Eurozone PMIs in December 2020

Fecha: enero 2021

Pamina Lantos, Research Assistant, Funcas Europe

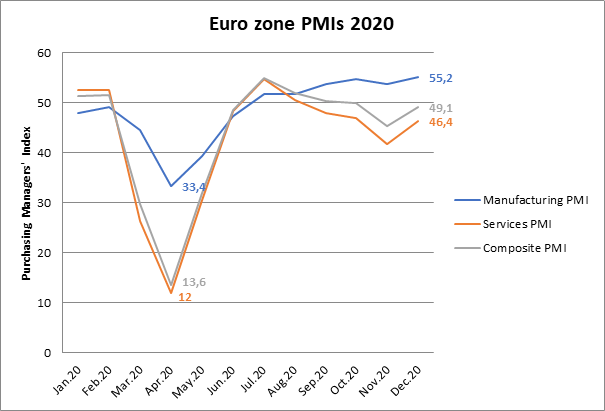

The Eurozone composite PMI for December points to a contraction of activity for the second consecutive month, with an overall drop in demand and new orders. However, the pace of the contraction is slowing down, where the PMI, though still below 50, shows an increase by 3,8 points with respect to November. This slight improvement reflects developments in both the manufacturing and service sector. (1)

On one hand, the manufacturing PMI of the Eurozone rose by a rather limited 1,4 points to 55,2, while remaining comfortably in positive territory for the 6th consecutive month. Moreover, all four major economies of the Eurozone exhibit an expanding manufacturing sector, with Germany leading the way (the PMI reaches 58,3 – their highest value in nearly three years). (2)

On the other, a much larger increase, by nearly 5 points, was detected in the service sector PMI of the Eurozone. Especially in Spain and Italy, where the indicator rose by nearly 10 points with respect to November, as a result of end-of-year consumer purchases. Yet, the composite service sector PMI of the Eurozone remained below the threshold of 50, pointing to a contraction, with Italy scoring a record low of 39,7. (1)

Another survey of Markit Economics suggests that nine industries in Europe were on an expansionary path in December. The majority of these (seven out of nine) belong to the manufacturing sector, with automobile, machinery and metals/mining experiencing the largest advancements. In contrast, in transportation and tourism-related services, activity remains subdued. (3)

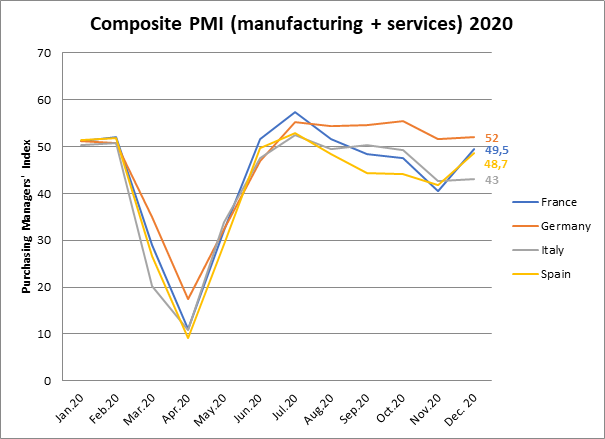

Discrepancies between member states persist, although they seem to be slowly converging as Germany and Spain are only 3,3 points apart in their Composite PMIs, compared to a 10-point difference in November. The same goes for France, which is only 0,5 points away from a positive Composite PMI value. As an outlier, Italy is left with a Composite PMI score of 43, reflecting the contractions in their service sector. (1)

Overall, despite the depressionary forces, the recovery of the manufacturing sector has prevented a return to the numbers recorded in spring. Nonetheless, the Composite PMI of the Eurozone remains below the threshold of 50, indicating a contracting economy and thus, a weak start for 2021, as renewed waves of infections and restrictions are leaving a toll on businesses. The prospects for the new year in the Eurozone will greatly depend on the deployment of vaccines across countries as well as the likely recovery of international trade, as suggested by the increase in new export orders which has been registered in recent surveys.

Source:

[1] IHS Markit Eurozone Composite PMI – final data. IHS Markit. 6th January 2021.

[2] IHS Markit Eurozone Manufacturing PMI – final data. IHS Markit. 4th January 2021.

[3] IHS Markit Europe Sector PMI – Automotive Sector Returns to Top of European Growth Rankings in December. IHS Markit. 7th January 2021.