Conjunctural indicators for the Eurozone June 2021

Fecha: July 2021

Almudena García Sanz, Economist and Researcher, Funcas Europe

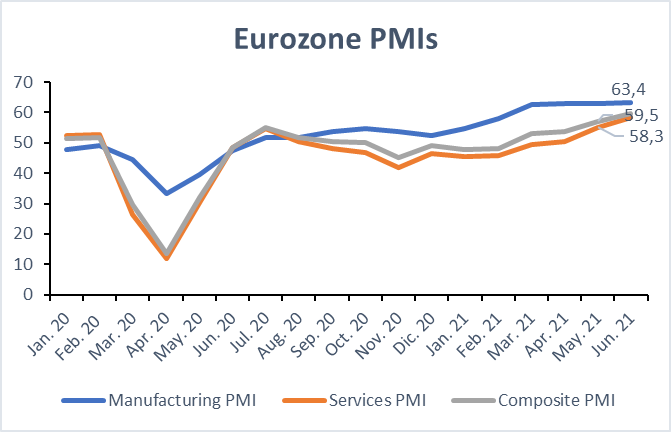

The main short-term indicators, notably PMIs, suggest that the recovery gathered momentum in the second quarter In June, the PMI-IHS Markit Composite Output Index of the Eurozone reached 59,5, leaving the index at its highest index level since June 2006. The indicator exceeded the value of 50 for the fourth consecutive month and is up by 2,4 percentage points with respect to May. All this suggests that the Eurozone private sector economy is growing at its fastest rate for the last 15 years, underpinned by increasing levels of output in both manufacturing and services sectors [1].

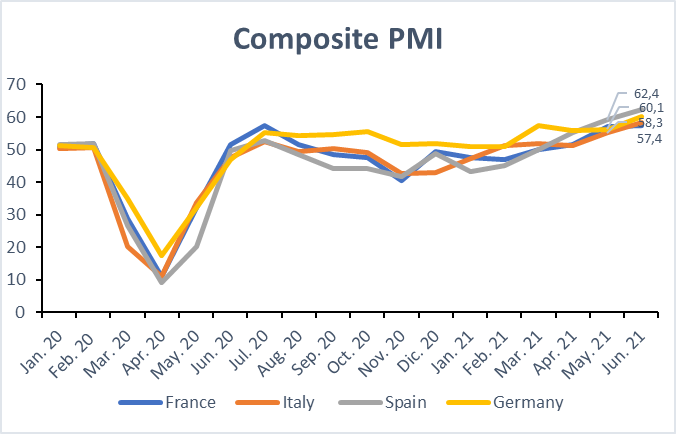

PMIs are on the rise in all four major Eurozone economies led by Spain (62,4), the best value since February 2000, [1] and followed by Germany (60,1). France and Italy both showed their best performances for nearly three-and-a-half years [1].

The outcomes are predominantly driven by the PMIs in the services sector which are reaching record highs since mid-2007. But manufacturing PMIs are also pointing in a highly expansionary direction, with record value of 63,4 in June, the best in 24 years of history of the index [2]. This substantial growth takes shape from an overall reinforced demand and a positive economic perspective as witnessed by the increase in new orders. Demand prospects are improving both domestically and internationally [4]. Thus, based on the high demand and larger volume of orders, the backlogs of work rose as did the logistical delivery problems. The price of manufacturing’ inputs appears to be rising particularly fast [2]. Services firms too, are noticing the rise in production costs, though with a delay with respect to manufacturing. Thus, the Services input price index reached a value of 58,3 (3,1 points up with respect May), exhibiting growth for the third successive month [1].

The improved outlook has an impact on employment, notably in the services sector, with an overall rose for the fifth consecutive month and the highest value since October 2018. In the case of manufacturing, the employment index also increased for a fifth successive month being the rate of expansion strengthened also, achieving its highest level since the start of 2018 [1]. That means that that firms are hiring more staff at a rapid pace, and that they are bringing workers back from furlough [3]. There is little sign in the surveys of upward pressure on wages, for the time being.

Inflationary pressures are building up. The phenomenon is transitory, for the time being, driven by transportation delays and suppliers’ delivery times [2]. The excess of demand they are facing up has been translated into new investments on business equipment and machinery as well as hiring new staff with the aim of meeting the orders solving the temporary shortages, and to create new capacity. All these indicators will need to be monitored in coming months to shed light on whether some of the upward pressures are permanent to some extent. Thus, all this scenario is the result of the optimistic consumers perspective about the recovery. So, the continuation of these trends depends crucially on the evolution of vaccination programs, on whether inflationary pressures will be temporary or more long-lasting, as well as on the maintenance of this increasingly confident prospect.

Bibliography:

[1] https://www.markiteconomics.com/Public/Home/PressRelease /0b7e738f21904b59b682589a18e485d0

[2] https://ihsmarkit.com/research-analysis/eurozone-manufacturers-report-unprecedented-price-spike-July21.html

[3] https://www.capitaleconomics.com/clients/publications/european-economics/european-data-response/euro-zone-final-pmis-june-2/

[4] https://www.capitaleconomics.com/clients/publications/european-economics/european-data-response/euro-zone-final-pmis-june-2/