Conjunctural indicators for the Eurozone August 2021

Fecha: September 2021

Almudena García Sanz, Economist and Researcher, Funcas Europe

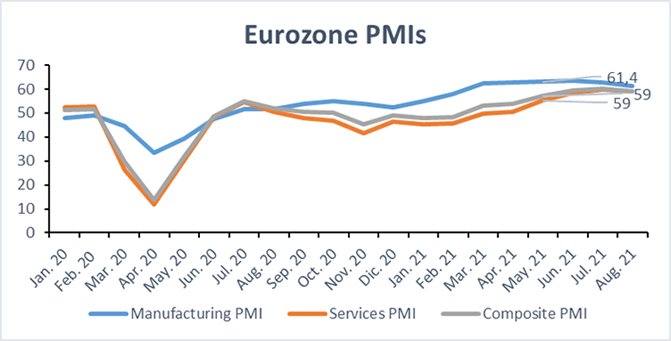

The main short-term indicators, notably PMIs, suggest that the recovery gathered momentum in the last few months. In August, the PMI-IHS Markit Composite Output Index of the Eurozone reached 59, slightly below the level of July (60,2), which marked the highest value since June 2006. This suggests that the Eurozone private sector is growing at its fastest rate for the last two decades, underpinned by increasing levels of output in both manufacturing and services sectors.

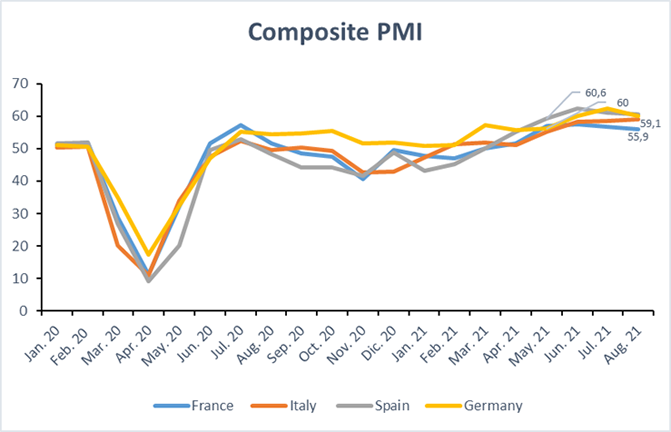

PMIs are on the rise in Italy (59,1), while the readings for Germany (60), Spain (60,6), and France (55,9), fell slightly in August while remaining at high levels. [2].

These favorable trends reflect an overall reinforced demand recovery along with positive economic prospects as witnessed by the increase in new orders. The outlook is improving both domestically and internationally, pointing to trends well above the historical average since 1998 [3]. Moreover, Service sector growth exceeded that of manufacturing for the first time since the start of the pandemic, encouraged by the further reopening of the economy as COVID-19 and a further ease of containment measures [1].

The slip side of high demand and a raising volume of new orders is the intensification of shortages and supply bottlenecks. Backlogs continue to rise at a strong pace, including August, as suppliers struggle to meet demand in a timely manner. The rate of backlog accumulation was particularly pronounced in the manufacturing sector [3]. Meanwhile, the price of manufacturing’ inputs appears to be rising particularly fast, signaling substantial inflationary pressures. Input costs increased at a rate slightly below July’s (near 21-year high) and pressures were particularly acute the manufacturing sector. On the other hand, higher input costs were passed on to customers in the form of higher selling prices for both goods and services. Measured overall, input cost and selling price inflation rates were the third-highest recorded over the past two decades, exceeded only by the levels seen in June and July [1].

The improved outlook has an impact on employment, with a markedly rise in the demand for jobs in August (although at a rate slightly weaker pace than July’s near 21-year high [1]). Manufacturing recorded faster jobs growth than the services counterparts, although a slowdown at the former contrasted with the latter, where the expansion in employment was on par with July’s near three-year peak [1].

Finally, the degree to which inflation will remain elevated will depend to a large extent on the persistence of demand-supply imbalances [3]. On one hand, the spread of the Delta variant is aggravating supply disruptions, especially in Asia, which is likely to maintain cost pressures in coming months. On the other hand, firms are succeeding to bring in more workers and thus add capacity, which should help keep underlying inflation pressures at a bay. The concern is that some upward movement in wages are recorded in some sectors which could feed through to higher inflation, especially if combined with continued supply shortages [3].

Source: Markit

Source: Markit

References:

[1]https://www.markiteconomics.com/Public/Home/PressRelease/c4a96eb6dee04ef19264776341957b53 [2]https://www.capitaleconomics.com/clients/publications/european-economics/european-data-response/euro-zone-retail-sales-july-final-pmis-aug-2/ [3]https://ihsmarkit.com/research-analysis/eurozone-flash-pmi-holds-close-to-15year-high-in-august-Aug21.html