State aid to enterprises in France, Germany, Italy and Spain

Raymond Torres, Director of Macroeconomic and International Analysis, Funcas

Date: 30th march 2021

One of the most worrying consequences of the crisis generated by the pandemic is the deterioration of the financial situation of European companies. The restrictions operated during the first wave of contagion caused an abrupt economic shock, to which government policies responded not only through job-retention support, but also by providing loans under advantageous conditions and guaranteed by the state (ICO in the case of Spain). As a consequence, although part of the burden of crisis responses was assumed by the government, corporate debt soared, especially in the sectors most affected by mobility restrictions.

With the prolongation of the crisis, and the succession of opening and closing phases of the economy, the financial situation of many companies and small businesses has deteriorated, threatening the survival of part of the productive fabric. Faced with the prospect of cascading bankruptcies and a multiplication of defaults, as well as the risk that this entails for financial institutions and for the financing of the economy as a whole, governments have gradually chosen to implement direct aid and refinancing operations –rather than cheap loans. The new strategy aims to strengthen business solvency, and thus preserve many viable businesses on the verge of insolvency, at least until the generalization of vaccination facilitates the relaxation of restrictions and the recovery of the economy.

The aim of this note is to present the recent initiatives of the governments of France, Germany, Italy and Spain regarding direct transfers to enterprises. Indirect aid (including equity injections, debt restructuring, participating loans and other financial support) will be addressed in a separate paper.

Eligibility criteria

In France and Germany, aid began to be granted in the autumn, in the middle of the second wave. Though the programme was originally targeted on those companies that faced administrative restrictions of activity, it has since been extended to all sectors. Italy and Spain have followed, but with an important difference: while in Italy aid has been generalized to the economy as a whole, as in Germany and France, in Spain it is limited to the most affected sectors (trade, hospitality, leisure, etc).

Table 1. Eligibility requirements

| Sectors covered | Percentage of reduction in income from which a business is eligible to direct State aid | |

| France | All | - Businesses in sectors most affected: from the first euro lost - Businesses with activity restrictions due to Covid-19: losses greater than 20% - Other businesses: losses greater than 50% |

| Germany | All | 30% (businesses with turnover up to 750 million) |

| Italy | All | 30% |

| Spain | Only those most affected by the crisis | 30% |

Source: Funcas based on national regulations.

On the other hand, eligibility to the transfer depends on thresholds determined by the percentage of income lost due to the crisis (table 1). In Germany, Spain and Italy, only businesses that have reduced their turnover by at least 30% compared to 2019 are eligible. In France the criteria are more permissive - especially in the sectors most affected by the crisis, which are entitled to a transfer since the first euro of lost income.

In principle, only viable firms are entitled to the scheme. In the case of Spain, the regulations only exclude aid to businesses that were already incurring losses before the crisis. And in Germany, the assessment of the degree of viability is carried out by the Länder.[1] However, in practice the viability requirement seems to carry little weight in all four countries, perhaps because it is not easy to establish objective criteria without unduly delaying the allocation of resources. Governments are above all concerned with limiting the disruption of the productive fabric - although this might entail in some cases the perpetuation of some unviable businesses.

Amount of State aid

The German system is the most generous of the four examined, especially in relation to the ceiling of aid that can be granted (up to 1.5 million euros, see table 2). However, in the German case only fixed costs are taken into account for the calculation of benefits - compared to the other three countries, where the calculation of benefits is based on the total income lost.

The amount of aid is relatively low in Spain compared to the other three countries. It only compensates between 20 and 40% of the revenue lost by companies in the sectors most affected by the pandemic, compared to 20-60% in Italy and up to 100% in the case of small businesses in France. The compensation rate can reach up to 90% in Germany (although, as already mentioned, it only applies to fixed costs).

Table 2. Level of benefits

| Amount of the direct transfer that each eligible business can receive | Maximum level of the transfer | |

| France | Between 15% and 100% of lost turnover (a lump-sum of € 1,500 in some circumstances) | 200,000 € |

| Germany | Between 40% and 90% of the fixed cost. Additional aid available for digitization | 1.5 million € |

| Italy | Between 20% and 60% of lost turnover | 150,000 € |

| Spain | € 3,000 for own-account workers and small businesses, and between 20% and 40% of lost turnover for the rest (with a minimum of € 4,000) | 200,000€ |

Source: Funcas based on national regulations.

However, Spain is the only country that grants a minimum benefit, of 4,000 euros for all businesses eligible to State aid. This particular feature of the Spanish scheme can be particularly beneficial for small businesses. It should also be noted that, in France, companies with a turnover drop of more than 50% that have not been affected by activity restrictions and are not part of the priority sectors (hospitality, etc.), can receive a lump-sum benefit of 1,500 euros.

Budgetary costs and implementation

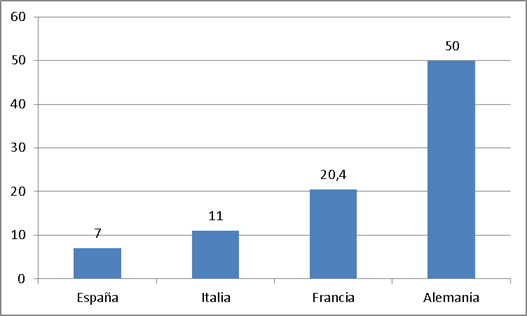

The estimated cost of the measures reflects the characteristics of the programmes, whose design is more generous in Germany and France, according to the graph below (figure 1). Furthermore, in the case of France, a budget ceiling is not determined, because the aid is considered to be part of the automatic stabilizers and, therefore, total expenditure will fluctuate depending on the allocation of the aid.

Graph 1. Budgetary cost of aid (in billions of euros)

Source: Funcas based on national regulations (in the case of France: effective expenditure as of March 29).

Finally, the management of the measures differs significantly between countries. In France and Italy, applications are made directly from the portal of the Tax Agency, which is the body in charge of granting aid. In Germany and Spain, implementation is the responsibility of regional administrations - in the case of Spain, after a call for proposals by each autonomous community.

Main conclusions on the case of Spain

In terms of the percentage of losses that are offset, the aid established by the Spanish law on extraordinary measures to support business solvency is similar to those applied in the other three countries. Furthermore, by incorporating a minimum (of 4,000 euros), the scheme tends to favour small businesses.

However, the Spanish regulations arrive several months later than the other three countries. Additionally, their coverage is relatively limited, reflecting the narrow targeting on the sectors most affected by the pandemic. Perhaps the main risk concerns getting started with the implementation of the programme, which is more complex than in other countries and could significantly delay the arrival of aid in addition to posing management challenges and disparity between the different autonomous communities.[2]

[1] The viability criteria are more central in indirect aid, as will be mentioned in the next note.

[2] Detailed information o each of the four programes is available on he web site of Funcas. See https://blog.funcas.es/las-ayudas-directas-a-empresas-en-alemania-espana-francia-e-italia/