathways-for-deep-decarbonisation/

Peszko, G., Midgley, A., Zenghelis, D., Ward, J., van der Mensbrugghe, D., Gloub, A., Marijs, C., Schopp, A. and Rogers, J. (2020). Diversification and cooperation in a decarbonizing world: Climate strategies for fossil-fuel dependent countries (Climate Change and Development). World Bank. https://openknowledge.worldbank.org/handle/10986/34011

Saadi, D. (2022, June 15). Aramco to invest in 12 GW renewables, reduce upstream carbon intensity by 15% by 2035 [S&P Global Commodity Insights]. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/061522-aramco-to-invest-in-12-gw-renewables-reduce-upstream-carbon-intensity-by-15-by-2035

Semieniuk, G., Holden, P. B., Mercure, J.-F., Salas, P., Pollitt, H., Jobson, K., Vercoulen, P., Chewpreecha, U., Edwards, N. R. and Viñuales, J. E. (2022). Stranded fossil-fuel assets translate to major losses for investors in advanced economies. Nature Climate Change, 12(6), pp. 532–538. https://doi.org/10.1038/s41558-022-01356-y

World Bank (2022). Exports of Goods and Services (% of GDP) – World Bank Open Data. https://data.worldbank.org/indicator/NE.EXP.GNFS.ZS?locations=AE-BR

NOTES

* Tufts University.