Conjunctural indicators for the Eurozone in January

Fecha: February 2023

Almudena María García Sanz, Economist and Researcher, Funcas Europe

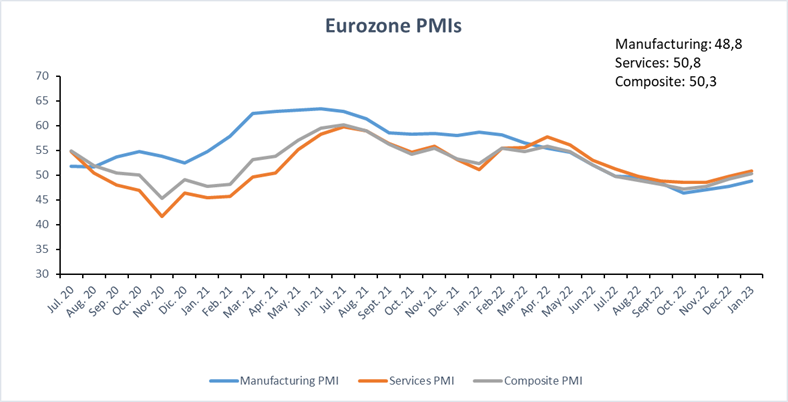

The PMI Composite Index for the Eurozone posted 50.3 on January. moved into expansion territory in January for the first time since June 2022. At 50.3, this was up for the third month in succession and compared with a reading of 49.3 in December. Overall, the headline figure was indicative of a marginal rate of growth in private sector business activity across the euro area.

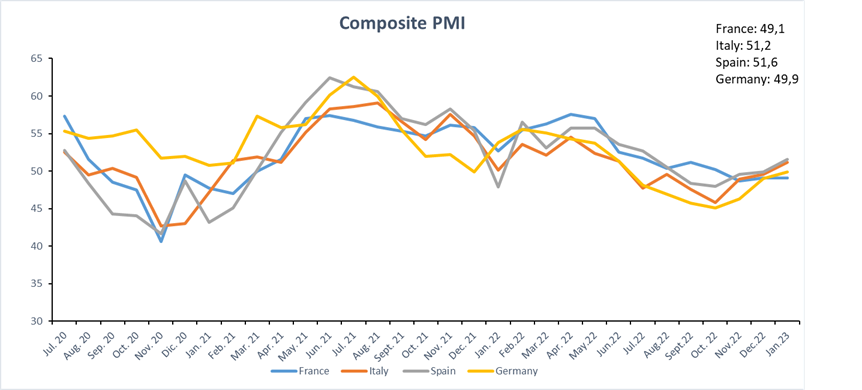

Spain and Italy exhibited upturns in activity during the latest survey period, while Germany’s economy broadly stabilized. Meanwhile, the French private sector continued to contract, albeit only marginally.

Higher levels of business activity were accompanied by stronger jobs growth as the region’s labor market continued to exhibit a remarkable level of resilience, as well as a strengthening of business confidence. Although new orders fell, in line with the trend since the summer of 2022, the rate of decline was the softest over this period. Backlogs of work also decreased, particularly in the manufacturing sector.

Meanwhile, January survey data showed input cost inflation easing again, with the indicator moving down to its lowest level since April 2021. The cooling of cost pressures was most pronounced in the manufacturing sector. Input cost inflation at services firms has remained far more stubborn and, despite also easing during the latest survey month, has remained strong amid reports of strong wage pressures.

The increase in total activity was mainly supported by companies’ efforts to clear their backlogs of work, as attested by the associated indicator which fell for the third month in succession. January survey data also signaled a broad stabilization in new business volumes, ending a six-month sequence of decline.

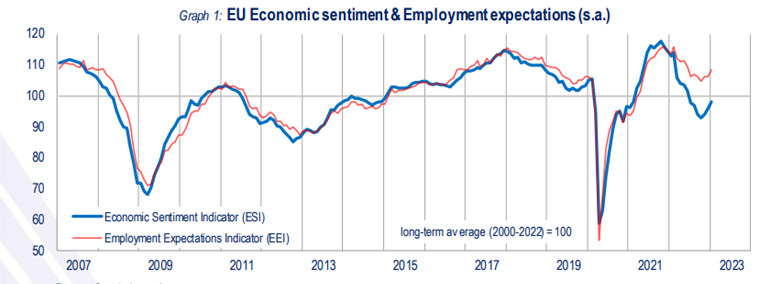

Finally, these results are in line with the improvement of the Economic Sentiment Indicator[1] (ESI). The ESI’s increase in January reflected strong improvements in industry, services, retail trade and consumer confidence. The ESI indicator for construction was the only one that recorded a decline. The ESI increased in all the largest EU economies, led by in France (+4.4), and followed by Spain (+2.7), Germany (+2.5), and Italy (+1.7).

The increased in the Employment Expectations Indicator[2] (+2.3) was driven by improved employment plans in services, retail trade and, to a lesser extent, industry, while managers in the construction sector expected employment in their firms to decrease over the next three months.

[1] The Economic Sentiment Indicator (ESI) is a composite indicator combining judgements and attitudes of businesses (in industry, construction, retail trade, services) and consumers by means of a weighted aggregation of standardized input series.

[2] The Employment Expectations Indicator is constructed as a weighted average of the employment expectations of managers in four surveyed business sectors.

References:

[1]https://www.pmi.spglobal.com/Public/Home/PressRelease/df1eb8e3228b44c2aaf645b14f9e36c5 [2]https://economy-finance.ec.europa.eu/system/files/2023-01/bcs_2023_01_en.pdf