Conjunctural indicators for the Eurozone in June

Fecha: July 2022

Almudena María García Sanz, Economist and Researcher, Funcas Europe

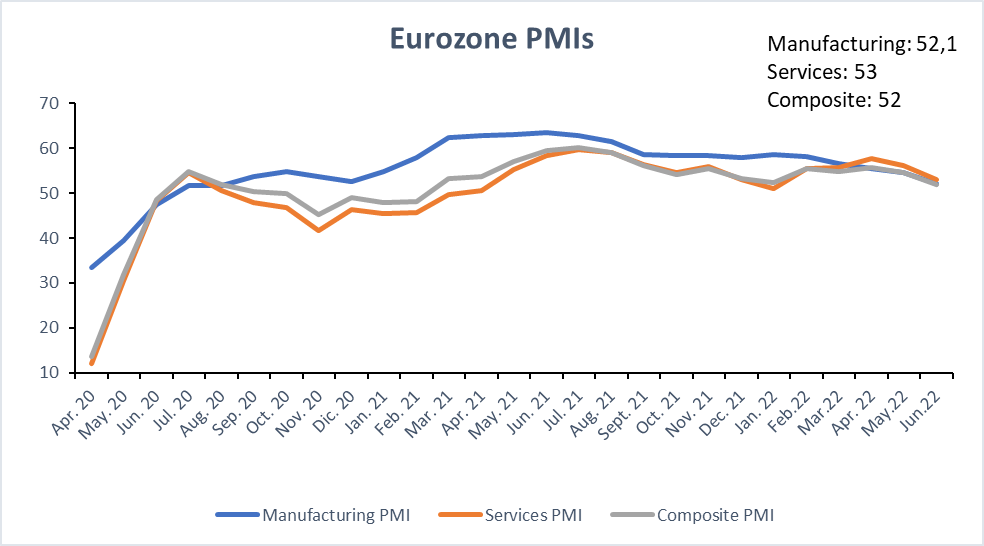

The PMI Composite Index reached 52 in June, the lowest level since February 2021. This suggests a marked slowdown in economic activity at the end of Q2 [1].

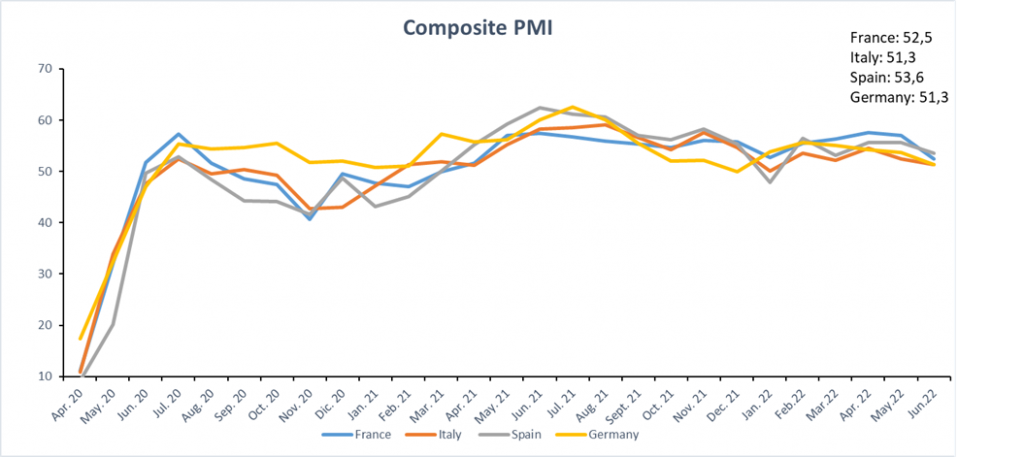

The Index kept “above the 50-point threshold” in the four largest eurozone economies. While also on a downward trend in all of them. The decline was particularly sharp in France [1].

The fall in the headline figure reflected both a weaker upturn in service sector activity – the slowest since January – and a negative outcome in manufacturing, with levels below 50 [2]. Inflows of new work to eurozone companies stagnated in June, ending a 15-month sequence of growth. The main weakness was in the manufacturing sector, where order book volumes declined sharply. Services recorded a slowdown in demand, not an actual cut.

Despite the overall deterioration in demand, eurozone firms continued to face capacity pressures in June, as signaled by a further increase in outstanding business. That said, the rate of backlog accumulation was the slowest since the supply disruptions were first noticed in March 2021. Ongoing capacity pressures were nonetheless strong enough to hire additional workers in June, stretching the current sequence of hiring growth to 17 months.

Turning to prices, June data highlighted further severe inflationary pressures. Costs faced by euro area firms rose steeply, although the rate of inflation retreated further from March’s peak. Cost pressures were again more acute in manufacturing [2].

Eurozone services firms reported ongoing cost pressures in June, extending the current sequence of rising input costs to over two years. The rate of increase accelerated on the month and was the third steepest on record. Efforts to maintain margins subsequently led firms to raise their average charges further during June [2].

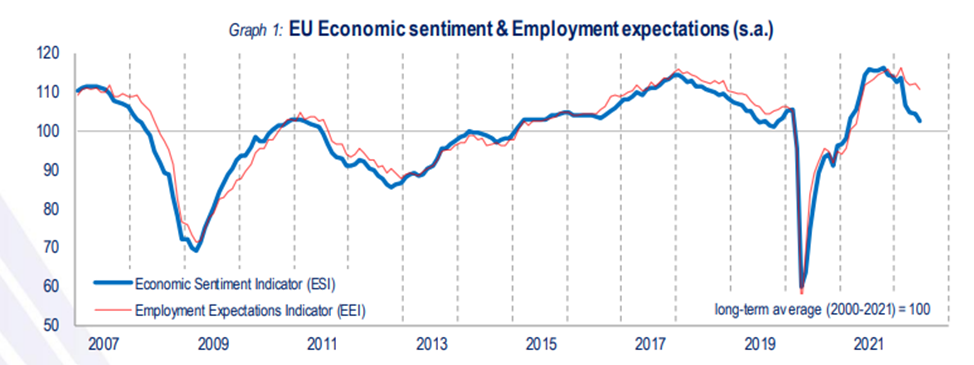

Finally, the Economic Sentiment Indicator[1] (ESI) dropped in both the EU (-1.7 points to 102.5) and the euro area (-1.0 point to 104). The decrease in the ESI was due to weaker confidence among construction managers, consumers, and to a lesser extent, retail trade managers. Confidence decreased marginally in services and remained broadly stable in industry. The ESI fell across the six largest EU economies. The Employment Expectations Indicator[2] (EEI) also decreased (-1.6) points to 110.6 in the EU and -1.7 points to 110.9 in the euro area). It was driven by significantly deteriorated employment plans in construction. Also, managers in industry, retail trade and services expected employment in their firms to decrease over the next three months [3].

[1] The Economic Sentiment Indicator (ESI) is a composite indicator combining judgements and attitudes of businesses (in industry, construction, retail trade, services) and consumers by means of a weighted aggregation of standardized input series.

[2] The Employment Expectations Indicator is constructed as a weighted average of the employment expectations of managers in four surveyed business sectors.

*** The PMI Composite Index in July seems that will decrease below the 50 points. More details in the next publication.

References :

[1]https://www.capitaleconomics.com/clients/publications/european-economics/european-data-response/euro-zone-final-pmis-june-3/ [2]https://www.pmi.spglobal.com/Public/Home/PressRelease/62c985d513f64e0eb84c37255281a39f [3] https://ec.europa.eu/info/sites/default/files/bcs_2022_06_en.pdf